Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 7, 2026

By Cristalina Pinto and Shankar Bose

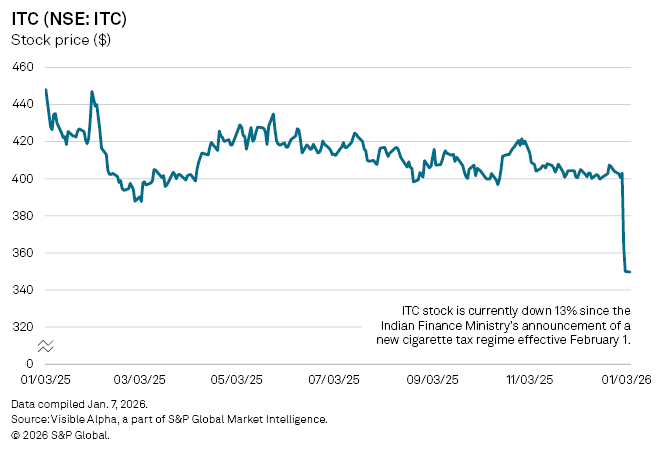

Shares in ITC Ltd. (NSE: ITC), India’s leading cigarette maker and consumer staples group, fell after the government announced a steep increase in cigarette taxes, the most significant shift in tobacco taxation in India in over a decade.

On December 31, 2025, the Indian government said it would introduce an additional excise duty on cigarettes and raise the goods and services tax (GST) rate to 40% from 28%. The new regime, which replaces the existing structure, will take effect from February 1, 2026.

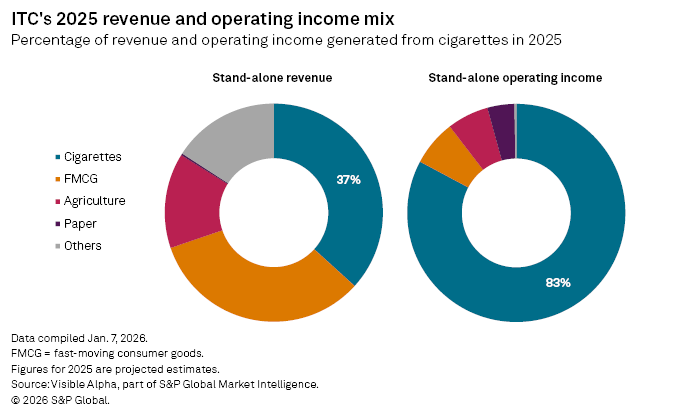

For ITC, the cigarette business remains a key engine of profitability despite having a diversified business which includes packaged foods, agribusiness, and paper products. Cigarettes accounted for about 83% of the group’s operating income in 2025, leaving overall profits highly sensitive to changes in tobacco taxation.

The announcement has clouded earnings visibility and has raised concerns over pricing and volumes. Following the news, most sell-side analysts have downgraded their stance on the stock to “Hold” or “Neutral”. Analysts broadly expect ITC to pass on most of the higher tax burden to consumers through price increases. These steeper prices are in turn expected to weigh on volumes, accelerating a decline in consumption in a price-sensitive market like India.

With the new taxes starting in February, distributors and retailers may bring forward purchases, temporarily cushioning volumes. As a result, analysts expect the full impact of the tax hike to become more visible from fiscal year 2027.

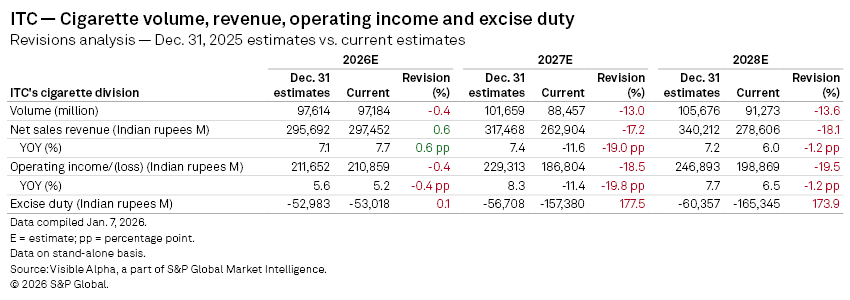

Visible Alpha custom consensus estimates, based on 11 analysts who have revised their projections after the December 31 announcement, show sharp downward revisions to ITC’s cigarette business outlook. Cigarette sales volumes are now forecast to be 13% lower in 2027 compared with estimates prior to the new tax announcement. Similarly, current sales volume projections for 2028 are 13.6% lower compared to prior estimates.

Furthermore, cigarette net sales revenue estimates have been cut by 17.2% in 2027 and 18.1% in 2028, reflecting both weaker volumes and demand elasticity.

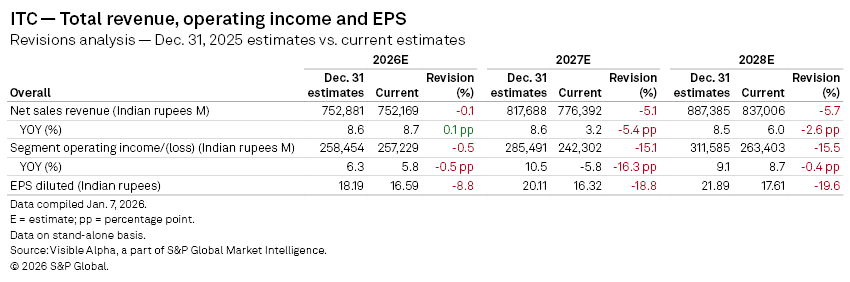

Revisions to Visible Alpha consensus estimates since December 31, also point to a sharply weaker overall earnings trajectory for ITC beyond the near term, reflecting the expected impact of higher cigarette taxes on total revenue and profitability.

For fiscal 2026, estimates are largely unchanged. The downgrade becomes more pronounced in 2027. Revenue estimates have been cut by 5.1%, with year-on-year growth now expected at 3.2%, down from 8.6% before the new tax announcement. Operating income has seen a sharper 15.1% downward revision, swinging from projected growth of 10.5% to a decline of 5.8%. EPS for the year has been reduced by 18.8%, highlighting the operating leverage to weaker cigarette volumes and margins. Similarly, expectations for 2028 remain under pressure.

Overall, the revisions highlight ITC’s heavy dependence on cigarettes for profits. While top-line growth moderates, the sharper swings in operating income and EPS point to elevated earnings sensitivity to regulatory and tax changes.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment