Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 11, 2025

By Ehteesham Ansari, Mehak Kamboj, Yamini Sharma, and Anirudh Mahesh

Snap Inc. (NYSE: SNAP), the parent company of Snapchat, is preparing to broaden its revenue base with a new partnership that will bring Perplexity’s AI-powered answer engine into Snapchat from early 2026. The integration will allow users to pose questions directly within the app’s chat interface and receive instant responses, a feature Snap hopes will strengthen engagement while opening a new line of revenue beyond its core advertising business.

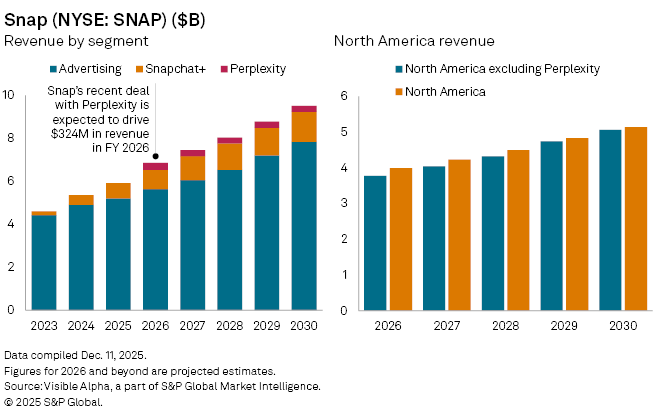

Based on Visible Alpha consensus, analysts expect the partnership to generate $324 million in revenue in 2026. While modest relative to Snap’s broader revenue base, the move marks the company’s attempt to diversify beyond advertising, which still accounts for the overwhelming majority of sales.

Perplexity’s integration could offer a hedge and help Snap drive user engagement and retention on its platform, although the impact of this remains to be seen.

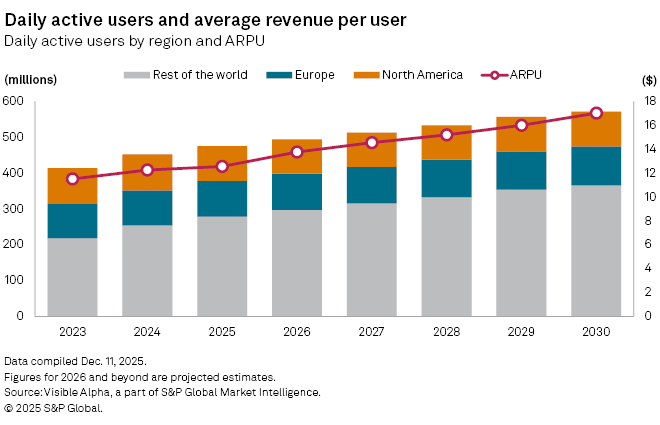

Consensus forecasts point to 475 million daily active users (DAUs) in 2025, rising to 514 million in 2026. Average revenue per user (ARPU) is expected to increase from $12.5 this year to $13.8 next year, with North America continuing to deliver the highest ARPU globally despite slower user growth. Meanwhile, user numbers remain largest in regions outside North America and Europe, offering scale but lower monetization.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment