Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 15, 2025

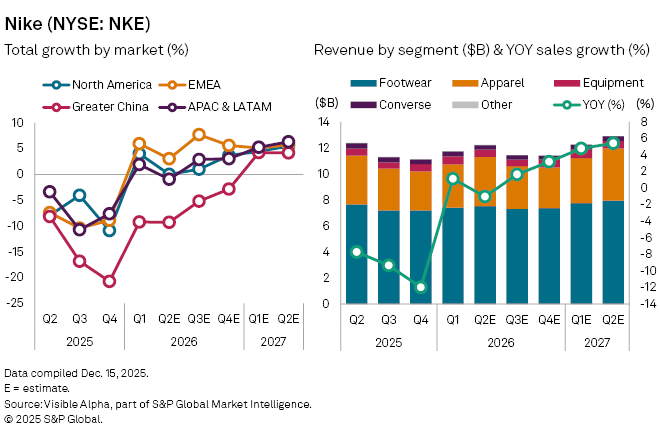

Nike Inc. (NYSE: NKE) is set to report second-quarter fiscal 2026 results on Thursday, December 18, with revenue and profit expected to remain under pressure. Based on Visible Alpha consensus, analysts forecast $12.2 billion in sales, down 1% year-on-year, reflecting pressures from ongoing promotional activity, inventory normalization, and rising competition from fast-growing brands such as On and Hoka. The company’s stock has fallen 8% year-to-date.

Nike brand revenue is expected to slip 0.6% to $11.9 billion. Revenue from Greater China is forecast to fall 9% to $1.6 billion, while North America remains flat at $5.2 billion. Europe, Middle East and Africa sales are expected to rise 3% to $3.4 billion, with Asia-Pacific and Latin America down 1% to $1.7 billion.

By category, footwear, accounting for nearly two-thirds of revenue, is projected to see sales decline 2% year-on-year to $7.5 billion, while apparel is set to rise 1% to $3.8 billion. Equipment sales are expected up 2% to $555 million. Converse, a smaller but closely watched brand, is forecast to drop 18% to $350 million.

On the channel side, wholesale revenue is forecast to grow 3% to $7.1 billion, while direct-to-consumer sales are expected to drop 5% to $4.8 billion, though analysts see digital growth supporting a rebound later in the year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment