Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 9, 2025

By Yamini Sharma

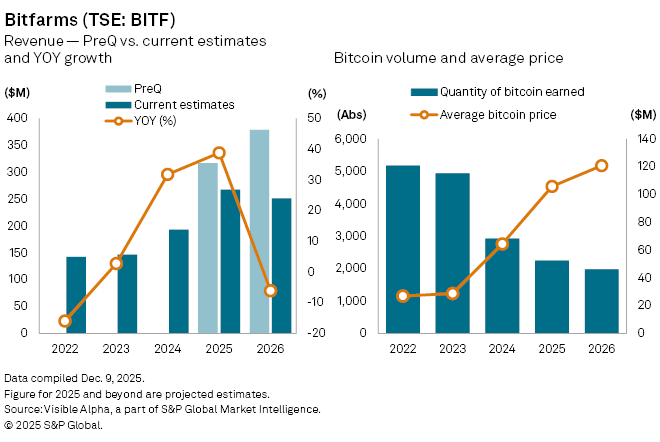

Bitfarms Ltd. (TSE: BITF) reported a sharp miss in third-quarter earnings, highlighting the challenges facing Bitcoin miners as they attempt to diversify beyond crypto. The crypto miner posted revenue of $69.2 million, 18% below Visible Alpha consensus of $84.6 million, driven mainly by weaker-than-expected Bitcoin production. Core mining revenue of $60.4 million fell well short of the $81.3 million analysts had forecast. The company, however, reported non-mining revenue of $8.8 million, beating expectations of $3.3 million.

Bitfarms is attempting to reposition itself from a pure-play Bitcoin miner to a low-cost provider of high-performance computing for AI and other data-intensive workloads, a strategy increasingly pursued across the sector as mining margins tighten, and hash rates rise.

Analysts have cut their forecasts for 2025 following the weak quarter. Total revenue is now expected at $268 million, down from pre-earnings expectations of $317 million. Mining revenue projections have been reduced to $254 million from $302 million, reflecting continued pressure on output and costs.

By contrast, expectations for non-mining revenue have been revised higher to $23 million from $14 million, suggesting expectations of some early traction in the shift toward HPC services.

Bitcoin production is projected to fall to 2,235 BTC in 2025, from 2,914 BTC last year, as network difficulty rises and Bitfarms reins in capital spending. A higher expected Bitcoin price of $105,768 should soften the impact of lower volumes, though not fully offset it. Analysts expect the company’s gross loss to narrow to $15 million in 2025, improving from a $32 million loss in 2024, with a return to gross profitability anticipated in 2026.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment