Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 14, 2025

By Soumya Khandelwal and Sneha Telge

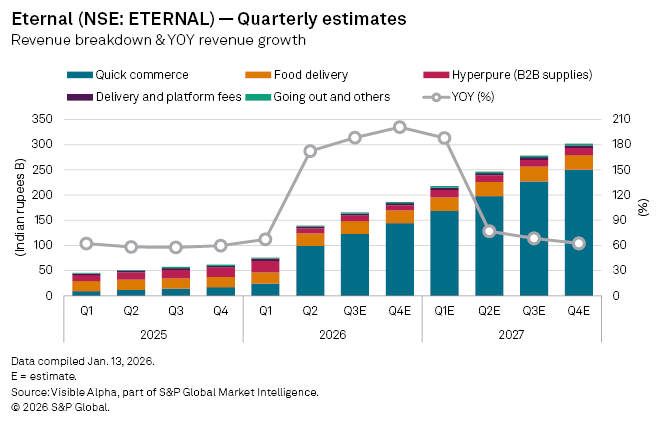

Eternal Ltd. (NSE: ETERNAL), parent of India’s leading food delivery platform Zomato and the fast-growing quick commerce arm Blinkit, is set for a step-change in growth when it reports its third-quarter 2026 results. Analysts expect the company’s aggressive expansion in ultra-fast grocery and essentials delivery to fundamentally alter its revenue mix.

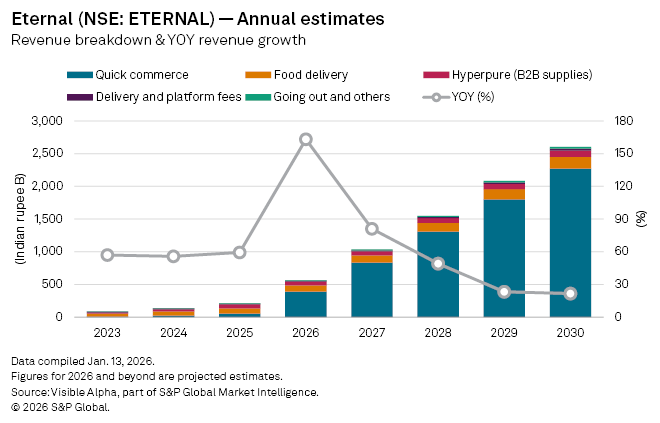

Visible Alpha consensus estimates show quick commerce will account for about 69% of Eternal’s revenue in fiscal 2026, up from 24% in fiscal 2025 and just 9% in 2023, highlighting the rapid growth of Blinkit, from a complementary offering to the core driver of the company’s growth.

Group revenue for the December quarter is expected to jump 188% year-on-year to ₹166 billion, compared with ₹57 billion a year earlier and ₹140 billion in the previous quarter. The surge reflects not only the scale-up of Blinkit but also Eternal’s transition from a marketplace model, where it connects buyers and sellers, to an inventory-led structure that allows tighter control over pricing, delivery times and customer experience.

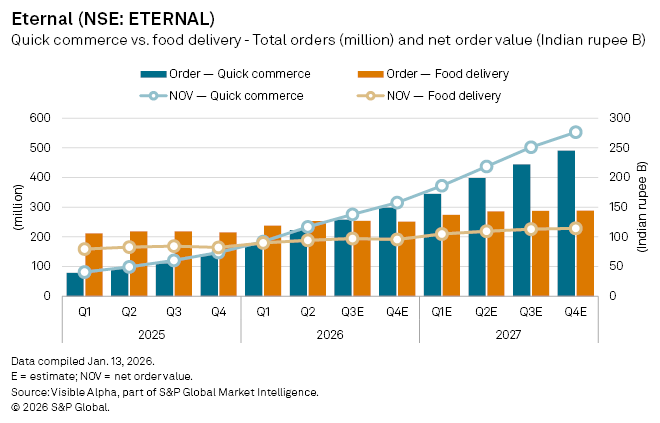

Quick commerce is forecast to overtake food delivery as the company’s largest business line. Revenue from the segment is expected to rise almost ninefold year-on-year to ₹123 billion, from ₹14 billion in the same quarter last year. Order volumes are projected to increase to 258 million, up from 110 million a year ago and 223 million in the previous quarter.

This growth has been fueled by heavy investment in infrastructure. Analysts expect Eternal’s network of dark stores, which are small warehouses located close to customers, to more than double year-on-year to about 2,080 locations, compared with just over 1,000 last year.

By contrast, the core food delivery business is expected to deliver steadier, more mature growth. Revenue is forecast to rise 21% year-on-year to ₹25.1 billion, supported by a 15% increase in net order value to ₹97.1 billion and a 16% rise in total orders to 255 million. The segment remains cash-generative, but its growth profile now looks modest relative to quick commerce.

Non-core businesses are expected to weigh on overall performance. Revenue from Hyperpure, the company’s business-to-business supplies arm, and the “going-out-and-others” segment is forecast to decline to ₹10.8 billion and ₹2.5 billion, respectively. Delivery charges and platform fees are expected to rise 14% year-on-year to ₹3.9 billion.

Looking beyond the quarter, Eternal’s growth trajectory appears increasingly tied to the expansion of quick commerce. For full-year 2026, revenue is projected to grow 163% year-on-year to ₹568 billion. Quick commerce revenue is expected to surge 650% to ₹391 billion, while food delivery revenue is forecast to rise 21% to ₹98 billion.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings