Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 17, 2025

By Nitin Kansal

US bitcoin miner Riot Platforms Inc. (NASDAQ: RIOT) reported record third-quarter results, supported by higher Bitcoin prices and increased production while also announcing a strategic shift beyond cryptocurrency and into the fast-growing market for AI and high-performance computing infrastructure.

The company has begun developing 112MW of new capacity at its Corsicana data center campus in Texas — a move that highlights its ambition to evolve from a pure-play miner into a broader compute-infrastructure operator.

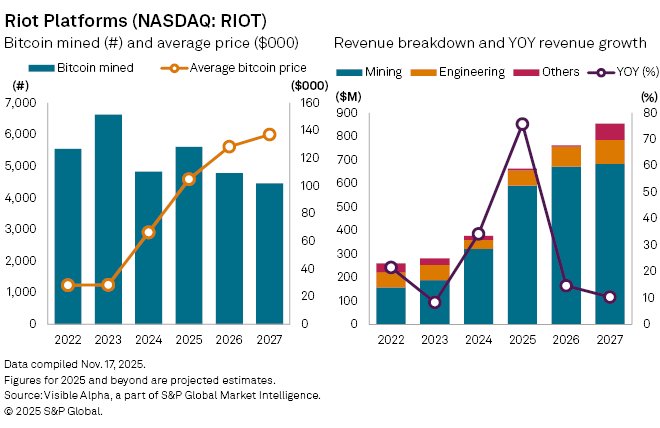

Visible Alpha consensus forecasts show full-year 2025 revenue is expected to rise 76% to $662 million. That expansion is driven largely by an 84% jump in Bitcoin mining revenue to $590 million, reflecting stronger network economics and an estimated 16% increase in output to 5,612 Bitcoins mined. The average Bitcoin price is expected to climb 58% to $104,869.

Riot’s growing scale remains a critical competitive advantage. With an expected year-end hash rate of 39EH/sec — roughly 4% of the global network’s estimated 920EH/sec — the group commands a large share of mining power in the industry. In a market where even 1% is material, such scale offers both revenue leverage and resilience against rising network difficulty.

Yet the business remains tethered to the volatility of the underlying commodity. Bitcoin price swings continue to dictate Riot’s earnings trajectory, prompting a wider debate about the sustainability of cash flows once network economics normalize.

Riot’s investment in data center development may help reduce those risks. The company’s access to low-cost power, multi-gigawatt infrastructure pipeline and experience running energy-intensive facilities position it to tap demand from AI developers and cloud providers, sectors now competing aggressively for power and rack space.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment