Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 17, 2025

By Tim Zawacki and Husain Rupawala

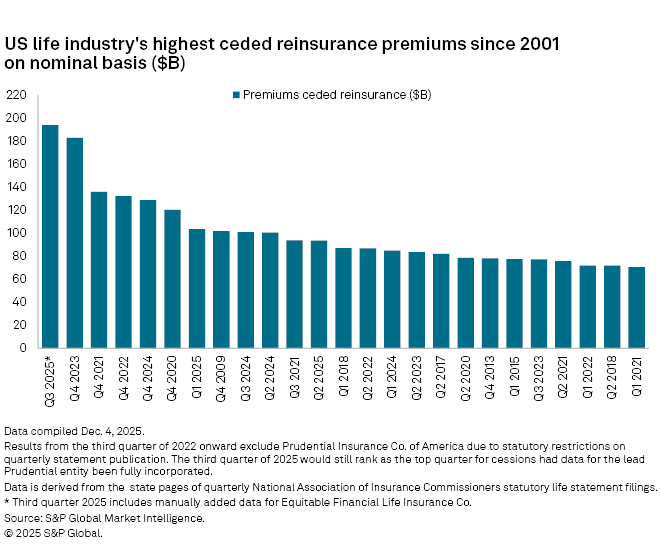

The completion of several previously announced reinsurance transactions involving large blocks of life or annuity business during the third quarter led to the industry posting its highest amount of ceded premiums on record in a single reporting period on an absolute basis, reaching a total of approximately $193.99 billion.

The third quarter marked the sixth time in the last eight quarters where total ceded premiums across lines exceeded $100 billion, including life, annuity and accident-and-health business, with the year-over-year growth rate reaching 92.2%. For the first three quarters of 2025, ceded premiums increased by 36.4%. This remarkable growth demonstrates the compelling supply and demand dynamics that persist among primary life and annuity writers and reinsurers, including an ever-growing array of asset intensive reinsurers in offshore domiciles. Life and annuity companies continue to strategically leverage reinsurance solutions to manage risk effectively, optimize their capital structures and facilitate new business expansion.

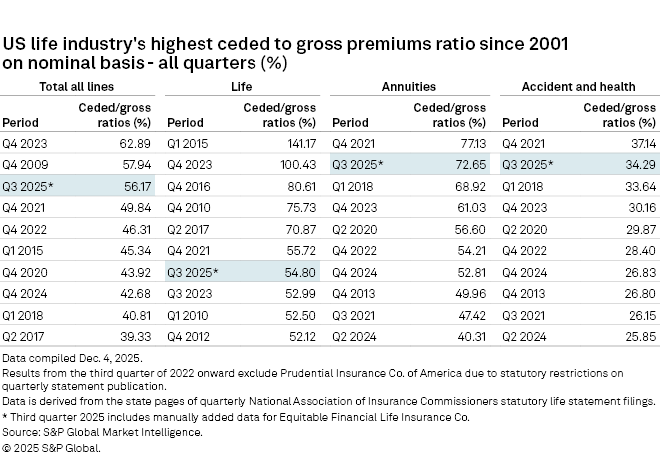

On a relative basis, quarterly ratios of ceded to gross premiums provides an indication of the industry's utilization of reinsurance. To that end, the third quarter's result of 56.2% ranked third highest in any quarter since the start of 2001, trailing only the fourth quarters of 2023 and 2009. The last four months of 2023 had ranked as the high-water mark for cessions on an absolute basis prior to the third quarter of 2025. By line, the ratios of ceded to gross premiums in the annuity and accident-and-health business, limited to entities that file life statutory statements, each ranked second-highest this century.

The record level of ceded premiums had a deleterious impact on net premiums for the industry due to the nature of the accounting associated with certain of the larger block reinsurance transactions and the absence of offsetting assumed premiums with many of the reinsurers domiciled in geographies that are outside the scope of National Association of Insurance Commissioners reporting. The $140.75 billion in net premiums represented a year-over-year decline of just under 25.0%, which we fully discount as a byproduct of nuances specific to statutory accounting and reporting in a period during which direct premiums and considerations continued to grow.

We expect that block and flow reinsurance transactions will continue to drive high levels of ceded premiums on absolute and relative bases, subject to significant lumpiness from quarter to quarter based on the timing and size of future block deals. This volatility may wane over time, however, as flow reinsurance agreements, which typically involve a quota share of new business writings as opposed to the much larger one-time premium spike associated with the transfer of in-force blocks, become more prevalent.

The substantial increase in ceded premiums in the third quarter was primarily driven by key transactions in the variable annuity and life insurance segments, none larger than an Aug. 1 transaction with the Apollo Global Management Inc.-backed Venerable Holdings Inc. that Corebridge Financial Inc. characterized as "transformative."

The mechanics of the transaction involved Corebridge's American General Life Insurance Co. ceding 100% of reinsured liabilities related to new and existing individual retirement variable annuity contracts through coinsurance and modified coinsurance, with $45.1 billion in separate account liabilities transferred to Venerable's Corporate Solutions Life Reinsurance Co. through the modco portion of the arrangement. American General booked a total of $51.79 billion in ceded premiums in the third quarter and, according to Note 23 of its third-quarter statutory statement, attributed $49.56 billion of that amount to the Venerable transaction. The $51.79 billion figure represents the third-highest amount of ceded premiums reported by an individual US life insurance entity in a single quarter dating back to the start of 2001.

American General's net premiums for the third quarter amounted to a negative $43.41 billion, but that amount was fully offset by a reserve adjustment on reinsurance ceded on American General's top line and, to a lesser extent, a contra-expense associated with a negative change in aggregate reserves.

Another historically large block deal that closed during the quarter involved Reinsurance Group of America Incorporated's 75% quota-share of a diverse array of Equitable Holdings Inc.'s in-force individual life insurance liabilities. RGA Reinsurance Co. posted assumed premiums of $36.71 billion, largely reflecting the business it assumed from Equitable Financial Life Insurance Co. and affiliated entities, but also posted $31.59 billion in ceded premiums, which included the retrocession of approximately $28 billion of the Equitable business to these liabilities to the Bermuda-domiciled RGA Americas Reinsurance Co. Ltd. Equitable Financial Life posted net premiums and considerations in the third quarter of a negative $7.09 billion.

Much of the focus regarding reinsurance in the sector has centered on life and annuity liabilities, but included in the record third-quarter ceded premiums tally was a significant new accident and health arrangement involving the primary life statement filing subsidiary of UnitedHealth Group Inc.

Ceded premiums at UnitedHealthcare Insurance Co. spiked to $2.43 billion from $533.6 million in the year-ago period as it entered a quota-share agreement with Hannover Life Reassurance Co. of America (Bermuda) Ltd. The agreement contemplates quota shares of 80% for employer stop-loss business and 60% for group dental and small-group commercial business.

The United States Business of The Canada Life Assurance Co. reported the sector's third-highest amount of ceded premiums in the third quarter at a total of $13.28 billion, with $9.10 billion of that amount pertaining to the accident and health business. While the Great-West Lifeco Inc. subsidiary regularly cedes large amounts of accident and health premiums in the ordinary course, its third-quarter 2025 cessions more than doubled on a year-over-year basis. The company's third-quarter statutory filing reveals the entry of reinsurance agreements, effective July 1, with the affiliated Canada Life International Reinsurance (Barbados) Corp. to cover other medical risks, but it does not discuss specifics of the arrangements nor indicate whether they were responsible for the steep rise in cessions.

Block and flow reinsurance agreements have become essential components of the modern US life and annuity business model with in-force and new business writings of many of the sector's largest issuers of products such as multiyear guaranteed annuities and fixed indexed annuities already subject to coinsurance and modified coinsurance treaties. Reinsurers have continued to expand their appetites by product and geography in recent years to drive further expansion. This trend continued into the fourth quarter as MetLife Inc. completed a $10 billion variable annuity risk transfer transaction with Talcott Resolution Life Insurance Co. Several leading reinsurers have devoted considerable economic and human resources to growing their capabilities in Japan and select other geographies.

Domestic cedants that have limited their engagement in offshore reinsurance might represent another fertile target to drive future growth in cessions as those carriers may be left competitively disadvantaged by eschewing a strategy that virtually all of their competitors have embraced.

To that end, mutual and former mutual US life insurers have taken steps in 2025 to either begin or expand their use of offshore reinsurance arrangements.

New York Life Insurance & Annuity Corp. ceded $2.72 billion in premiums and liabilities to a domestic entity, Everlake Life Insurance Co., under a forward flow coinsurance agreement from inception in February through Sept. 30. Its third-quarter ceded premiums of $941.8 million marked a sharp increase from a tally of $138.2 million in the year-earlier period. The reinsurer assumes a variable quota share of certain fixed annuity business under the arrangement.

Ceded premiums for Pacific Life Insurance Co. spiked to $3.08 billion from $1.56 billion on a year-over-year basis in the third quarter. The company in September expanded an existing coinsurance with funds withheld agreement with a Bermuda-domiciled affiliate to incorporate an additional group annuity block and also entered a modified coinsurance with funds withheld agreement with that entity to cede certain group annuities.

Massachusetts Mutual Life Insurance Co. in 2021 sponsored a sidecar vehicle that, beginning in 2022, reinsured in-force business associated with certain acquired entities along with a quota share covering new multiyear guaranteed annuity business written by the mutual. The sidecar, Martello Re Ltd., later expanded its MassMutual assumptions to include quota shares on pension risk transfer group annuities, single-premium immediate annuities and deferred income annuities. MassMutual's ceded premiums at the individual entity level totaled $2.66 billion in the third quarter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language