Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 2, 2025

By Monika Panchal

Australian miner Lynas Rare Earths Ltd. (ASX: LYC) has seen its shares more than double year-to-date among growing interest in the few large-scale suppliers of rare earths operating outside China. The company’s positioning in a strategically sensitive market, supplying key materials for electric vehicles, wind turbines and advanced electronics, has also helped drive this momentum after two years of declining output and weaker pricing.

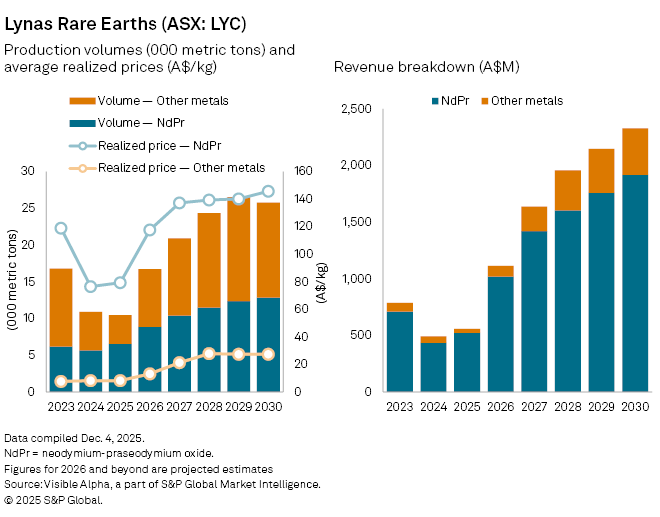

Lynas is expected to enter a stronger growth phase in fiscal 2026 as new processing capacity ramps up. Visible Alpha consensus shows total rare earth oxide production to rise 53% year-on-year to 16.1K tons in 2026, marking a sharp reversal from recent declines. Average realized prices are projected to climb 47% to A$72.5 per kg, up from $49.5 per kg last year, supported by tighter global supply and improving demand in the EV and renewable energy sectors.

Lynas’s most important product, neodymium-praseodymium (NdPr) oxide, which accounts for 91% of revenues, is also benefiting from a pricing rebound. Consensus estimates show average realized NdPr prices to rise 48% year-on-year in 2026 to A$118 per kg, while production volumes are expected to grow 35% to 8.8K tons. This is set to deliver a 95% increase in NdPr revenues, contributing roughly A$1 billion to the group’s 2026 topline.

Overall, the combination of higher volumes and improved pricing is set to lift financial performance materially. Revenues are forecast to double to A$1.1 billion in 2026, compared with A$557 million last year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment