Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 3, 2025

By Hardik Savla

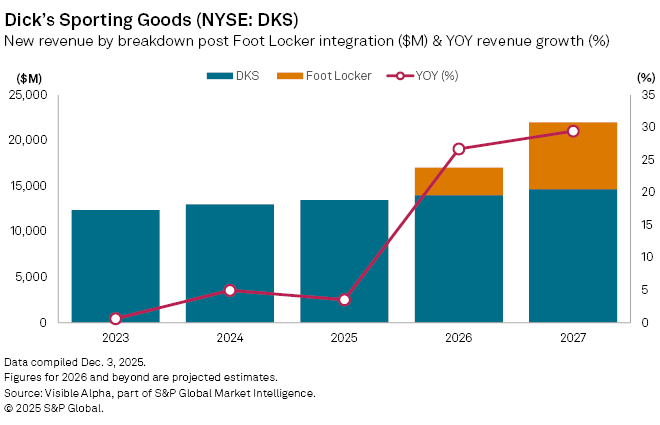

DICK'S Sporting Goods Inc. (NYSE: DKS) completed the acquisition of rival Foot Locker in September. The acquisition is expected to help the US sports equipment retailer deepen its footprint in urban markets and sharpen its edge in the athletic footwear category. On its part, Foot Locker has struggled in recent years, weighed down by declining traffic and store closures. Dick’s aims to leverage the deal to broaden its customer base, unify loyalty programs, and enhance its consumer data capabilities.

The tie-up creates a sporting goods giant with projected combined revenues of $17 billion and a network of more than 3,200 stores in fiscal 2026, according to Visible Alpha consensus. Analysts expect comparable store sales to grow 2.5% in 2026, with non-comparable sales up 24.4% as Foot Locker’s portfolio is consolidated.

Revenue for Dick’s is forecast to reach $22 billion by 2027, the first full year reflecting Foot Locker’s integration, with group-wide comparable store sales expected to rise 1.6%. Analysts see Dick’s standalone comparable sales improving 2.91% in 2027, while Foot Locker is expected to return to modest growth of 0.82%.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment