Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 21, 2026

By Soumya Khandelwal

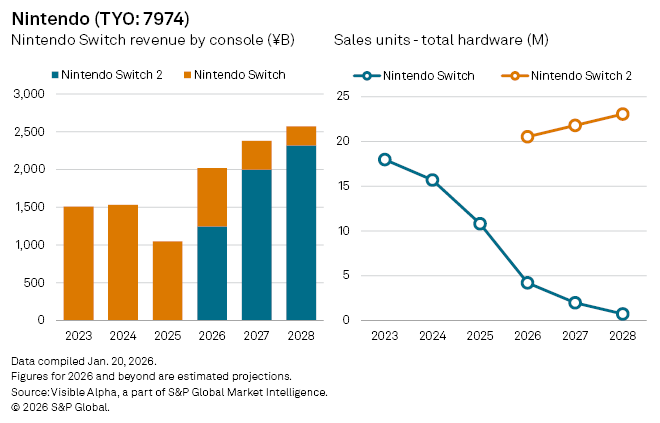

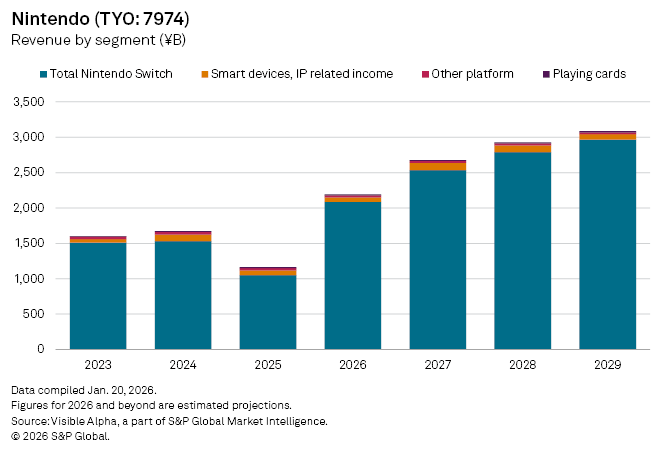

Nintendo Co. Ltd. (TYO: 7974) is poised for a sharp revenue recovery in fiscal 2026, as the long-awaited launch of the Switch 2 console reignites demand after a weak year for hardware sales. Revenues are forecast to more than double, rising 103% year-on-year to about JP¥2.4 trillion in 2026, reversing a roughly 30% decline in last year as the ageing original Switch lost momentum.

The rebound hinges on a new hardware cycle. Revenue from the Switch platform is expected to climb 97% year-on-year, driven by the June 2025 debut of the Switch 2 console. Analysts estimate Switch 2-related sales of around JP¥1.2 trillion in fiscal 2026 in its first full year, compared with roughly JP¥774 billion generated by the previous-generation Switch.

Unit volumes underscore the scale of the upgrade cycle Nintendo is banking on. The company is expected to sell about 20 million Switch 2 consoles in fiscal 2026, versus roughly 4 million units of the original Switch.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment