Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 16, 2025

By Melissa Otto, CFA

Introduction

With repeated references to consumer resilience by both companies and the Fed recently, the holiday season seems to be off to a good start. However, questions remain about what consumers will shop for this holiday season and whether they will hit stores or purchase online. With reports of consumers looking for a better price and value equation for a wide assortment of items, affluent consumers seem increasingly willing to pay more if the value is there. In addition, US consumers are continuing to enjoy the shopping benefits of a strong US dollar in the UK/EU and Japan. As we begin to close out the final few months of the year, revenue expectations remain mixed. This holiday season is likely to pack a few surprises in the next earnings reports.

Key macro trends impacting consumption

Amazon and Walmart: Online vs. brick/mortar superstores

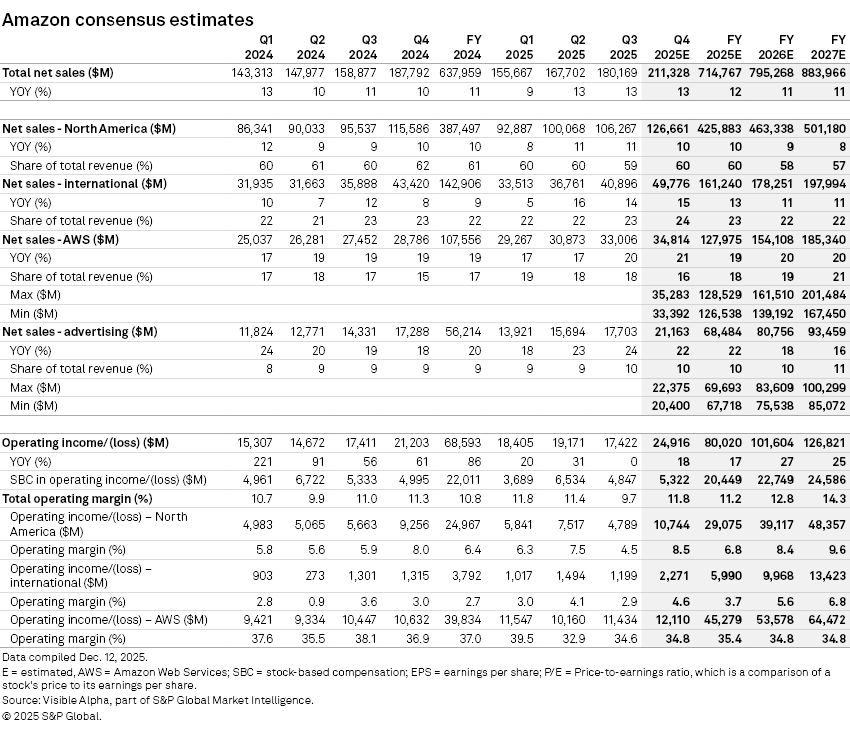

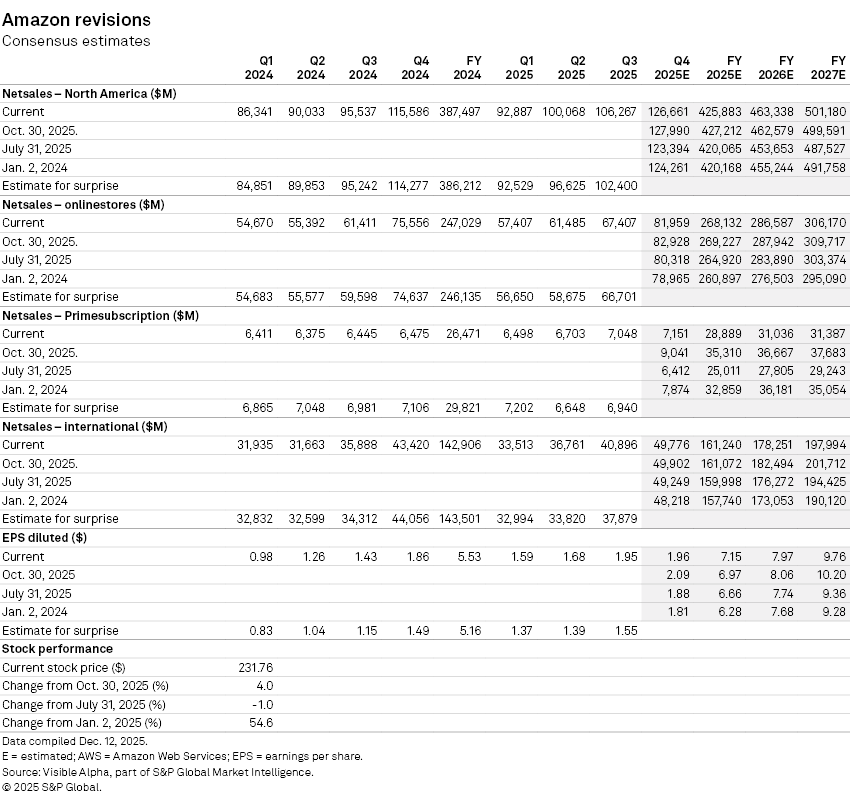

Looking at the numbers, more revenue growth is likely to continue to come from online retail for both Amazon.com Inc. (NASDAQ: AMZN) and Walmart Inc. (NASDAQ: WMT). At Amazon, International revenue growth is expected to outpace North America by 500bps in the Q4 2025.

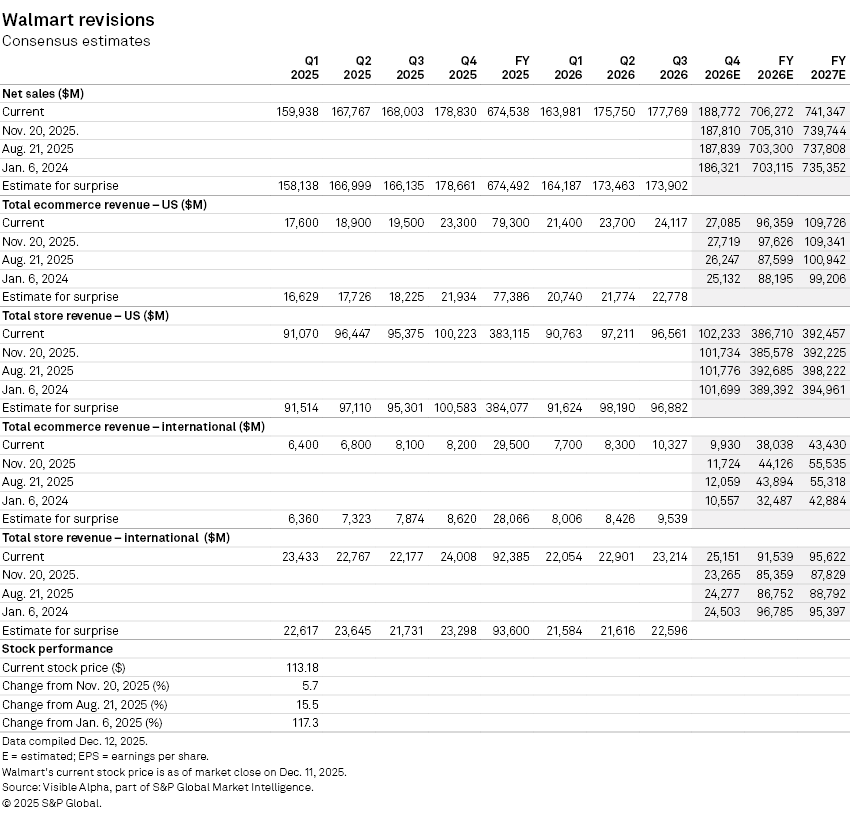

While at Walmart, US sales are projected to be flattish, and international sales growth is estimated to slow this year. However, this sluggishness is more than offset by almost 30% growth in e-commerce sales internationally and over 20% growth in the US e-commerce segment in FY 2025. In Q4, e-commerce alone is expected to generate 16% YOY sales growth in US and 21% internationally, outperforming the store segment. These estimates suggest that consumers may be buying more online this holiday season at both Walmart and Amazon.

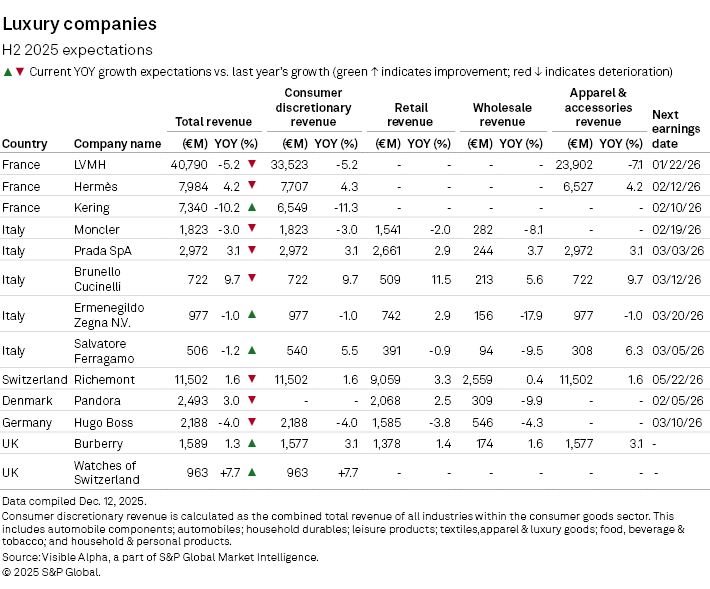

Luxury: Mixed growth trends

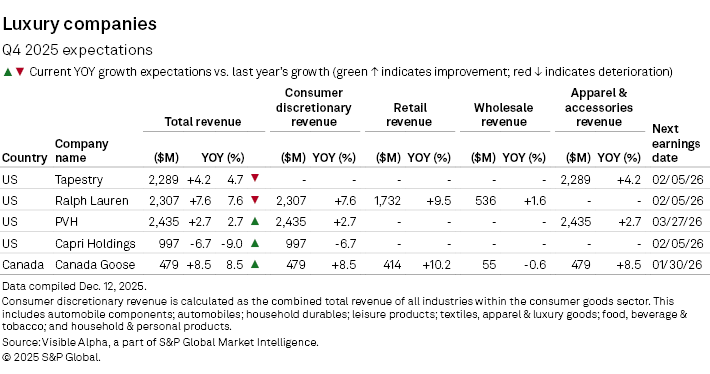

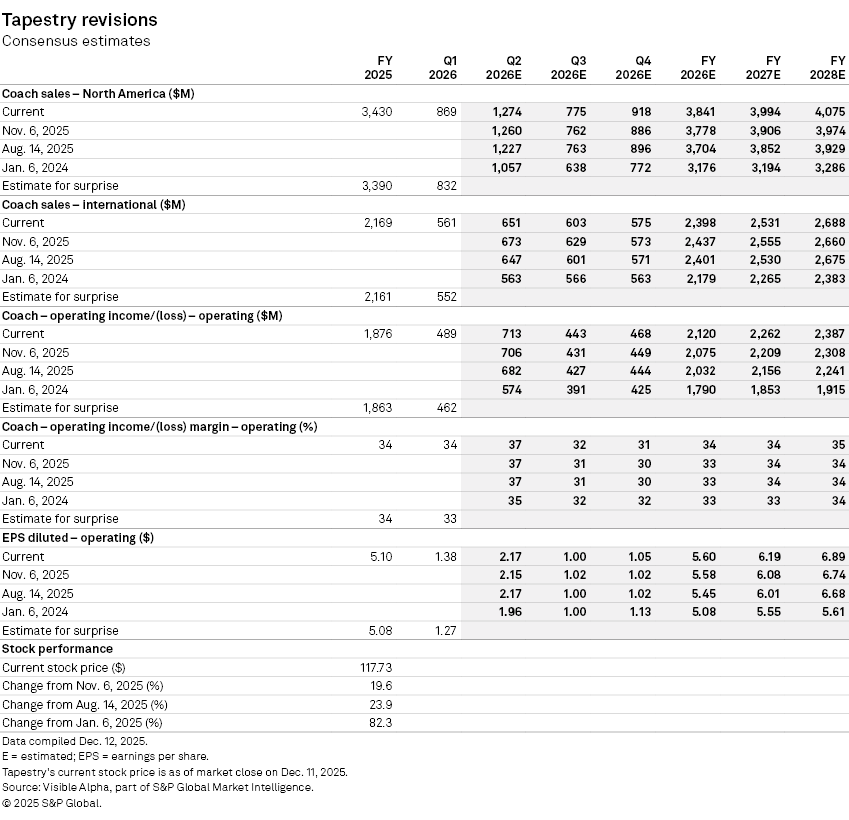

Performance across the luxury goods companies is expected to be mixed year-over-year. LVMH Moët Hennessy - Louis Vuitton Société Européenne (ENXTPA: MC), Kering SA (ENXTPA: KER) and Capri Holdings Ltd. (NYSE: CPRI) are expecting negative revenue growth and Hermès International Société en commandite par actions (ENXTPA: RMS) , Prada SpA (SEHK: 1913), Tapestry Inc. (NYSE: TPR) and Ralph Lauren Corp. (NYSE: RL) are estimated to show positive growth. The pace of year-over-year growth expectations when compared to last year varies by company. Notably, LVMH’s -5.2% sales growth worsened year-over-year and Watches of Switzerland Group PLC (LSE: WOSG) strong 7.7% expected growth improved year-over-year.

LVMH: The luxury bellweather

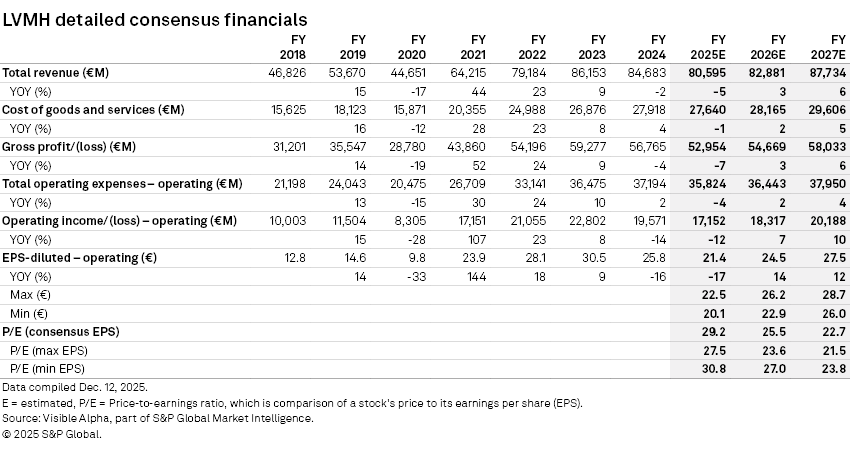

With luxury in the doldrums since the Covid-era demand surge, LVMH may serve as a bellweather for overall spending and growth expectations in the space. Near-term, LVMH consensus total revenue growth of -5% year-over-year for the H2 captures continued softness in luxury. However, given this backdrop, expectations into this holiday season are tempered.

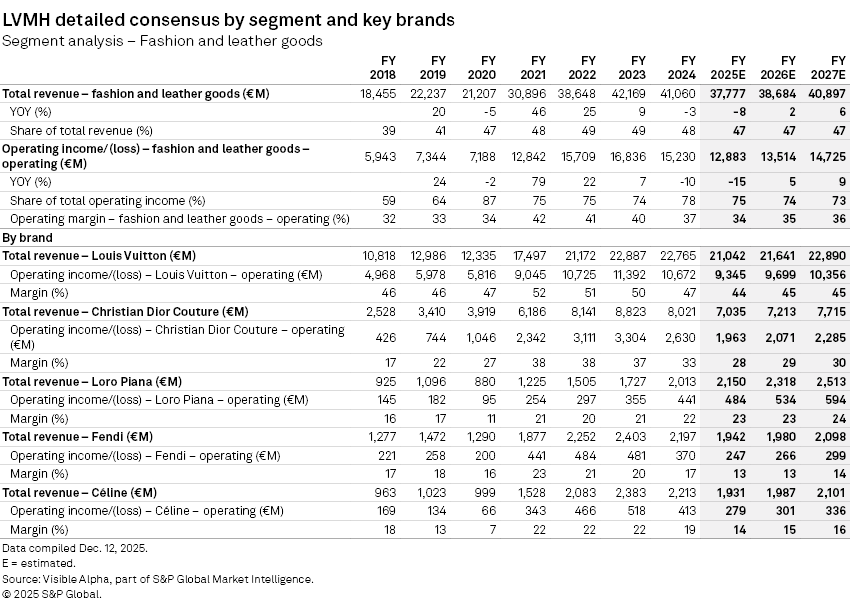

FY 2026 may see trends turn a corner. The Fashion and Leather Goods segment make up 75% of LVMH’s total operating profit. Based on consensus, the company is expected to generate a 34% operating profit margin, below the 40% peak from a few years ago. While this margin is not likely to return to 40% anytime soon, we may see it stabilize and start to shift up, especially if foreign exchange rates become more favorable. FY 2027 operating profit margin for this segment is expected to move up to over 35% from this year’s expected 34% and next year’s 35%. In addition, sales in this critical division are projected to stop falling and slowly return to 2% growth in FY 2026 and 6% growth in FY 2027.

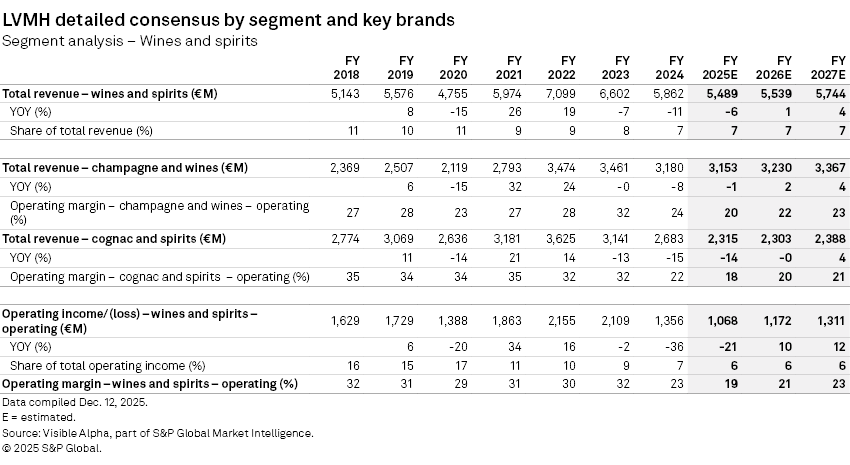

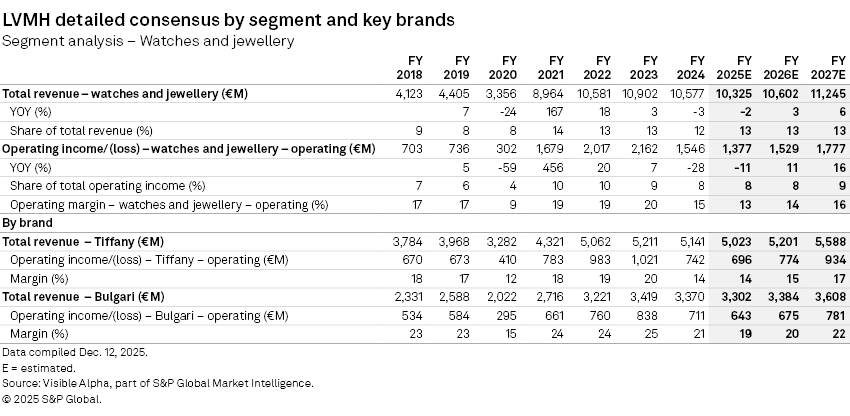

Even though they contribute a smaller portion of profitability to the total group, the Wine and Spirits and Watches and Jewelry segments are expected to bottom this year and to grow operating profit by over 10% in FY 2026. For the LVMH group, sales in the segments have been impacted by a mix of tourism trends, foreign exchange and China’s macro-economic slowdown. Looking out to FY 2027, these macro trends look poised to shift, as the US began cutting rates and China has started to show signs of improving.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment