Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 23, 2026

By Nathan Stovall and Zain Tariq

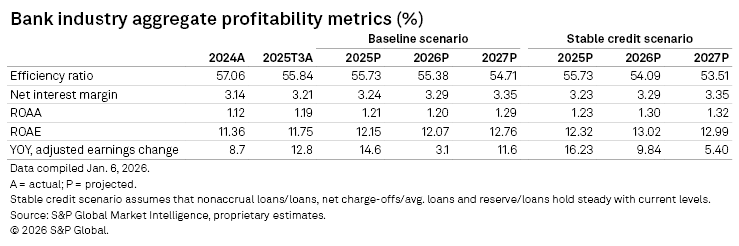

Net interest margin expansion has driven returns higher across the banking industry in 2025. Earnings growth should continue in the coming quarters, even as credit costs continue to migrate higher.

US bank earnings have continued to grow as strong margin expansion and benign credit quality supported performance. While credit costs should continue to normalize, we expect favorable results to continue, buoyed by additional margin expansion and steady loan growth. The positive fundamental landscape and a friendlier regulatory environment should spur more bank M&A activity as acquirers see deals as an attractive and faster way to gain scale — in the overall size of the company or specific markets — that they see as necessary to effectively compete.

Click here to access data exhibits and the US banking industry aggregate's projections template.

Investors warming up as credit conditions hold for now

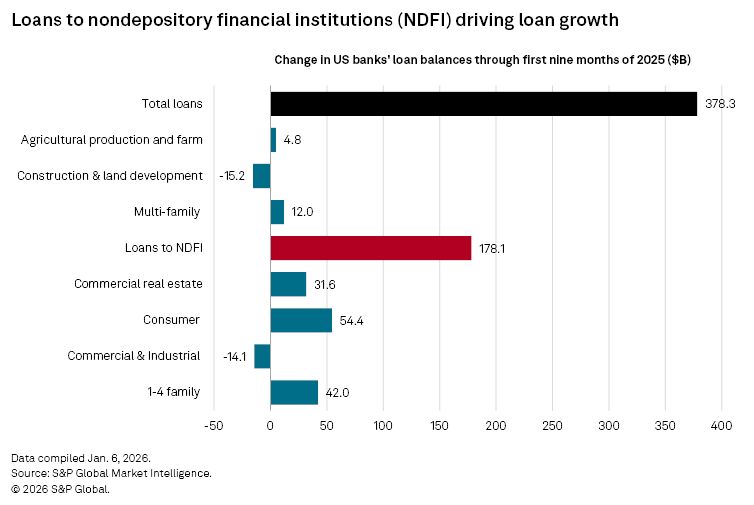

Many generalist investors heading into third-quarter 2025 earnings expected and looked for credit problems in banks' results. Save for a few one-offs that emerged in the period — often related to loans to nondepository financial institutions, which have driven much of the loan growth through the first nine months of 2025 — credit quality trends largely remained benign. Valuations, particularly for large banks, improved heading into the 2026 as the consumer and the economy remained resilient and credit concerns eased.

We expect credit quality to normalize from current levels due to weakness in the US consumer and some stress in commercial real estate portfolios, leading to a higher level of losses. Consumer delinquencies have risen from historical lows and student loan delinquencies have jumped back near pre-pandemic levels now that the moratorium on payments is several quarters in the rear-view mirror. The deterioration offers another indicator that the US consumer is stretched, marked by slower savings rates and recent weakness in the labor market.

However, bankers say that while consumer sentiment has waned, the consumer and small businesses remain resilient. Many consumers took advantage of historically low rates to refinance their mortgages before the Fed began raising rates, reducing the impact that rate hikes would have on their debt service. Consumers and other borrowers are also expected to receive more relief in the form of additional rate cuts.

Banks have seen delinquencies in their commercial and industrial and commercial real estate loan portfolios rise off historical lows, but delinquencies stabilized in the first, second and third quarters of 2025. Banks have reduced their exposure to CRE and have arguably benefited from private credit firms growing their market share and helping support the asset class.

Some skeptics argue that lenders have downplayed credit quality deterioration by modifying loans and extending maturities further out the horizon, invoking the phrase "extend and pretend." There is evidence that extensions have occurred in the CRE market, with the number of CRE mortgages estimated to mature declining in 2025 when compared to estimates a year earlier. What remains to be seen is whether those extensions offered borrowers enough breathing room to weather the storm and if recent rate declines position them to service their debts.

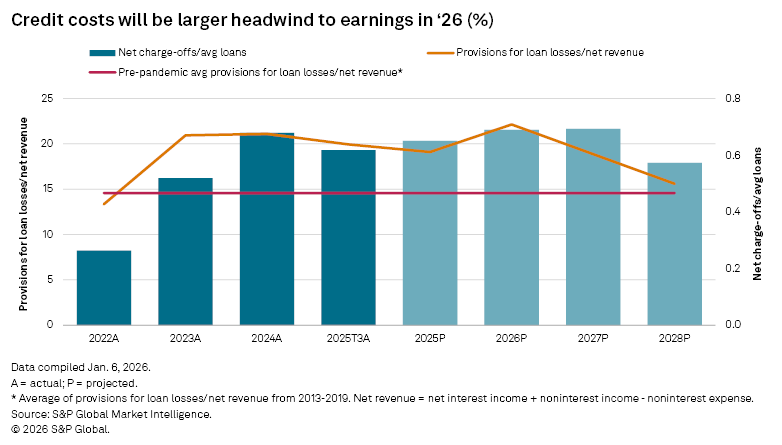

We expect higher loss content in the future, but to date, few problems have occurred. In our baseline scenario, we expect provisions to dip to 19.1% of net revenue in 2025 from 19.9% through the first nine months of 2025. That ratio is expected to increase to 22.1% in 2026 as banks prepare for tougher sledding ahead.

The higher level of provisioning will serve as a modest headwind, but earnings are still expected to rise 14.6% year over year in 2025 and grow another 3.1% in 2026.

Many bankers and members of the sell-side community expect credit trends to remain stable. If that occurred, bank earnings would grow 16.2% in 2025 and another 9.8% in 2026.

Fed cuts spell funding cost relief, further margin expansion

Banks will continue to benefit from the remixing of their balance sheets as funding costs decline, while lower-yielding assets purchased or originated when rates were low, mature and are reinvested at higher yields.

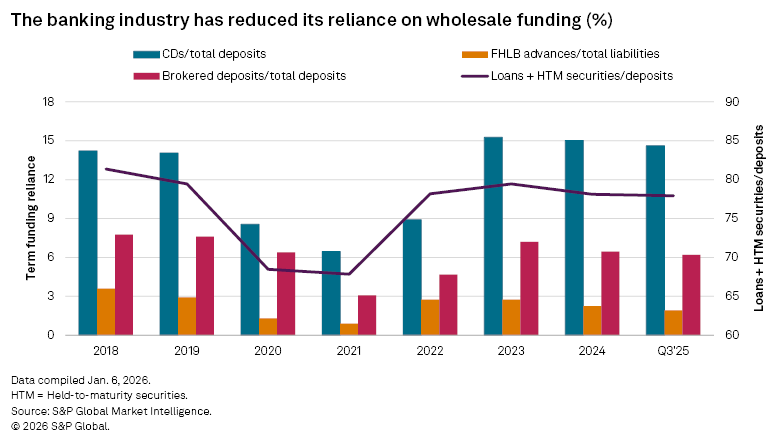

Deposit costs dropped substantially late in 2024 and early in 2025 as the highest cost deposits, often certificates of deposits (CDs) originated when rates were lower, matured and repriced at lower rates. Banks, particularly regional and community banks, increased their reliance on CDs for funding during the Fed's tightening cycle. CD pricing appears to have peaked in the second quarter of 2024 before the Fed's first rate cut in September. Since many CDs carry one-year terms, many institutions have already experienced relief from their highest cost CDs that likely matured in the first half of 2025.

The industry failed to record the same level of declines in the second and third quarters of 2025 but has reduced its reliance on CDs for funding. Rates cut by the Federal Reserve late in 2025 were expected to offer greater funding cost relief. Fourth-quarter results from JPMorgan Chase & Co. and Bank of America Corp. offered support for that thesis, with the companies' cost of interest-bearing deposits dropping 17 basis points and 21 basis points, respectively, from the prior quarter.

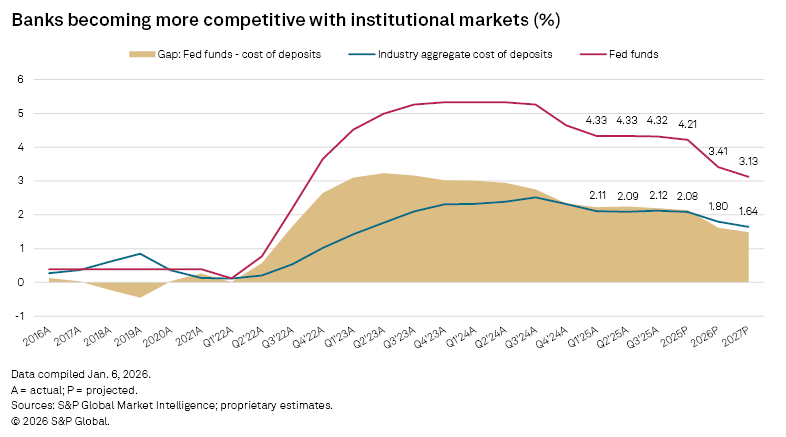

Banks will need to remain competitive with alternatives in the Treasury and money markets as they seek to cut costs further. The difference between the average fed funds rate and the industry's cost of deposits declined modestly in the third quarter of 2025. That gap should narrow as additional rate cuts by the Fed allow banks to lower their deposit costs while staying competitive with higher-yielding alternatives to maintain deposit growth.

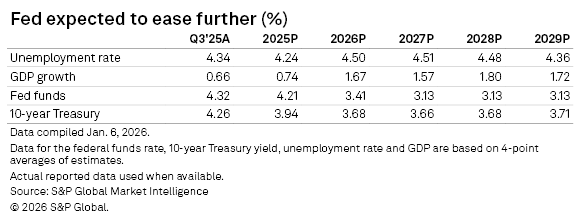

However, stronger loan growth means that banks funding needs are greater, tempering just how quickly they can lower their deposit costs. We expect banks' deposit costs to decline notably in the fourth quarter of 2025 and the first quarter of 2026, but additional funding relief will be harder to come by without further rate cuts by the Fed. The central bank is expected to cut rates again later in 2026, resulting in sharper declines in deposit costs.

Lower rates will also lead to pressure on loan yields, but this pressure will be mitigated by the replacement of historical, lower-rate assets with newer, higher-yielding alternatives. That dynamic will allow for continued margin expansion.

Looking ahead

The desire to grow earnings, gain scale and a friendlier regulatory environment should support stronger bank M&A activity. Stronger banks likely will use the positive fundamental environment to invest in technology and their franchises and remain relevant, while weaker institutions could find it more difficult to compete and could look to partner with their larger counterparts.

Bank M&A activity closed 2025 with a bang after several years of depressed activity. Fifth Third Bancorp opened the fourth quarter with plans to acquire Comerica Inc., marking just the fourth bank deal over $10 billion in value since the financial crisis. Other sizable transactions followed, including Huntington Bancshares Inc.'s plans to purchase Cadence Bank for $7.59 billion and Nicolet Bankshares Inc.'s $866 million pending purchase of MidWestOne Financial Group Inc. The fourth quarter ended with eight bank deals with values over $500 million announced in the period — the most in any quarter since the first quarter of 2021.

Large buyers like Huntington and active acquirers like Nicolet have returned as regulators have signaled that they are far more supportive of M&A activity. With more buyers, the desire to gain scale to invest in technology, succession issues, pent-up demand for deals during the pandemic, and the rate hike cycle, as well as stable fundamental trends, all should lead to greater bank M&A activity.

The expected pickup in deal activity among regional and community banks would alter the competitive landscape. Buyers that gain scale through deals likely would be less focused on organic growth while integrating their acquisitions. They will also be more likely to address any concerns they have in their loan portfolios since bank M&A accounting requires the buyer to mark a target's balance sheet to market. The fair value mark would, in theory, allow an institution to purge unwarranted assets without taking large additional losses.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language