Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — December 12, 2025

By Bhavik Jain

Accenture PLC (NYSE: ACN) committed $3 billion investment in “Data & AI” back in 2023, aimed at building out its AI capabilities. Since then, the consulting firm has made several strategic acquisitions and partnerships, including recent alliances with OpenAI and Anthropic, along with the acquisitions of AI consultancies such as RANGR Data, NeuraFlash, and Halfspace this year.

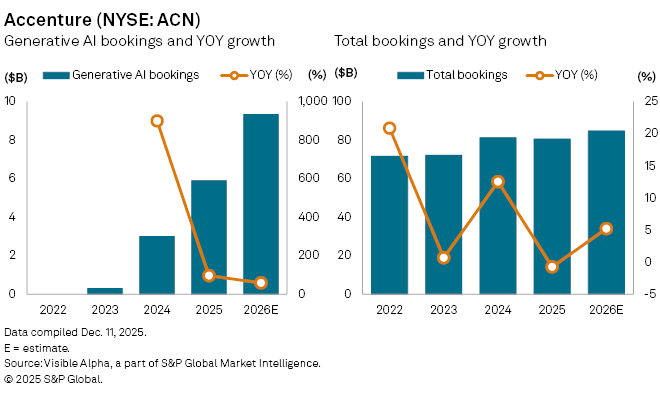

Generative-AI bookings have scaled rapidly, from just $300 million in 2023 to 5,900 in fiscal 2025. According to Visible Alpha consensus estimates, generative AI bookings are expected to hit $9.3 billion in 2026, a 58% rise year-on-year. By contrast, total bookings are forecast to rise only modestly (around 5%) to an estimated $84.8 billion, highlighting how AI is becoming the key growth lever.

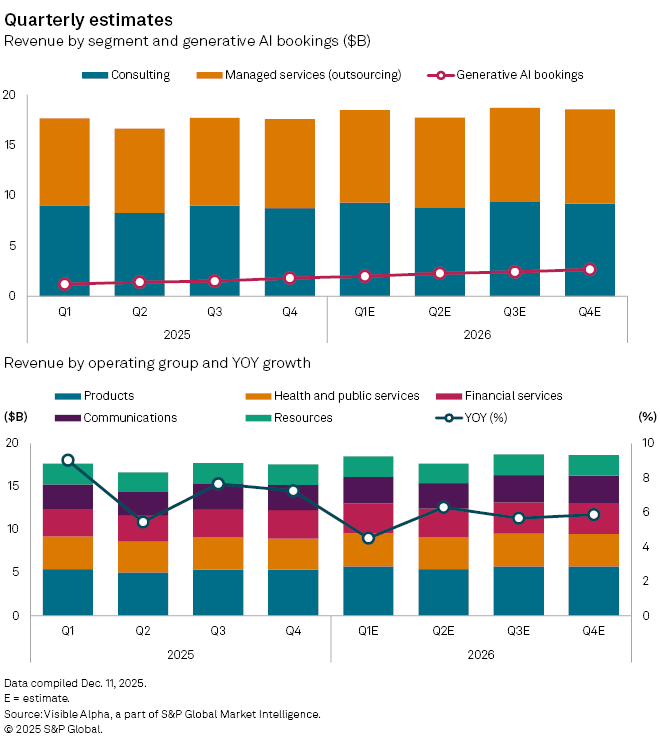

Accenture reports fiscal Q1 2026 earnings on Thursday, December 18. Analysts expect another quarter of steady top-line expansion, supported by rising demand for AI and cloud transformation work. Q1 revenue is forecast at $18.5 billion, up 4.5% year-on-year, driven by ongoing strength in generative AI programs. Generative AI bookings are expected to rise 66% to $2 billion, following a near-doubling last year.

By business segment, consulting revenue is expected to grow 2.7% year-on-year to $9.3 billion, while managed services revenue is projected to increase 6.4% to $9.2 billion. Among operating groups, financial services is expected to lead growth (10.4% YOY), followed by communications, media and technology (7.6%) and products (5.5%), while health/public services and resources remain relatively flat.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment