Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 17, 2025

By Ashish Negi, Fatima Qasim, and Yamini Sharma

US chipmaker Marvell Technology Inc. (NASDAQ: MRVL) is in advanced discussions to acquire Celestial AI Inc., a startup specializing in optical interconnect technology. The acquisition would deepen Marvell’s exposure to one of the fastest-growing segments of the AI data center market.

Marvell’s core portfolio is dominated by electrical networking chips, which move data using traditional copper-based connections. Celestial AI’s optical technology, which transmits data using light, is seen as a technological leap that can be integrated into Marvell’s core products. Optical interconnects are increasingly favored by hyperscale data center operators as AI workloads push power consumption, latency and bandwidth requirements to new extremes.

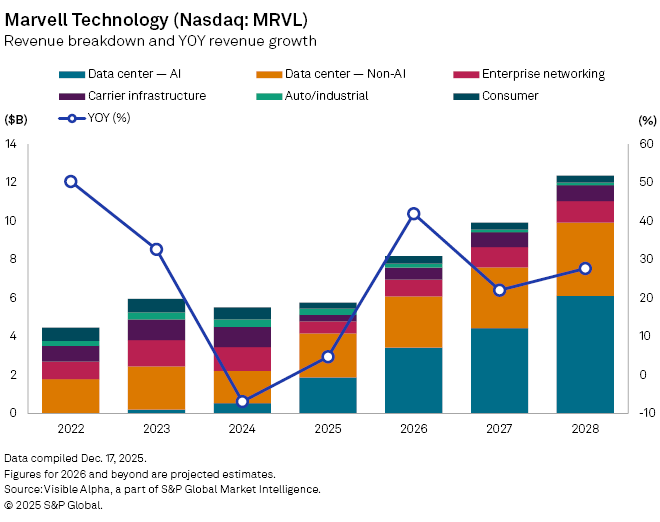

The potential acquisition comes as Marvell enters a sharp earnings inflection. Based on Visible Alpha consensus, group revenue is forecast to rise 42% year-on-year in fiscal 2026 to $8.2 billion, a strong acceleration from the 5% growth seen last year. The rebound is being driven overwhelmingly by AI infrastructure spending. Revenue from AI-focused data center products is expected to surge 83% to $3.4 billion, accounting for more than 40% of total sales. Similarly, non-AI data center revenue is forecast at a solid $2.7 billion, up 17% year-on-year.

Beyond data centers, several of Marvell’s end markets are expected to recover after a deep cyclical downturn over the last two years. Enterprise networking revenue is forecast to rise 37% to $860 million, following a 49% decline last year as customers worked through excess inventories. Carrier infrastructure revenue is set for the sharpest rebound, with revenue expected to jump 84% to $624 million after a 68% drop. Consumer revenue is projected to increase 23% to $389 million.

One area of continued weakness remains auto and industrial, where revenue is expected to fall 33% to $218 million as demand softness persists.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings