Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 26, 2025

By Kanika Garg

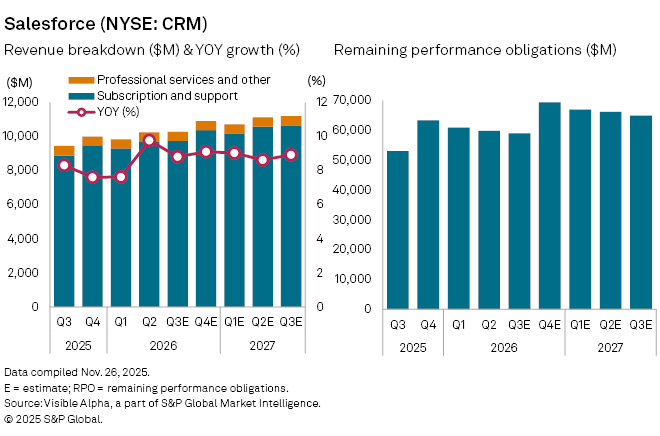

Salesforce Inc. (NYSE: CRM) is expected to report Q3 FY2026 earnings on Wednesday, December 3. Based on Visible Alpha consensus, analysts expect revenues of $10.3 billion, an 8.8% increase from a year earlier. The outlook points to another quarter of steady expansion after the cloud software giant posted 7.6% growth in Q1 and 9.8% in Q2.

Salesforce’s performance continues to be driven by its core subscription and support division, which accounts for nearly 95% of total revenue and is projected to rise 9.7% to $9.7 billion in Q3. Within this, the platform and data units stand out, with expected growth of 14.6% and 12.3% respectively, to $2.1 billion and $1.5 billion.

Salesforce’s other cloud categories are set for more moderate gains:

The main drag remains professional services and other, where revenue is expected to decline 3.8% to $544 million, driven by Salesforce’s ongoing shift toward higher-margin, recurring software subscriptions.

Forward-looking indicators remain solid. Remaining performance obligations (RPO), a measure of contracted future revenue, are expected to increase 11% year-on-year to $59 billion, signaling steady enterprise demand and visibility into future growth. Net income is forecast to rise 5% to $1.6 billion, with diluted EPS projected at US$1.67 for the quarter.

Salesforce continues to lean heavily into artificial intelligence, expanding its Agentforce portfolio, including Agentforce 360, as it seeks to capture growing demand for agentic AI systems. The company’s recent acquisition of Informatica is aimed at strengthening data-integration capabilities.

The company’s shares, however, have fallen 31.4% year-to-date, mirroring a broader industry pullback across as investors reassess the pace and payoff of AI-related spending.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings