Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 10, 2025

By Hardik Savla

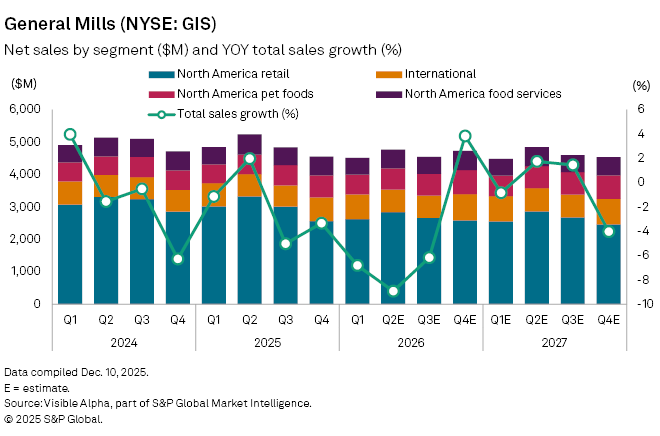

General Mills Inc. (NYSE: GIS) is expected to report another quarter of declining revenue when it posts fiscal Q2 2026 earnings on Wednesday, December 17, with analysts forecasting a 9% year-on-year fall in net sales to $4.8 billion. The packaged food group has struggled to revive growth following two subdued years, with analysts expecting sales weakness to persist through the first half of 2026 before a modest rebound in the fourth quarter.

The divestiture of General Mills’ US yogurt business, including Yoplait, Go-Gurt, and others, to French dairy group Lactalis in June 2025 is set to cut approximately 6% from Q2 sales. Broader challenges remain as consumers continue to shift towards healthier, less processed foods and value-seeking consumers amid macroeconomic pressures.

North America retail, General Mills’ largest division, is expected to bear the brunt of the slowdown, with sales projected to fall 15% year-on-year to $2.8 billion. North America foodservice revenue is forecast to decline 7% to $583 million. Growth pockets persist abroad, with international sales projected to see a modest 1.2% rise to $699 million and the North America pet food unit, one of the company’s more resilient categories, expected to see 9% growth, reaching $649 million in Q2.

Profitability is also expected to be under pressure. Net income is forecast at $554 million, down 30% from a year earlier.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings