Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 13, 2026

By Sakshi Matta

Antero Resources Corp. (NYSE: AR) announced last month that it has agreed to buy upstream assets from privately held HG Energy for $2.8 billion, expanding its footprint in Appalachia. In a parallel move, Antero Midstream, which provides gathering, processing and water services to Antero Resources, will acquire HG Energy’s midstream assets for $1.1 billion.

Besides the two deals, Antero has also agreed to sell its Ohio Utica Shale upstream assets for $800 million and its Utica midstream assets for $400 million. All four transactions are subject to customary closing conditions and are expected to complete in early 2026.

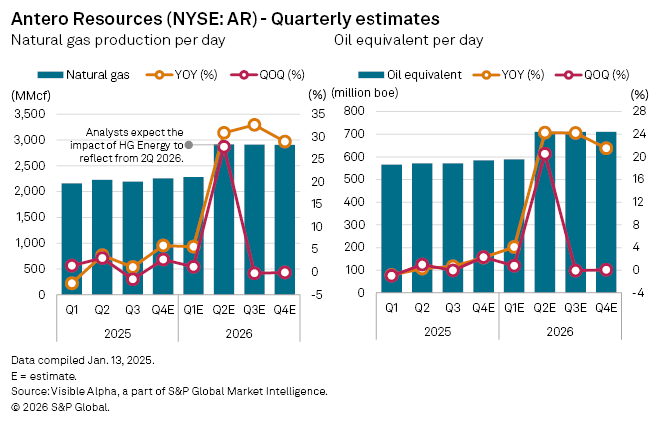

Visible Alpha consensus estimates suggest the impact of the HG Energy acquisition will begin to show in results from the second quarter of 2026, materially lifting production and revenues.

Natural gas output is forecast to rise to 2,919 million cubic feet per day in 2Q 2026, from 2,284 million cubic feet in 1Q 2026, a sequential increase of 28%, and from 2,230 million cubic feet a year earlier, up 31%. Total production, measured in barrels of oil equivalent, is expected to reach 710 million barrels of oil equivalent per day, representing growth of 24% year-on-year and 21% quarter-on-quarter.

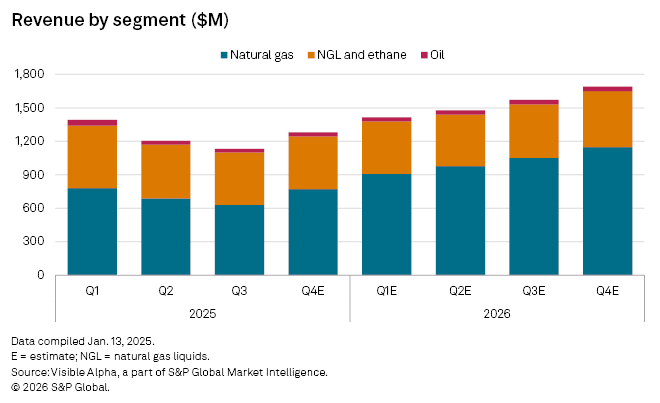

That higher output is expected to translate into stronger financials. Quarterly revenue is projected at $1.5 billion in 2Q 2026, up 24% from a year earlier and 8% from the previous quarter. Natural gas revenues are set to drive most of the increase, rising an estimated 42% year on year and 7.5% sequentially.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment