S&P Global Market Intelligence recently hosted a webinar that examined middle-market M&A activity. Here are seven key takeaways from the event, M&A in Focus: The State of the Middle Market, recorded on Oct. 9, 2025.

7 Middle Market M&A Activity:

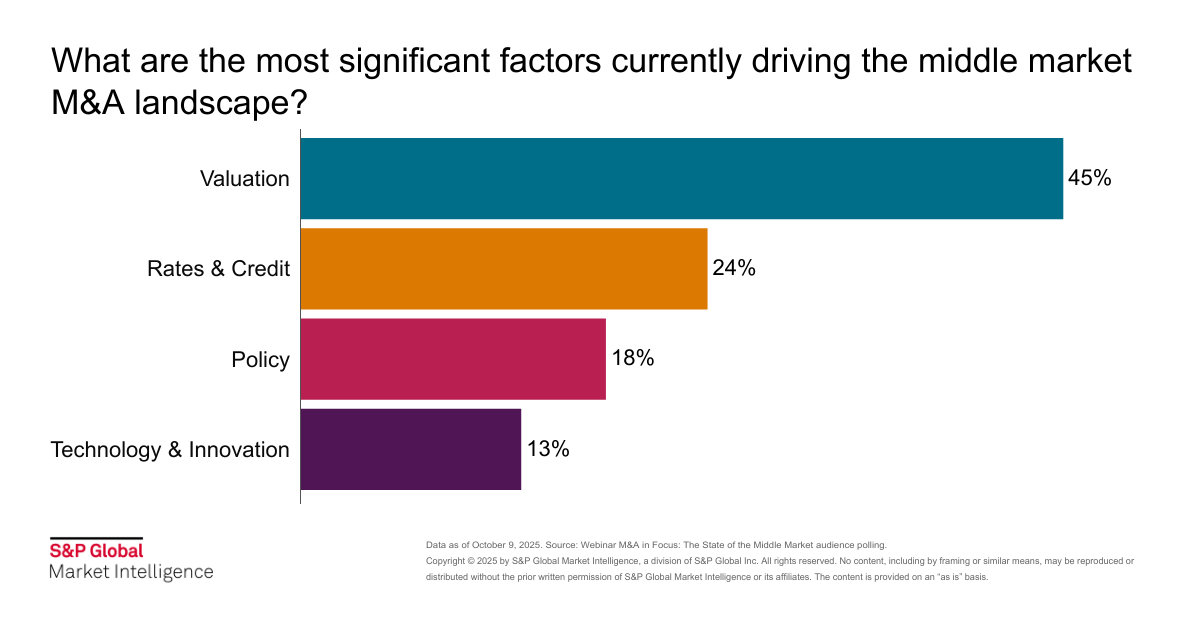

- Valuation Dynamics: A significant factor influencing middle-market M&A is valuation. Ryan Budlong, a Harris Williams managing director and consumer group co-head, highlighted that consumer valuations for service-based businesses and those with recurring revenue are nearing the levels reached in 2021 and 2022 in some cases. This trend is encouraging business owners to consider selling, especially as the market has shown signs of optimism. However, businesses that have been impacted by tariffs are facing valuation challenges, which can lead to wider bid-ask spreads.

- Economic Conditions and Interest Rates: Budlong and Patrick McAuley, partner for Transaction Advisory Services at Grant Thornton Advisors, pointed out that recent rate cuts by the Federal Reserve have improved market sentiment, but uncertainties around tariffs and labor pressures continue to pose challenges. The interplay between economic conditions and M&A activity remains a critical area for businesses to monitor.

- Sector-Specific Opportunities: Budlong noted the resilience of the middle-market consumer sector despite uncertainty in the macro environment. Regarding the transportation and logistics sector, McAuley mentioned that it has been challenged by a wide range of headwinds, including low-capacity availability and tight margins. However, this presents an interesting opportunity for private equity to reenter the market.

- Private Equity's Role: Private equity firms remain active players in the middle market, leveraging their expertise to navigate the current economic landscape. McAuley emphasized that private equity is looking for quality targets with strong operating leverage and management teams. The continued influx of dry powder from private equity firms is expected to drive M&A activity, particularly as firms seek to deploy capital effectively.

- Cross-Functional Collaboration: Budlong and McAuley underscored the importance of cross-functional teams in navigating the complexities of M&A transactions. McAuley mentioned that successful companies are forming multidisciplinary response teams to address systemic challenges such as tariffs and supply chain disruptions. This collaborative approach enables organizations to develop comprehensive strategies that align with their overarching goals.

- Increased Focus on AI and Technology: The adoption of AI technologies is becoming increasingly important in the middle market. Budlong observed that companies leveraging AI for operational efficiencies, particularly in customer service and marketing, are gaining a competitive edge. However, he hasn’t noticed a parallel large reduction in headcount as AI efficiencies are being gained.

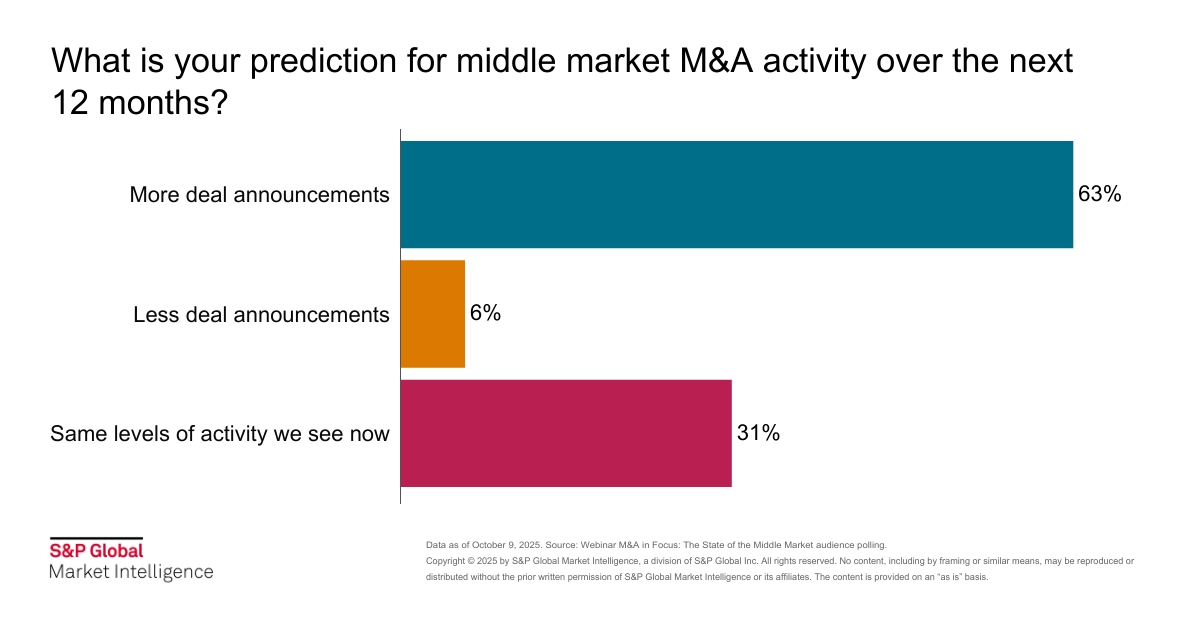

- Future Outlook for M&A Activity: Looking ahead, both Budlong and McAuley expressed optimism about the potential for increased M&A activity in the middle market. They anticipate that pent-up demand, coupled with improving economic conditions, will drive more deal announcements over the next 12 months. This sentiment is echoed by the expectation that private equity will continue to play a significant role in shaping the future of middle market M&A.