Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 5, 2025

By Deepanshi Agrohi

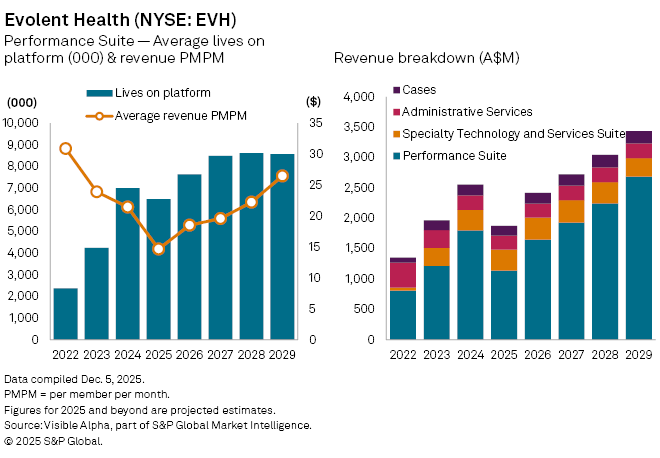

Evolent Health (NYSE: EVH) shares have shed over 60% this year as the US healthcare services group faces broad-based revenue pressure. The company has seen revenues drop since the first quarter of 2025, driven primarily by weakness in Performance Suite, its largest and historically highest-margin business, accounting for roughly 61% of revenue.

A series of contractual changes has led to both fewer members on the Performance Suite platform and sharply lower fees. For Performance Suite, analysts expect average revenue per member per month to fall 32% year-on-year to $14.7 in 2025, while the number of covered lives is projected to drop 7% to 6,490. The dual decline is set to push Performance Suite revenue down an estimated 37% to $1.1 billion, according to Visible Alpha consensus.

The slowdown extends beyond the flagship business. Evolent’s Administrative Services and Cases units are also forecast to contract, with 2025 revenues expected to fall 5% to $227 million and 7% to $165 million respectively. These areas had previously served as stabilizing contributors but are now reflecting the same margin compression and muted client activity affecting the rest of the portfolio.

The lone bright spot is the Specialty Technology and Services Suite, where revenue is expected to grow 3% to $347 million. Although the number of covered lives is set to increase from 73,339 to 77,807 this year, average fees are expected to edge 2% lower to $0.37. Also, given the very low per-unit fee compared to Performance Suite, the increase in volume hasn’t translated into significant top-line growth for Evolent.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment