Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 10, 2025

By Aman Gupta

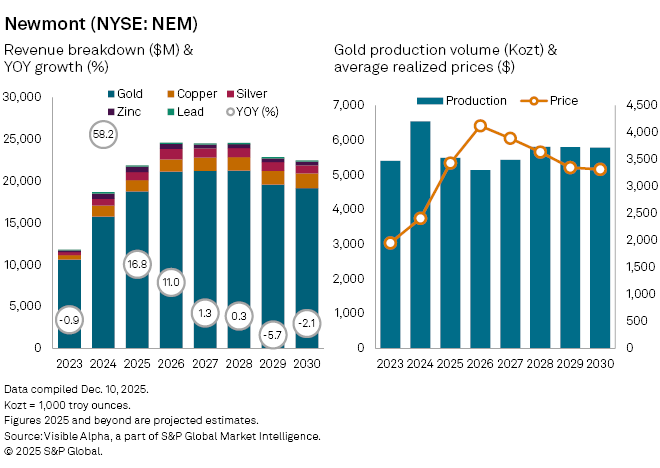

Newmont Corp. (NYSE: NEM) has seen its shares grow 132% year-to-date fueled by a significant rise in gold prices. The leading gold producer has been a major beneficiary of a flight to safe assets, as macroeconomic uncertainty and shifting interest-rate expectations pushed bullion prices to record highs.

Visible Alpha consensus shows Newmont’s revenue is expected to rise 17% year-on-year in 2025 to $21.8 billion, extending last year’s rebound. Gold will once again do the heavy lifting: sales from the metal are forecast to climb 19% to $18.8 billion, supported by a sharp 43% increase in the average realized gold price to $3,432 per ounce.

Growth elsewhere is more muted. Copper, silver and zinc revenues are projected to rise 0.4%, 20%, and 5% respectively, while lead revenue is expected to fall 11% to $174 million. The uneven performance reflects the company’s ongoing shift toward a streamlined “Tier 1” portfolio, which has involved shedding non-core assets including its stakes in Orla Mining and the Coffee Project in Yukon, in an effort to improve cost discipline and capital efficiency.

The portfolio reshaping, however, comes with a trade-off. Analysts expect group-wide production volumes to decline meaningfully in 2025, with gold output forecast to fall 16% to 5.86 million ounces. Copper, silver, and zinc volumes are projected to drop 12%, 14%, and 4% respectively. Lead is the sole exception, with production expected to edge up 2% to 216,000 ounces.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings