Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 17, 2025

By Scott Robson

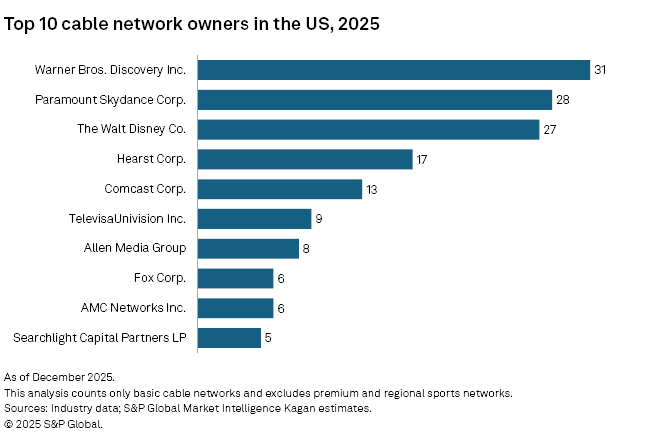

Cable network ownership has remained consistent in recent years, with most of the major network owners maintaining their portfolio of channels. That seems primed for disruption as the largest owner of US basic cable network, Warner Bros. Discovery Inc., is in the process of being sold. This could create a large-scale network operation that results in rebrands, consolidation or network closures.

Warner Bros. Discovery has more basic cable networks under its umbrella than any other group, with 31 channels. Aside from the potential M&A deals, Warner Bros. Discovery has been actively managing its portfolio of international networks, transitioning some, like TLC in the UK, to free-to-air.

Paramount Skydance Corp. is not far behind with 28 networks. Paramount Skydance has been trimming its international channel portfolio, shuttering MTV networks in the UK, which could be a sign of things to come in the US.

Access the cable network ownership database in Excel format.

There appears to be little interest in purchasing cable networks in today's environment of declining revenues. Paramount has been shopping around the BET Media business for a few years now without finding a buyer. Instead, companies are spinning off their cable network assets into separate companies.

Warner Bros. Discovery has made plans to split its company in two in 2026, separating its linear cable networks from its studio and streaming business. While the sale of the company might occur before this happens, it highlights how major media companies are looking to spin off these channels from higher-growth streaming assets.

Comcast Corp. is also currently in the process of spinning off most of its basic cable networks into "Versant," with the exception of Bravo (US), which will stay under the Comcast umbrella.

Cable network purchases

One of the larger cable network purchases of the year was announced in August 2025 when the NFL agreed to a deal with ESPN Inc. for NFL Network (US) and RedZone. The deal includes the NFL acquiring a 10% stake in ESPN (US) and is projected to close in late 2026.

MAVTV was sold to Racer Media & Marketing, Inc. in March 2025 and rebranded as the RACER Network (US). The channel focuses on motorsports and has media rights deals for a slew of events from the Automobile Racing Club of America and American Speed Association.

Since our last update, AMC Networks Inc. acquired the remaining 50.1% of BBC America (US) in November 2024 for an estimated $42 million. AMC had previously owned a 49.9% stake in the network beginning in 2014.

Portfolio management

Children's networks seem prime for disruption due to declining ratings and market saturation. While Universal Kids (US) was shuttered by NBCUniversal in March 2025, there were also closures of the Boomerang streaming service at the end of September 2024 and the Noggin streaming service in July 2024. We anticipate that other children's networks could go off air in the coming years, especially at companies like Paramount Skydance, as new leadership evaluates its deep stable of youth-oriented channels like Nick Jr. (US) and Nicktoons (US).

Comcast, which has been the most aggressive company in shutting down cable networks in recent years, relaunched the NBCSN (US) after it originally shut down at the end of 2021. The network will air a lot of the sports content featured on the Peacock streaming service, including NBA and MLB action. The company also rebranded MSNBC as MS NOW (US) in November 2025.

Allen Media Group LLC was active in its portfolio management, as the company shut down The Weather Channel en Español at the end of 2024, after it had been on air for only about two years. The company still owns eight cable networks; however, in August of 2025, Allen Media Group announced that it was selling 10 of its local broadcast TV stations to Gray Media Group Inc.

While our analysis does not include premium networks, Warner Bros. Discovery made moves in August 2025 to streamline its premium networks by shuttering HBO Family, ThrillerMax, MovieMax, and OuterMax. These "multiplex" networks no longer fit with the company's overall distribution strategy.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Segment

Language