Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 16, 2026

By Pooja Pandey

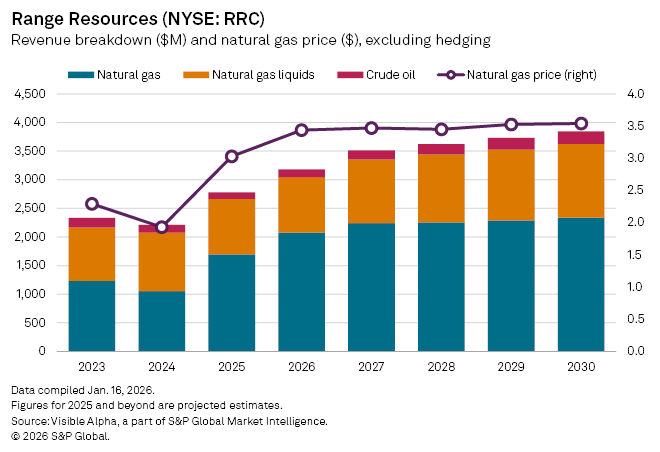

US energy company, Range Resources Corp. (NYSE: RRC) is set to end the final quarter of fiscal 2025 with renewed momentum, as a rebound in US natural gas prices is expected to drive strong top-line growth. Analysts expect fourth-quarter revenues of about $736 million, up from $700 million in the third quarter and 26% higher than a year earlier. For the full year, revenues are forecast to rise 27% to roughly $2.9 billion, reversing two consecutive years of decline.

The recovery is being driven largely by natural gas, which accounts for about 58% of Range’s revenue base. After two years of falling prices, weighed down by record US production, bloated inventories and demand that failed to keep pace, the market has turned more supportive. Visible Alpha consensus estimates show Range’s realized natural gas prices, excluding hedging, are expected to climb 57% year-on-year in 2025 to $3.03, a sharp contrast to the 16% decline in 2024 and the 63% slump recorded in 2023.

That pricing uplift is expected to translate into a 61% jump in natural gas revenues, excluding hedging, to around $1.7 billion in 2025. By contrast, revenues from crude oil and natural gas liquids are forecast to remain under pressure through 2025, reflecting softer pricing. Analysts expect those segments to recover more meaningfully in fiscal 2026 as higher production volumes begin to offset price headwinds.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment