Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 9, 2026

By Vijnesh Shetty

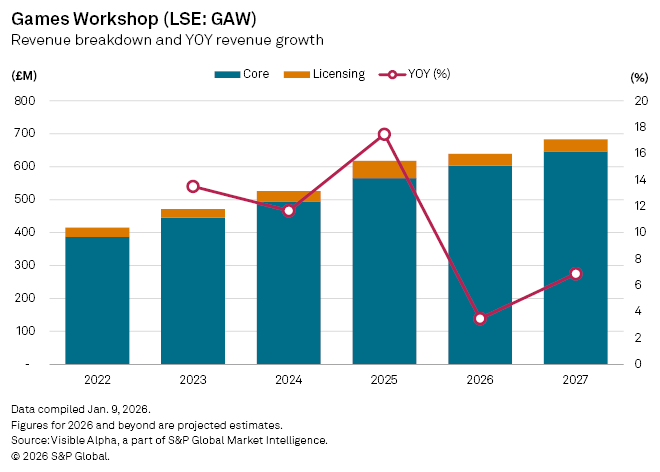

Britain’s Games Workshop Group PLC (LSE: GAW), the maker of Warhammer tabletop miniatures, is expected to enter a period of slowdown in 2026 after a standout 2025 marked by major product launches and strong licensing activity. Visible Alpha consensus estimates point to revenue rising 3.5% year-on-year to £639 million in 2026, a sharp deceleration from the 17% increase recorded last year.

The slowdown largely reflects a high base and a lighter pipeline of headline releases. Games Workshop’s core retail and trade business, which sells miniatures, rulebooks and paints, is still expected to grow, but at a more measured pace. Core revenue is forecast to increase 6.8% to £603 million in 2026, compared with double-digit growth of 14.2% in 2025. By contrast, licensing income is expected to fall 32.4% to £35 million as fewer games and media projects reach monetization during the year.

Management commentary has been constructive on demand across the core hobby, where the group benefits from a vertically integrated model, pricing power and a highly engaged global fan base. However, analysts are cautious on licensing forecasts amid uncertainty in the video games industry, where development timelines are long, and revenues can be volatile.

In December 2025, SEGA and its studio The Creative Assembly unveiled Total War: WARHAMMER 40,000, extending a long-running partnership built around Games Workshop’s flagship intellectual property. The deal underlines the enduring appeal of Warhammer in digital gaming and supports long-term brand value. Still, analysts do not expect a near-term boost: any meaningful financial contribution is likely to arrive closer to the game’s eventual launch currently expected in late 2026 or early 2027.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment