Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 24, 2025

By Govinda Patwa and Harshal Bhoir

Arrowhead Pharmaceuticals Inc. (NASDAQ: ARWR) shares rose after the US FDA approved Redemplo (plozasiran), its first commercial product, to reduce triglycerides in adults with familial chylomicronemia syndrome (FCS). FCS is a rare genetic disorder that causes extremely high fat levels in the blood.

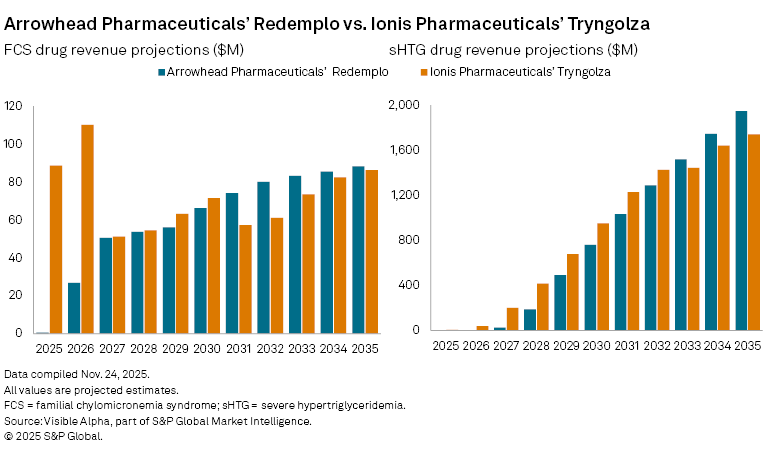

The therapy is only the second FDA-approved treatment for FCS, following Ionis Pharmaceuticals, Inc. (NASDAQ: IONS) Tryngolza, which was approved late last year. Analysts note that Redemplo’s broad label and the absence of safety warnings included on Ionis’s product may give Arrowhead a competitive edge in a small but underserved market.

Based on Visible Alpha consensus, Redemplo is expected to generate $0.5 million in FCS-only sales in 2025, rising to $27 million in 2026 and reaching $66 million by 2030. In comparison, Ionis, as the first mover in FCS, is expected to generate $89 million in 2025, $110 million in 2026 and $71 million by 2030.

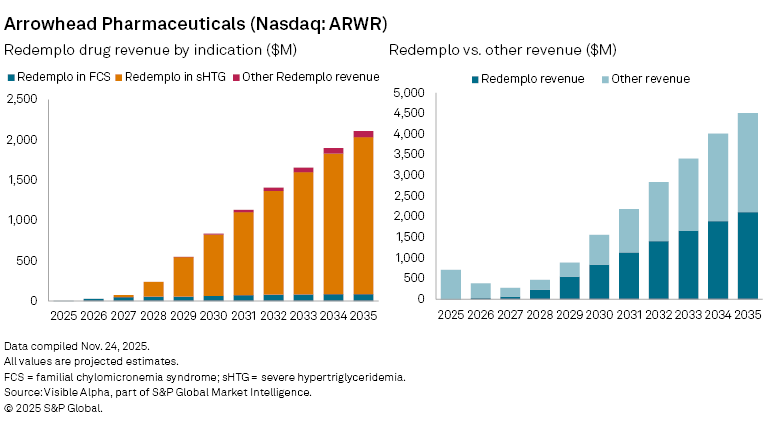

For Arrowhead, the larger opportunity for Redemplo lies beyond FCS. Redemplo is also being tested in severe hypertriglyceridemia (sHTG), where analysts assign it an estimated 77% probability of success (POS). Consensus forecasts show $23 million in risk-adjusted sales in 2027, ahead of an expected $1 billion in blockbuster sales by 2031 and peak global sales of $2.2 billion by 2037.

Redemplo is also in development for mixed dyslipidaemia and pancreatitis, indications that would significantly expand its addressable market. Based on current forecasts, Redemplo could grow from 7% of Arrowhead’s total revenue in 2026 to more than half by 2031.

Ionis is also targeting sHTG with Tryngolza and remains ahead in development, with approval expected by late this year or early next. Analysts assign a 90% POS to Ionis in sHTG, forecasting $3 million in 2025 risk-adjusted sales, pending approval. Sales are expected to rise to $1.2 billion in 2031 and reach $1.8 billion at peak in 2036.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment