Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 14, 2026

By Shaily Jain

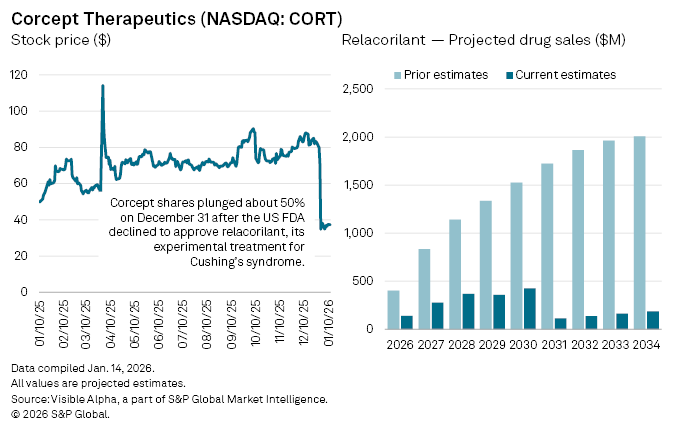

Shares in Corcept Therapeutics Inc. (NASDAQ: CORT) fell almost 50% on December 31, 2025 after the FDA declined to approve relacorilant, the biotech’s experimental treatment for Cushing’s syndrome, a rare hormonal disorder.

The FDA said it was unable to reach a favorable benefit–risk assessment for the oral cortisol-modulating therapy without additional evidence of effectiveness. Corcept had sought approval for relacorilant to treat patients with hypertension secondary to hypercortisolism, a subset of the broader Cushing’s population.

The decision is a significant setback for Corcept’s growth ambitions. Relacorilant had been positioned as the company’s next major revenue driver beyond Korlym, its sole marketed product, which is approved to treat hyperglycaemia in certain patients with Cushing’s syndrome.

Analysts have swiftly downgraded their expectations. According to Visible Alpha consensus, the probability of approval for relacorilant in Cushing’s syndrome now stands at 44%. Subject to approval, forecast sales for 2026 have been cut by 65% to $140 million, down from $401 million before the FDA decision. Longer-term projections have also been pared back sharply: the drug had been on track for blockbuster sales of about $1.1 billion by 2028, but expectations have since been reduced to $369 million.

Corcept said it plans to continue pursuing a path to commercialization and intends to meet FDA officials in the near term to discuss potential next steps, including what additional data may be required.

Despite the regulatory blow, relacorilant remains a meaningful pipeline asset through Corcept’s oncology programs. The drug is being studied in several cancer indications, including platinum-resistant ovarian cancer and endometrial cancer. An FDA decision in platinum-resistant ovarian cancer is currently expected around mid-July 2026, which could provide a medium-term catalyst for the company, and a chance for Corcept to restore some of the value lost in its late-December sell-off.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment