Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 18, 2025

By Nitin Mirajkar

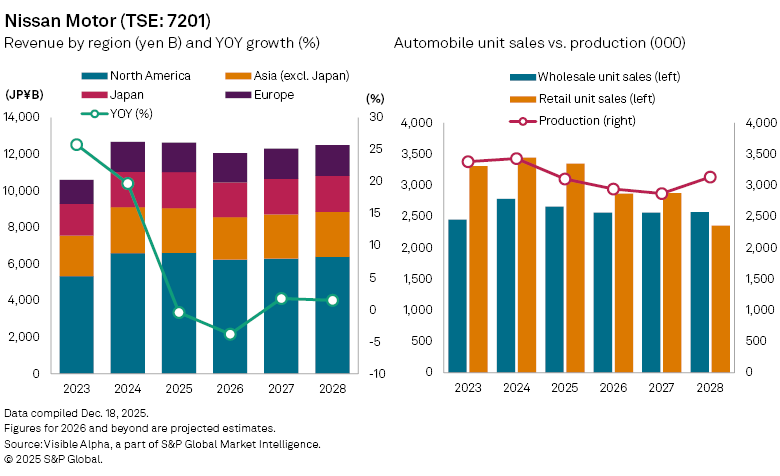

Nissan Motor Co. Ltd. (TSE: 7201) is navigating a challenging year as it grapples with falling sales and rising costs. In the first half of fiscal 2026, revenues fell 6.8% year-on-year to JP¥5.6 trillion, while the automaker recorded an operating loss of JP¥27.6 billion.

The decline reflects a broad slowdown in global retail sales, particularly in Asian markets outside Japan, where Chinese competitors have eroded Nissan’s market share. At the same time, the company is undertaking a major restructuring plan to cut costs and restore profitability. Heavy investment in electric vehicles (EVs) has also pushed up operating expenses in the short term.

Visible Alpha consensus shows analysts expect full-year revenues to decline 4% year-on-year to JP¥12.2 trillion in fiscal 2026, following a modest 0.4% drop in 2025. North American revenues, the group’s largest market, are projected to fall 5% to JP¥6.2 trillion, partly due to tariffs. Sales in Asia excluding Japan are expected to decline 6% to JP¥2.3 trillion, while Japan and Europe sales are forecast at JP¥1.9 trillion (-3% YOY) and JP¥1.6 trillion (-0.5% YOY), respectively.

Retail unit sales, reflecting cars sold to customers, are expected to drop sharply by 14% to 2.9 million vehicles in 2026. Wholesale volumes or cars shipped to dealerships, are projected to fall 3% to 2.6 million units, while production is forecast to decline 5% to 2.9 million vehicles.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment