Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 9, 2025

By Hardik Savla

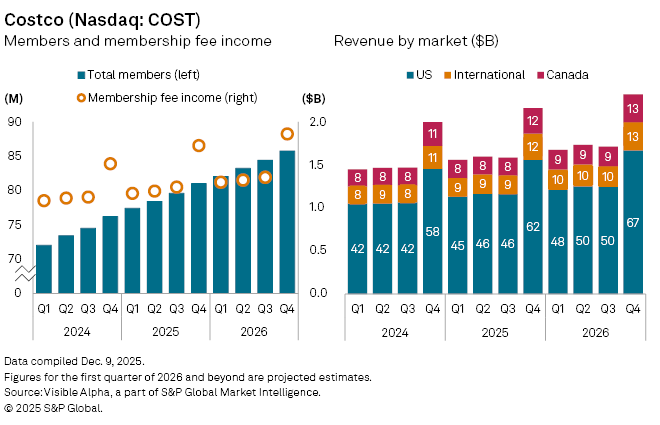

Costco Wholesale Corp. (NASDAQ: COST) is expected to deliver another quarter of steady expansion when it reports fiscal Q1 2026 results on Thursday, December 11. Based on Visible Alpha consensus, analysts expect revenue of $67 billion, up 7.9% from a year earlier, driven by rising membership income and continued gains in comparable sales across key markets.

Membership fees are projected to rise 11% year-on-year to $1.3 billion. The retailer’s global paid membership base is estimated to have reached 82 million, up from 81 million last quarter and 77 million a year ago.

By region, the US is expected to generate $48.2 billion in revenue, with Canada contributing $9 billion and other international markets $9.6 billion. Comparable sales excluding fuel and currency effects are forecast to rise 5.5% in the US, 6.1% in Canada and 6.9% internationally, a sign that discretionary spending among Costco’s core middle-income consumer remains resilient despite a cooling macro backdrop.

Costco’s ongoing expansion is also supporting growth. The company’s US store base is expected to reach 634 locations, up from 629 in the prior quarter and 616 a year ago. Canada is set to close the period with 111 stores, while international markets (excluding Canada) rise to 177. Altogether, Costco is projected to end the quarter with 921 warehouses worldwide.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings