Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 3, 2025

By Shankar Bose

Bath & Body Works Inc. (NYSE: BBWI) reported a weaker-than-expected third quarter as macroeconomic pressure, shifting consumer behavior, and focus away from core categories weighed on the business.

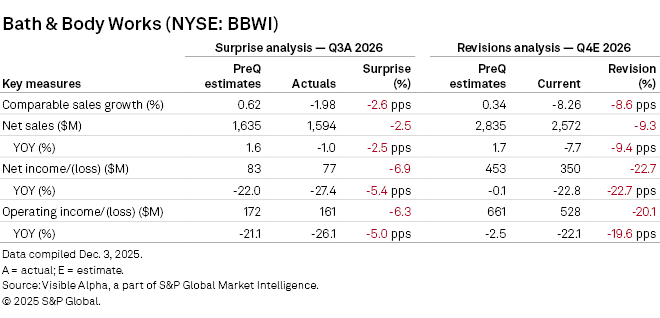

Net sales slipped 1% year-on-year to $1.59 billion in Q3, while net income fell 27% to $77 million. This is compared to Visible Alpha pre-quarter estimates of 1.6% sales growth to $1.6 billion and a net income of $83 million. Comparable sales declined 1.98%, well short of the small 0.62% increase analysts had forecast.

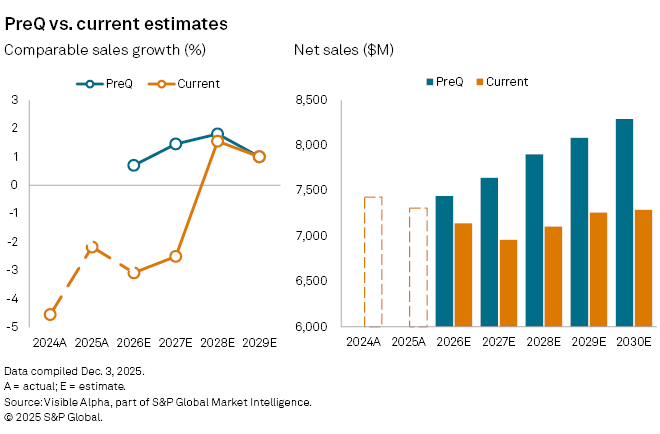

Analysts have since pared back expectations for the crucial holiday period. Based on Visible Alpha consensus, fourth-quarter revenue is now projected to drop 8% year-on-year to $2.6 billion, compared with earlier hopes of 1.7% growth and a pre-quarter projection of $2.8 billion. Comparable sales are forecast to drop 8.26%, a sharp reversal from prior estimates that called for slight growth.

Similar revisions are expected across all key parameters for the US personal-care and home-fragrance specialist.

Expectations for the full year have also been reset. Revenue is now projected to decline 2.3% year-on-year to $7.1 billion, versus pre-quarter forecasts for a 1.8% increase. The consensus for fiscal 2026 comparable sales has swung from a modest 0.69% expected rise to a projected 3.08% decline.

The company has expanded in recent years into adjacent categories such as hair care and men’s grooming, but the push has diverted attention from its core home-fragrance and personal-care lines. Margin pressure has intensified as promotional activity picked up across specialty retail, eroding profitability at a time when consumers have become more price sensitive.

However, the company has now outlined a transformation plan aimed at refocusing the business. The strategy includes simplifying product assortments, accelerating trend-driven innovation, and modernizing distribution. Bath & Body Works plans an Amazon launch and introduce new experiential formats such as kiosks, pop-ups and in-store discovery zones designed to appeal to younger shoppers.

Shares in Bath & Body Works have fallen nearly 54% year-to-date, reflecting concerns over weakening demand and competitive pressures, though the stock has edged up slightly since the turnaround announcement.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment