Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 14, 2025

By Fatima Qasim, Himani Tyagi, and Ashish Negi

SkyWater Technology Inc. (NASDAQ: SKYT), the US-based semiconductor foundry, reported a sharp rise in third-quarter earnings, with revenue surging 60.6% year-on-year to $151 million. The robust performance was fueled by strong demand for its wafer services, which have gained momentum following the integration of the company’s newly acquired Texas fabrication plant.

The $93 million acquisition of the Texas fab from Infineon Technologies AG (FWB: IFX) in June marks a pivotal moment for SkyWater. The deal marks a strategic expansion that significantly increases SkyWater’s manufacturing capacity and could nearly double its annual revenue base once fully integrated.

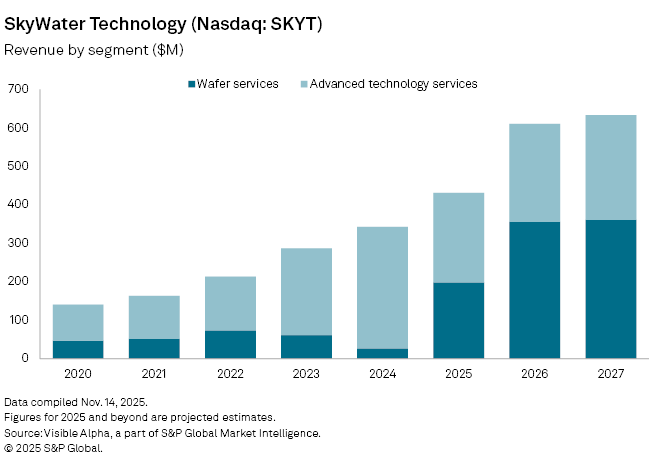

Consensus estimates from Visible Alpha shows analysts project SkyWater’s 2025 revenue to climb 26% to $431 million, driven by a sharp 638% surge in wafer services revenue to $198 million. This growth, however, is expected to be partly offset by a 26.2% decline in its advanced technology services (ATS) business, which has faced delays in government-funded R&D programmes. By 2026, wafer services are forecast to become SkyWater’s primary revenue driver, accounting for 58% of total sales—up from just 8% in 2024.

Beyond its core foundry business, SkyWater is expanding into quantum computing, one of the most capital-intensive frontiers in chip technology. The company recently announced a multi-million-dollar partnership with QuamCore and has added four new customers in the segment this year, highlighting its ambitions to move up the value chain into higher-margin markets.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment