Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 13, 2026

By Jessica Fuk

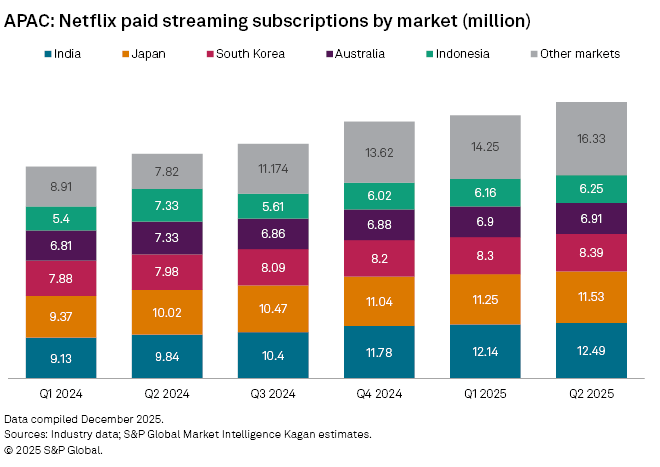

Contributing to roughly 17%–18% of the Asia-Pacific's total subscription streaming revenue, Netflix Inc.'s dominant position in major markets in the region (excluding mainland China) could further strengthen following the acquisition of Warner Bros. Discovery Inc.'s select assets. S&P Global Market Intelligence Kagan estimates that the global streaming giant serves 312.5 million paid subscribers worldwide with the region accounting for nearly 20% as of June 2025.

Netflix is a clear leader in major streaming markets in the region while HBO Max falls behind when it comes to market share. The tie-up may not cause a significant boost to subscription numbers due to an overlap between Netflix and HBO Max subscribers, but the value comes from Warner Bros. Discovery's well-known IP and established relationships with advertisers and other stakeholders. The merger could enhance Netflix's premium pricing strategy, further differentiating it from the affordable pricing model that is widely adopted by most services in the region.

Despite its leading position, Netflix is facing increasing competition with growth rates moderating in some key markets such as South Korea and Japan. Major competitors have turned to live sports streaming and the paid ad-supported model to generate growth. In South Korea, leading local service CJ ENM CO. Ltd.-owned Tving Co.Ltd. has been delivering double-digit subscription growth since starting its exclusive carriage of the nation's Korea Baseball Organization League and launching ad-supported subscriptions in March 2024.

Netflix faces a similar situation in Japan, where Amazon.com Inc.'s Prime Video has expanded quickly with the debut of the MLB series and the launch of ads in March 2025. In September, Netflix responded by acquiring the exclusive rights to stream the upcoming 2026 World Baseball Classics. Prime Video has maintained the largest subscriber base while Netflix claims the biggest revenue share. The recent expansion of Prime Video's subscriptions could boost its revenue share, which remains roughly half the size of Netflix's due to the e-commerce giant's low-cost strategy.

Our model indicates that India, Japan and South Korea are Netflix's three largest markets in the region in terms of subscription. Effective content and bundling strategies may have helped accelerate annual subscription growth in the Indian market to an estimated 26.9% as of June 2025. While it doesn't hold rights to any of the must-watch cricket competitions, Netflix India continues to produce documentaries related to the national sport and star players. The streamer also made its first live sports acquisition in the country to exclusively stream WWE with Hindi commentary.

The addition of Warner Bros. Discovery's well-known IPs, including titles that Netflix has already licensed, could strengthen Netflix's premium pricing strategy in the region. Compared to affordable pricing strategies that are embraced by most service providers in the region, Netflix has maintained some of the highest-cost subscription plans in each market. In India, for example, Netflix's mobile tier is three times more expensive than a basic subscription by some of its major competitors such as JioStar India Private Ltd.-operated JioHotstar and Prime Video.

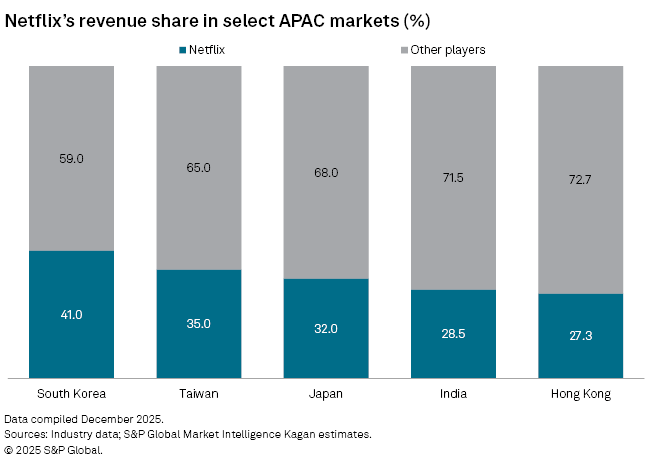

Premium pricing contributes to Netflix's predominant revenue share in most markets that the streaming giant operates in. Our research indicates that Netflix has an average of 30% revenue share in major Asia-Pacific markets while the number eclipses 40% in South Korea, where the service leads with an estimated 32.9% subscriber share as of June 2025. In developed economies like South Korea, less price-sensitive consumers opt for premium subscription tiers, driving revenue higher.

Rivals often form discounted bundles to fight Netflix's dominance. In South Korea, Disney+ recently debuted subscription packs with TVING and Wavve of Contents Wave resulting in discounts ranging from 23.1%–37.3%. Disney+ of Walt Disney Co. complements the latter two local services with a massive library consisting of kids and Hollywood content. TVING and Wavve have received conditional approval to merge, and the combined entity is expected to overtake Netflix as the largest streamer in the country.

HBO Max has a relatively minor market share in the Asia-Pacific region. Leveraging its long-term relationships with telcos and multichannel operators, the digital offering is mainly available via third-party operators. It has yet to launch a stand-alone direct-to-consumer service in major markets like India, Japan and South Korea. HBO Max content is available through an exclusive licensing deal with JioHotstar in India, U-NEXT HOLDINGS Co.Ltd.'s U-NEXT in Japan and Coupang Play of Coupang Inc. in South Korea. While so much is still unknown regarding the future operating model of Netflix and HBO Max should the deal materialize, local streamers could turn to other global studios for Hollywood and other English content that remains highly sought-after in the region.

In October, Warner Bros. Discovery and CJ ENM announced a partnership to jointly produce original Korean content. Those new programs will be made available as part of a collection of TVING titles on HBO Max in select markets in the region from 2026. The impact of the Netflix-Warner Bros. Discovery deal may not have a significant impact on the partnership as Netflix has an established relationship with Studio Dragon Corp., also backed by CJ ENM, on the production of Korean originals. However, TVING may seek another partner to support its global expansion plan when the existing contract expires. In November, the South Korean streamer forged a partnership with Disney+ for expansion in the Japanese market.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Segment

Language