Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 8, 2025

By Kanika Garg

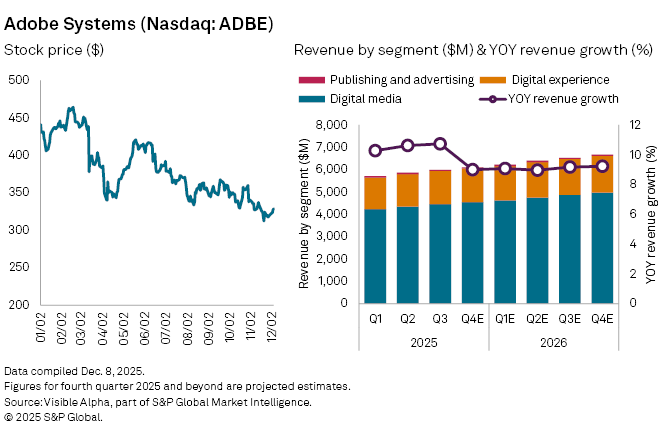

Adobe Inc. (NASDAQ: ADBE) will report fourth-quarter results on Wednesday, December 10. The stock has fallen 25% year-to-date, amid concerns over intensifying competition in artificial intelligence and signs of slowing growth in its core creative software business.

Visible Alpha consensus shows analysts expect Adobe to post revenue of $6.1 billion for the quarter, up 9% from a year earlier. Growth is expected to be led by its Digital Media unit, home to flagship products Photoshop, Illustrator, and Acrobat, where sales are projected to climb 10% year-on-year to $4.5 billion. Total Digital Media annual recurring revenue (ARR) is forecast to reach $19.2 billion, up nearly 11% year-on-year, buoyed by demand for AI tools such as Firefly, Acrobat AI Assistant, and GenStudio.

Adobe’s Digital Experience segment, which sells marketing and analytics software to enterprises, is projected to generate $1.5 billion in revenue, up 8% from the prior year. By contrast, the smaller Publishing and Advertising business continues to contract, with revenues expected to fall 18% to $53 million.

For the full-year, analysts expect fiscal 2025 sales to rise almost 10% year-on-year to $23.7 billion. Net income is projected to climb 27% to $7 billion, compared with a 2% gain last year, while earnings per share are forecast at $16.49, up from $12.37 last year.

In November, Adobe announced a deal to acquire SEO platform Semrush, expected to close in the first half of 2026, pending regulatory and shareholder approvals. The acquisition will help expand Adobe’s AI-based offerings for customer experience orchestration through Semrush’s generative engine and search engine optimization services.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment