Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 8, 2026

By Abhishek Jain and Lovey Mangal

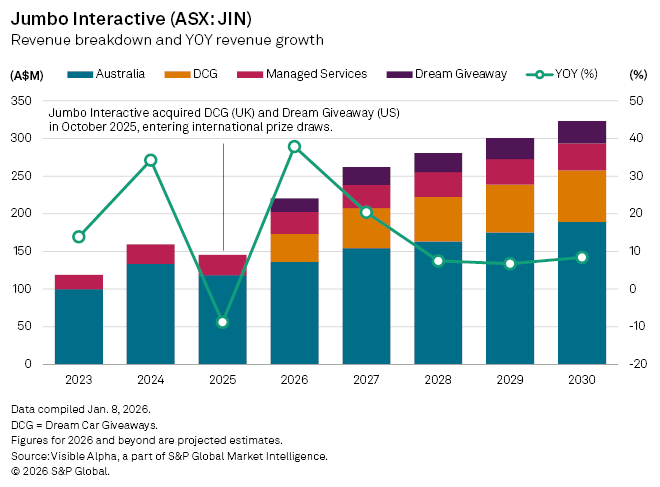

Australia’s Jumbo Interactive Ltd. (ASX: JIN), that specializes in digital lottery retailing, lottery software, and lottery management services, entered the US prize-draw market in October with the purchase of Dream Giveaway, following swiftly on from its acquisition of UK-based Dream Car Giveaways (DCG). Together, the deals mark a strategic shift beyond Jumbo’s traditional lottery software and retailing roots into direct-to-consumer digital prize-draw businesses in two large, fragmented markets.

According to Visible Alpha consensus estimates, DCG is forecast to contribute A$37 million of revenue in 2026, its first year of consolidation, while Dream Giveaway is expected to add A$18 million. By 2027, DCG revenue is projected to climb to A$53 million, a 44% year-on-year increase, accounting for about 22% of Jumbo’s group revenue. Dream Giveaway is expected to grow more modestly, to A$24 million, up 33%, contributing roughly 10%.

The timing is important. Jumbo endured a challenging 2025, with group revenue falling 9%, reflecting softer conditions in its core Australian lottery operations. Analysts expect a sharp rebound in 2026, with revenue forecast to rise 38% year-on-year to about A$200 million. Much of that recovery is driven by the new prize-draw assets, alongside a recovery in Australia, where revenue is expected to grow 15% to A$136 million after an 11% decline last year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment