Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 2, 2025

By Sonalika Mohanty and Satyaprakash Panda

Palantir Technologies Inc. (NYSE: PLTR) has seen its stock fall nearly 19% since early November, reflecting broader caution over high-valuation AI stocks. The decline comes despite the software analytics provider posting robust third-quarter results, with revenues rising 62.8% year-on-year to $1.2 billion, marking its second consecutive $1 billion quarter.

Palantir continues to expand its commercial footprint, recently signing a multiyear deal with PwC to accelerate AI adoption in the UK, alongside a contract with aircraft engine maintenance firm FTAI Aviation.

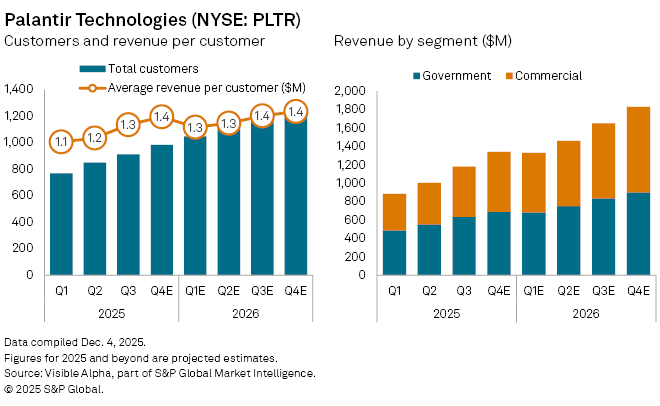

Total clients are expected to reach 982 in Q4, up from 911 in Q3 and 711 a year ago. Average revenue per customer is projected to increase to $1.4 million, compared with $1.3 million in the prior quarter and $1.2 million a year ago.

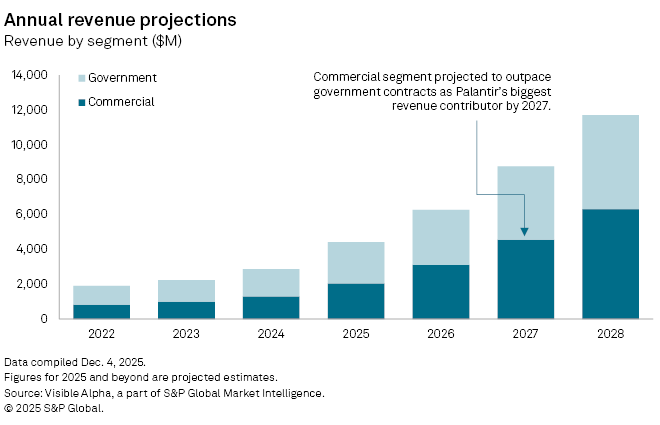

Analyst revenue expectations also remain optimistic. Visible Alpha consensus shows analysts forecast fourth-quarter revenue of $1.3 billion, up 61.8% year-on-year. Revenue from commercial clients is expected to jump 75% to $653 million, outpacing government contracts, projected to grow 51% to $688 million. The commercial segment is poised to become the largest revenue driver for Palantir by 2027.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment