Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 28, 2025

By Manan Tulsian and Jigar Saiya

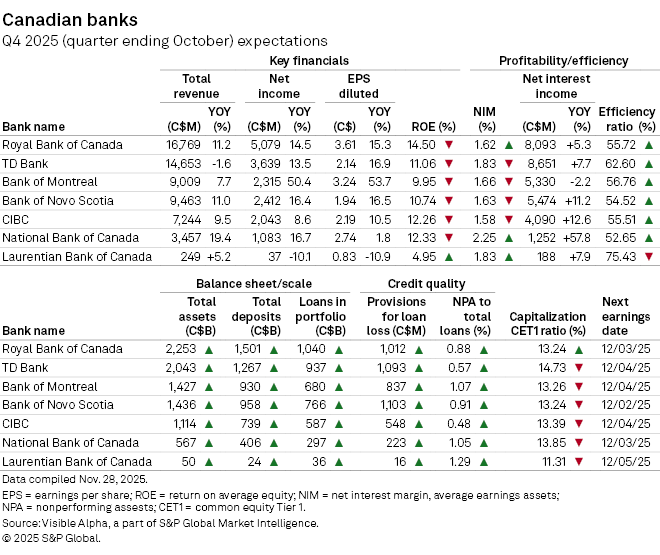

Canada’s largest banks are set to report fiscal fourth-quarter 2025 results this week, with consensus pointing to a broad improvement in profitability and resilient revenue growth despite persistent credit pressures. For most lenders, higher interest income, tighter cost control, and easing expense inflation appear to offset sluggish loan growth and mixed net interest margins (NIMs).

Across the group, revenue growth is expected to be healthy, with year-over-year gains led by National Bank of Canada (TSE: NA) at+19.4% year-on-year, Royal Bank of Canada (TSE: RY) at +11.2%, The Bank of Nova Scotia or Scotiabank (TSE: BNS) at +11%, and CIBC, short for Canadian Imperial Bank of Commerce (TSE: CM) at +9.5%. The Toronto-Dominion Bank (TSE: TD) stands as the outlier with a slight 1.6% decline, weighed down by softer US retail performance, lingering impacts from last year’s anti-money laundering shortcomings, and the earnings drag from reducing its stake in Charles Schwab.

Net income is forecast to climb more sharply, with several banks showing double-digit earnings growth. Most notably, Bank of Montreal (TSE: BMO), with NII expected to rise +50.4% year-on-year, reflecting a favorable comparison base given its weak quarter last year and improving US operations.

RBC (+14.5% YOY), TD (+13.5%), and Scotiabank (+16.4%) are also expected to deliver solid gains. Laurentian Bank of Canada (TSE: LB) remains the weakest performer, with profits projected to fall 10.1% year-on-year as restructuring initiatives and elevated costs continue to pressure margins.

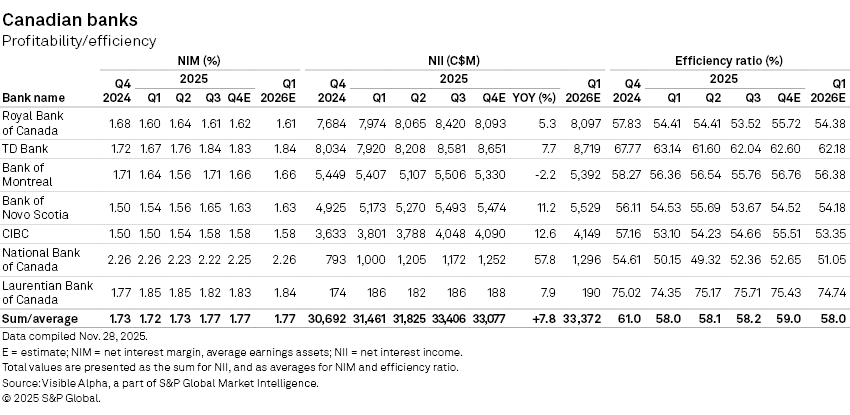

Profitability and efficiency: Margins remain under pressure; NII strengthens

Consensus estimates show some continued pressure on NIMs, stable growth in net interest income (NII), and continued pressure on operating efficiency. While margins remain well below the peaks seen during the rate-hike cycle, the forecasts suggest the banks are approaching a floor, with average NIM expected to hold steady at 1.77%, unchanged from Q3 and slightly above levels earlier in the year.

Despite muted margin movement, NII growth remains solid, rising 7.8% year-on-year across the group in Q4:

Consensus points to another sequential increase in NII in early 2026, with nearly all banks projected to post stronger Q1 results.

However, efficiency ratios are expected to worsen across the group, signaling a quarter where costs have risen faster than revenue. The average efficiency ratio across the seven banks is expected to rise to 59%, up from 58.2% in Q3, showing that cost management remains a priority heading into 2026.

TD, CIBC, BMO, and Scotiabank all show higher cost ratios QOQ, while National Bank stands out with the best operating efficiency of 52.7%. Laurentian Bank remains the most expense-heavy bank at 75.4%.

Early 2026 estimates point to continued stability rather than meaningful margin recovery.

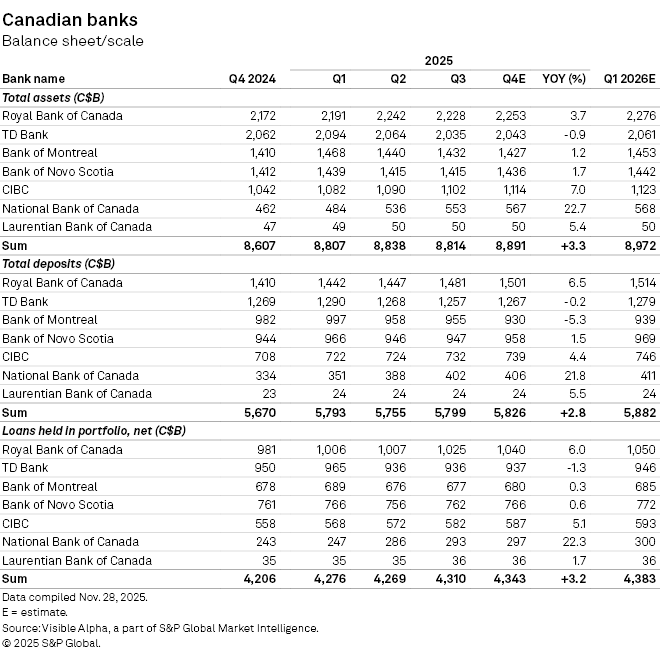

Balance sheet and scale: Steady asset growth and loan expansion

Canadian banks are expected to show modest balance-sheet growth in Q4 2025, with total assets, deposits, and loan portfolios trending higher for most lenders except for TD Bank.

Assets:

Total deposits across the banks show slower growth than assets, up 2.8% year-on-year:

For most banks, deposit growth broadly supports lending but rising competition for funds and relatively higher rates are constraining growth for some banks.

Loan growth is generally positive but uneven:

Overall, total loans for the banks are projected to rise 3.2% YOY, reaching C$4.34 trillion in Q4.

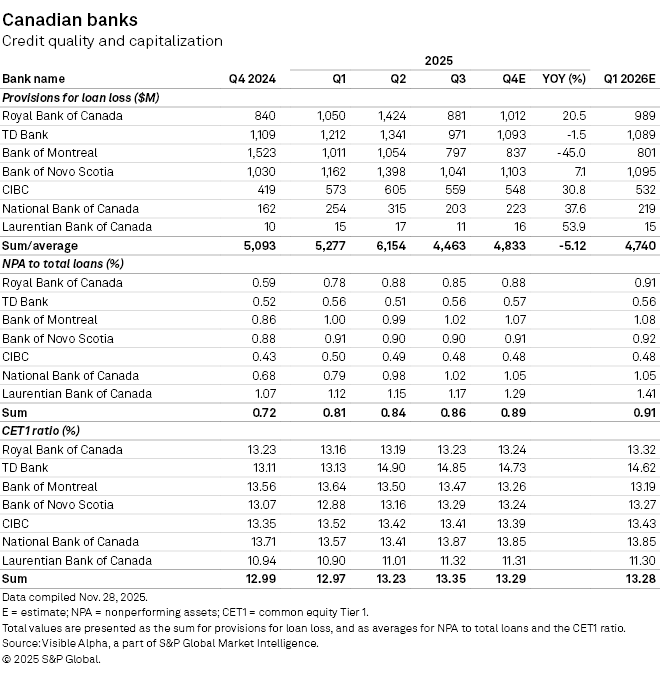

Credit quality: Provisions continue rising, although overall credit quality remains sound

CET1 ratios remain robust across the board, averaging at 13.3%, slightly up from 12.99% in Q4 2024.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings