Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 15, 2026

By Jay Rathod

Palvella Therapeutics Inc. (NASDAQ: PVLA), focused on rare vascular disorders, strengthened its market position after reporting encouraging Phase 2 data for its lead asset, Qtorin rapamycin, in cutaneous venous malformations (cVMs). The clinical-stage biotech announced late last month that the topical therapy met its topline endpoints in the mid-stage trial, bolstering confidence in the treatment, which already benefits from Breakthrough Therapy, Fast Track, and Orphan Drug designations from the US FDA, as well as an FDA orphan grant.

These regulatory advantages could shorten development timelines and lower execution risk. Palvella has now requested preliminary Breakthrough Therapy guidance from the FDA and plans to begin a Phase 3 study in the second half of 2026.

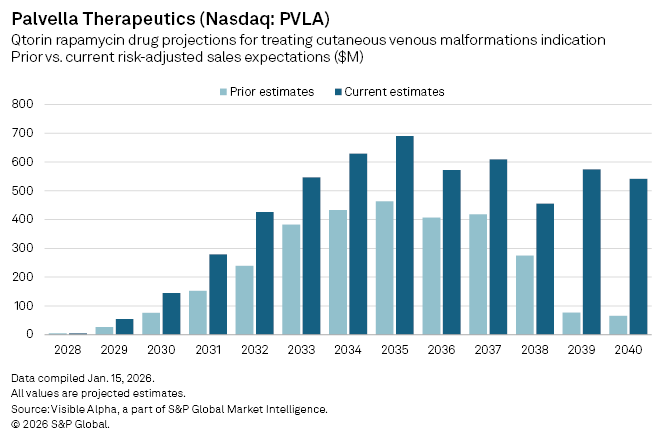

Analysts have responded swiftly. Following the data release, the consensus probability of success for Qtorin rapamycin in cVMs has been raised to 61%, from 38% previously. Revenue expectations have also moved higher in tandem. With expectations of a regulatory approval in 2028, analysts now forecast $54 million in risk-adjusted sales in 2029, up from prior estimates of $26 million. Peak risk-adjusted sales are now projected to reach $691 million by 2035, compared with earlier expectations of $463 million.

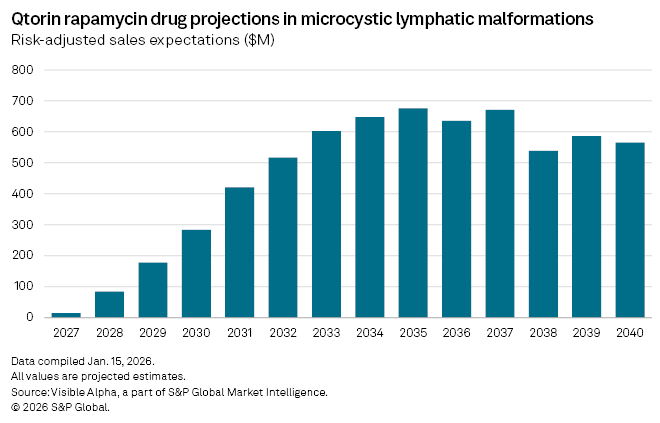

The more immediate catalyst, however, sits elsewhere in the pipeline. Qtorin rapamycin is further advanced in microcystic lymphatic malformations (mLM), where it is currently in Phase 3 trials. Topline results are expected in March 2026. If positive, Palvella plans to submit a New Drug Application in the second half of the year, setting up what could become the first FDA-approved therapy for mLM.

Visible Alpha consensus estimates show analysts assign a 73% probability of success to Qtorin rapamycin in mLM. With regulatory approval anticipated in 2027, analysts expect first-year risk-adjusted sales of about $15 million, rising to peak sales of $676 million by 2035.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment