Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 12, 2025

By Tim Zawacki and Husain Rupawala

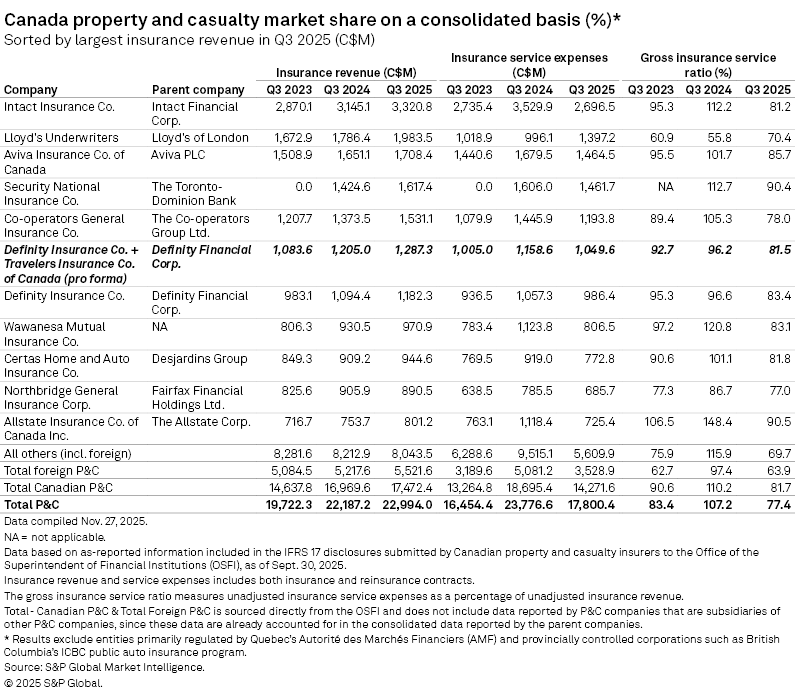

Canadian property and casualty insurers exited the third quarter with increased momentum, benefiting from a significant decrease in natural catastrophes compared to earlier periods.

The industry posted its lowest insurance service ratio, a key measure of underwriting profitability, in seven quarters, according to Office of Superintendent of Financial Institutions data compiled and analyzed by S&P Global Market Intelligence. The property business lines led the improvement, benefiting not only from an easy comparison on the catastrophe front but also continued improvement in underlying trends.

Total insurance revenue of C$17.64 billion across all lines reflected increases of 3% on both year-over-year and sequential bases, with growth rates at higher levels in the heretofore embattled automobile and property lines. The gross insurance service ratio improved to 81.8%, representing the industry's best result in any period since the fourth quarter of 2023. Relative to the third quarter of 2024, when Canada sustained three natural disasters that caused more than C$1 billion in insured losses apiece, the insurance service ratio improved by 28.4 percentage points.

The recent relative calm notwithstanding, the longer-term volatility induced by severe weather events, particularly in property lines, demands the need for continued vigilance in risk management and pricing strategies.

The performance of the insurance market varies significantly by region. Ontario remains the leader, accounting for nearly 50% of the market with insurance revenue of C$8.57 billion in the third quarter. Its gross insurance service ratio declined to 80%, down from 89.4% in the same period last year. In Alberta, which accounted for approximately 19% of the market, the year-over-year improvement was far more dramatic, even as the province's gross insurance service ratio remains elevated. The Alberta result of 97.0% was 83.2 percentage points better than the astronomically high ratio of the third quarter of 2024, when the province sustained historic catastrophe loss events in the form of the Jasper wildfire and Calgary hailstorm.

Aside from natural disasters, Alberta continues to face challenges due to its unique regulatory environment, which imposes rate caps and restrictions on new private-passenger auto insurance rate approvals. This has led to considerable and sustained difficulties for the business line in the province, as reflected in a third-quarter 2025 gross insurance service ratio of 116.0% in private auto and 110.0% across all automobile lines. It marked the fifth time in the last six quarters that Alberta's automobile gross insurance service ratio exceeded 100%.

Reforms approved earlier in 2025 promise improvement in the Alberta market over the longer term, particularly through the forthcoming implementation in 2027 of what is known as the Care-First system, aimed at curbing legal costs. In the meantime, the extension through 2026 of the province's existing 7.5% rate cap for good drivers will continue to limit insurers' ability to fully match rate to risk, likely causing Alberta’s auto insurance service ratio to remain elevated relative to other provinces.

On a nationwide basis, the automobile insurance sector remains a vital part of the Canadian P&C market, generating C$7.63 billion in revenue, including both personal and commercial risks, with a gross insurance service ratio of 88.3%. The private auto line accounted for C$6.07 billion in revenue against service expenses of C$5.55 billion, resulting in a gross insurance service ratio of 91.5%. This marked significant improvement from the year-earlier period when catastrophe losses, particularly from the Calgary hailstorm, pushed the ratio to 101.3%, but it was slightly higher than the second quarter's 90.2% result. Notably, gross insurance service ratios increased sequentially at a faster pace for the liability and personal accident lines than for the "other" line, which includes the physical damage coverages that would be most susceptible to any tariff-related inflationary pressures. The liability and personal accident ratios of 95.4% and 97.4%, respectively, were also markedly higher than the 84.2% result in the "other" line.

As the Canadian P&C sector adapts to external pressures such as inflation and fallout from US tariff policy, it is increasingly focusing on operational efficiencies and pricing strategies.

The recent removal of counter-tariffs on auto parts imported from the United States may offer some relief, but ongoing volatility in the automotive supply chain continues to present significant challenges, even if it has not yet manifested itself in a meaningful way in profitability measures.

In the third quarter, Intact Financial Corp. continued to lead the Canadian automobile insurance market with revenue of C$1.49 billion and a gross insurance service ratio of 86.5%. Second- and third-place Security National Insurance Co. and Co-operators General Insurance Co. reported revenues of C$1.05 billion with a gross insurance service ratio of 101.2% and C$706 million with a ratio of 88.2%, respectively. All three companies showed year-over-year declines in their automobile gross insurance service ratios but only Intact posted sequential improvement.

During Intact's earnings call, CEO Charles Brindamour said that his company's outperformance in the automobile business reflected its track record of confronting inflationary pressures through pricing and supply chain management.

The same sort of vigilance and adaptability remain critical themes in the property lines as well, despite the significantly stronger results posted by the industry and several key market participants in the third quarter.

Desjardins Group's P&C segment, which includes its subsidiary Certas Home and Auto Insurance Co., reported reported net surplus earnings of C$331 million, an increase of C$284 million from the previous year primarily due to a reduction in insurance service expenses as no major catastrophes occurred, unlike the Jasper wildfire, torrential rain from Hurricane Debby in Quebec and the Calgary hailstorm last year. Direct premiums written rose to C$2,177 million, reflecting growth in both automobile and property insurance, with Certas' disclosures to the Office of the Superintendent of Financial Institutions (OSFI) showing that it contributed C$944.6 million in revenue and a gross insurance service ratio of 81.8%. The group's overall insurance service result reached $804 million, up from $424 million in the prior year.

As the industry approaches the final quarter of 2025, insurers must continue to invest in technology and collaborate with stakeholders to strengthen building codes and enhance disaster preparedness initiatives. A focus on resilience and adaptability will be crucial for navigating ongoing challenges and ensuring sustained profitability in this evolving market.

While overall catastrophes were less prevalent in the third quarter of 2025, recent wildfires in Manitoba and Saskatchewan led to insured losses approaching C$300 million, and a July hailstorm in Calgary caused damages exceeding C$164 million. These events show the need for insurers to account for ongoing - albeit sporadic - risks across different regions of Canada amid increasingly acute threats from wildfires and severe convective storms in both risk-selection and pricing.

Methodology

In analyzing the Canadian market for the purposes of this article, we rely on the gross insurance service ratio for the Total Canadian P&C industry using nonconsolidated results for individual entities as the key measure of underwriting profitability. Note that the consolidated results for foreign P&C entities, which are defined as those incorporated outside of Canada, differed in magnitude and direction from those discussed in this article. Consolidated results by type of entity are available on tabs 9 through 12 of the data exhibits file.

The gross insurance service ratio incorporates two critical line items of IFRS 17 reporting: insurance service expenses, including incurred claims, claims-related expenses and acquisition costs, as a percentage of insurance service revenue prior to the impact of reinsurance. For the market share charts, we used consolidated results to include foreign entities. Note that the gross insurance service ratio differs from a combined ratio in that it does not incorporate general and operating expenses, which typically account for between 3% and 4% of insurance service revenue from quarter to quarter.

Importantly, our data is limited to results published by the Office of the Superintendent of Financial Institutions (OSFI), which excludes information for entities primarily regulated by Quebec’s Autorité des Marchés Financiers. It also does not contemplate results for public insurance corporations, most notably the government-controlled Insurance Corp. of British Columbia, which provides private-passenger auto insurance to drivers in its namesake province.

The data exhibits file contains additional discussion of the scope and limits of the data. Also, use the newly introduced Canadian market share tool for geographic and line of business level information. Take note of the currency selection in the settings of the S&P Capital IQ Pro Excel add-in when refreshing the spreadsheet.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language