Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 03, 2025

The Big Three cloud providers — Amazon Web Services, Google LLC and Microsoft Corp. — are infusing agents into their own services and expect customers to do the same, leading to a frenzy of deals with AI model purveyors and record capital outlays. Meanwhile, Oracle Corp. is pressing its advantage as a first-party software provider in multiple clouds as infrastructure sales ramp up.

Parent company earnings calls for the third quarter of 2025 indicate that Amazon Web Services Inc., Azure and Google Cloud are not tapping the brakes on capital expenditure as they strive to meet demand for AI infrastructure and services, although depreciation is starting to take a toll on margins. Common themes were growing backlogs and remaining performance obligations (contracted revenue), gigawatt-scale build-outs to meet AI demand, and a ramp in agentic capabilities for managed services (e.g., Gemini Enterprise, AWS Transform, Microsoft Copilots). While the enthusiasm for AI's potential remains strong, Wall Street is starting to wonder whether and when other enterprises can achieve the returns and productivity gains being touted by big tech.

Sales remain buoyant, but special charges and depreciation impact margins

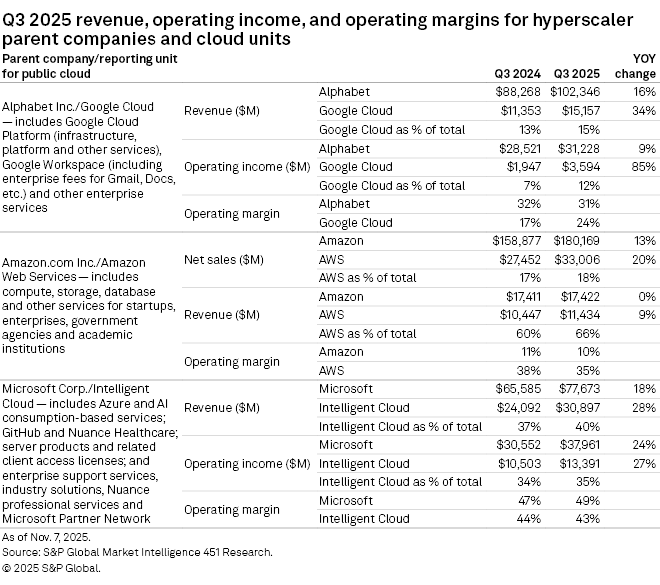

Revenue for the cloud units of Alphabet Inc., Amazon.com Inc. and Microsoft grew by an average of 27% in the third quarter of 2025 versus the year-earlier period, compared with an average of 16% revenue gain for the parent companies. CFOs called out factors that had a negative impact on margins for the quarter. Amazon CFO Brian Olsavsky cited charges related to a legal settlement with the Federal Trade Commission as well as severance costs in all three of its operating segments, and he noted that depreciation expense is dinging margins as new data center capacity is placed into service. (The company announced another 14,000 layoffs a few days before the earnings release.) Alphabet took a $3.5 billion charge related to a European Commission fine, and for Google Cloud, Alphabet CFO Anat Ashkenazi cited higher technical infrastructure usage costs (perhaps to service usage of its AI Overviews and AI Mode in search), including depreciation and energy expenses. Microsoft CEO Satya Nadella pointed to a continuous cycle of modernizing and depreciating the company's hardware fleet while using software to grow efficiency.

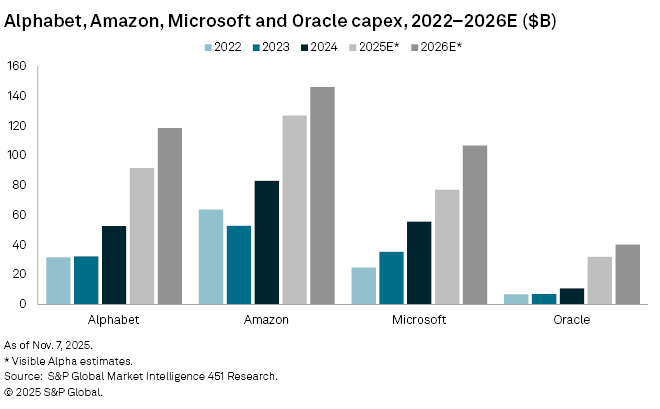

All three companies are pursuing large-scale data center build-outs, fueling record-setting capital expenses. Microsoft's Nadella referenced the Fairwater, Wis., AI data center, expected to go online in 2026 and scale to 2 GW. Amazon President and CEO Andy Jassy noted that AWS added 3.8 GW of power in the prior 12 months, including an $11 billion facility in St. Joseph County, Ind., dedicated to Project Rainier, a partnership with Anthropic PBC to build and run AI models largely using Amazon's own Trainium2 chips. Alphabet CEO Sundar Pichai cited the use of its seventh-generation Tensor Processing Units to populate its newest data centers. Amazon's Project Rainier and Alphabet's partnership with PJM Interconnection LLC, a regional transmission organization, are designed to distribute compute loads across multiple physical data centers.

Oracle Corp.'s reduction of the physical footprint required to stand up Oracle Cloud Infrastructure (OCI) regions and use of colocation facilities has allowed it to grow its cloud presence quickly without the heavy capex investment of the hyperscalers. That is about to change, given its involvement with OpenAI LLC and SoftBank Group Corp. in the Stargate initiative, which is building a gigawatt-scale AI data center in Abilene, Texas.

After Oracle reported a big jump in contracted revenue in its September 2025 earnings release, the Big Three seemed eager to crow about their own revenue pipelines. Amazon's Jassy noted that AWS' backlog was $200 billion at the end of the third quarter of 2025, and that by late October, it had outpaced total third-quarter deal volume. Alphabet's Ashkenazi said Google Cloud's backlog was $155 billion, an 82% increase from 2024. Microsoft CFO Amy Hood cited a companywide commercial remaining performance obligation (deferred revenue plus backlog) of $392 billion, a balance that has almost doubled in the past two years.

Oracle switches up its revenue mix

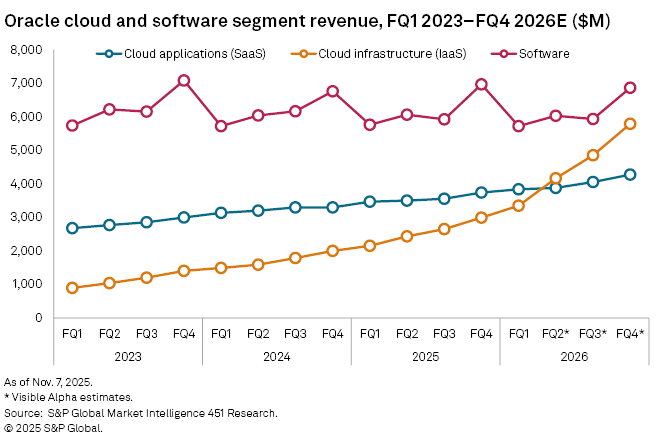

Oracle's stock soared in September after it reported more than tripling its remaining performance obligations to $455 billion during its fiscal first quarter, largely driven by deals with AI titans for OCI capacity, including a commitment from OpenAI worth $60 billion a year. Since then, investor skepticism has crept in. But the company's cloud and software unit (formerly known as "cloud and license") is set to drive cloud infrastructure (IaaS) revenue past cloud application (SaaS) revenue for the first time in fiscal second quarter 2026 (which ends Nov. 30, 2025), according to Visible Alpha consensus estimates, while software license revenue (including on-premises software) remains steady with a seasonal pattern. However you slice it, the segment's operating margin, for now at least, is 70% or more.

Visible Alpha is a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment

Language