Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 13, 2025

By Nitin Kansal

Shares of Pony AI Inc. (NASDAQ: PONY), the Chinese autonomous driving start-up backed by Toyota, fell about 9% on November 6 following its Hong Kong trading debut. While Pony AI continues to gain traction in the autonomous driving segment, it remains in the red with analysts expecting a net loss of $202 million in 2025 as it ramps up investment in Level 4 autonomous driving, technology that requires no human intervention.

Pony AI’s dual listing, less than a year after its Nasdaq float, signals its drive to expand internationally while hedging against growing US regulatory pressure. The US government has tightened restrictions on Chinese technology in connected vehicles, clouding the company’s prospects in the US even as it partners with Uber to deploy robotaxis once regulatory approvals are secured.

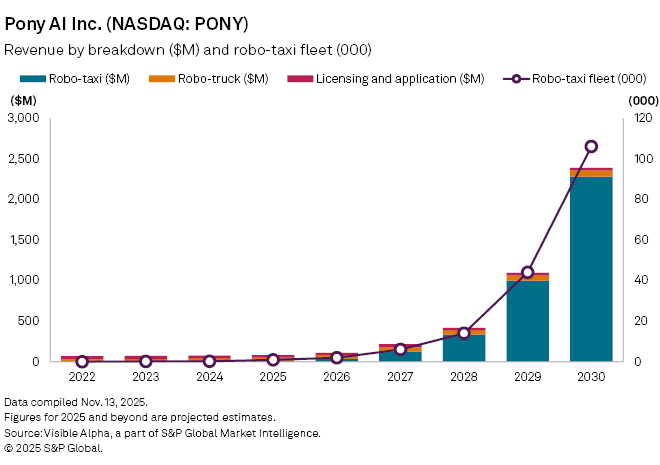

Despite the post-listing pullback, Pony AI’s growth outlook remains robust. Analysts forecast its robotaxi fleet to rise from 219 vehicles last year to about 928 by end-2025, nearly doubling again in 2026. Longer term, the fleet could surpass 100,000 units by 2030, reflecting expectations of broader adoption of autonomous mobility.

Revenue momentum is expected to follow. Visible Alpha consensus shows robotaxi revenue will more than triple from $7.3 million in 2024 to $38 million by 2026. The company’s robotruck division is also expanding, with its fleet projected to grow to 246 units in 2025 from 182 last year, though revenue is forecast to dip 1.3% to $39.8 million.

Overall revenue is projected to climb 11% year-on-year to $83 million in 2025, before surging to $2.6 billion by 2030, driven primarily by the robotaxi segment. Analysts expect Pony AI to reach profitability by 2029.

Pony AI is due to report third-quarter 2025 earnings on November 25, offering a closer look at its growth trajectory and capital spending plans.

Pony AI operates one of China’s largest robotaxi fleets and remains the only company licensed to run fully driverless Level 4 services across all four top-tier cities — Beijing, Shanghai, Guangzhou and Shenzhen. Internationally, the group has extended its footprint to Singapore and Saudi Arabia, partnered with Dubai’s Roads and Transport Authority to advance Level 4 autonomous mobility, secured a nationwide permit in South Korea, and begun road testing in Luxembourg.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings