Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov. 13, 2025

By Husain Rupawala and Tim Zawacki

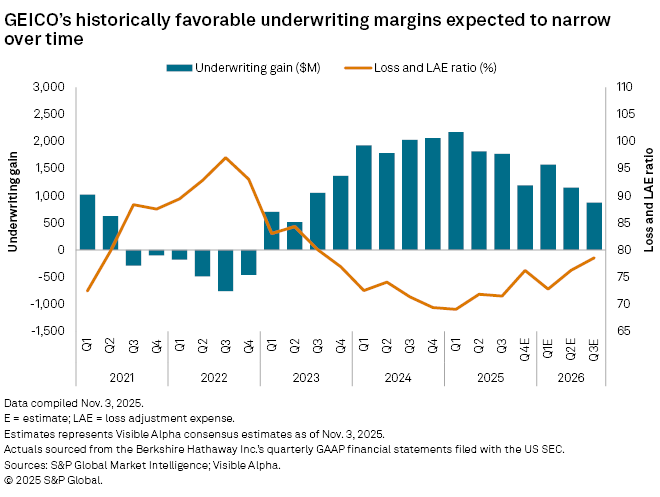

Amid its longest continuous stretch of highly favorable underwriting results in 18 years, as measured by consecutive periods with a loss and loss adjustment expense (LAE) ratio of below 75%, Geico Corp. continues to accelerate its efforts to win new business with mixed initial success.

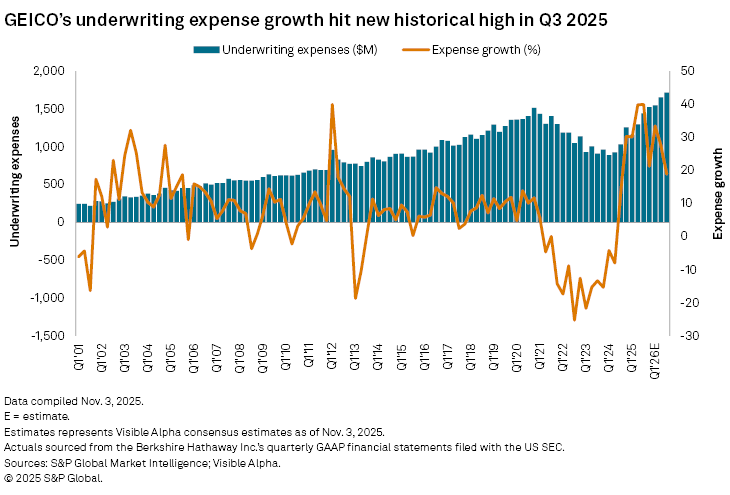

The No. 3 US private-passenger auto insurer's third-quarter net underwriting gain slipped by 12.8% from the year-earlier period and 2.6% on a sequential quarter basis to $1.77 billion, with rising underwriting expenses largely responsible for the unfavorable comparisons, according to disclosures in parent Berkshire Hathaway Inc.'s quarterly report on Form 10-Q as filed Nov. 3 with the SEC.

GEICO's reported loss and LAE ratio of 71.5% marked the seventh consecutive quarter for which the ratio was below 75%. It last posted sub-75% loss and LAE ratios for as few as four straight quarters during a 15-period stretch from the first quarter of 2004 through the third quarter of 2007.

While underwriting expenses surged by 39.9% for the second straight quarter due to higher policy acquisition costs, GEICO's 12.8% expense ratio remained well below historical norms, including the 17.8% average in that earlier period of low loss and LAE ratios. On the one previous occasion in the last 25 years where GEICO's underwriting expenses rose even more rapidly, by 40.0% in the first quarter of 2012, it was due to a change in US GAAP accounting standards regarding deferred policy acquisition costs.

Historical results suggest that GEICO could spend even more to pursue new business, and consensus analyst forecasts collected by Visible Alpha, part of S&P Global Market Intelligence, show the expense ratio rising to 14.5% by the fourth quarter of 2026.

Spending on advertising, a variable cost that we are assuming in this article to serve as a driver of the increased policy acquisition-related expenses, remains key to attracting new business for carriers like GEICO which primarily write business through the direct-to-consumer channel. But the more aggressive outreach has not to this point translated into faster growth in written premiums. GEICO's third-quarter growth rate of 5.0% lagged the 5.6% pace for the first nine months of the year.

From an industrywide standpoint, a trend towards fewer and smaller rate increases relative to recent years due to increasingly favorable underwriting results suggests that private auto writers will increasingly need to rely on unit growth to drive top-line expansion. Berkshire said that GEICO's policies in force increased by an amount it did not specify.

Our previous analysis of statutory data found that GEICO's ad spend surged by 67.0% to an estimated $1.40 billion in 2024 as the company's underwriting results had rebounded significantly from post-pandemic challenges. On a relative basis, the ad spend increased to nearly 3.4% of direct premiums written, an increase of 1.2 percentage points from what had been a 26-year low in 2023.

If we presume a rise in GEICO ad spend in full-year 2025 commensurate with the 35.2% increase in the company's underwriting expenses during the trailing-12-month period ended Sept. 30, 2025, it would yield a result of $1.89 billion. That would hypothetically amount to 4.3% of direct premiums written using a comparable methodology that uses the trailing-12-month growth rate through the third quarter of 2025 to the company's full-year 2024 result. From 2015 through 2019, GEICO's average ratio of ad spend to direct premiums written approached 5.5%. All else being equal, GEICO would need to spend $2.41 billion on advertising to reach a comparable ratio based on the aforementioned 2025 scenario.

At Progressive, meanwhile, the No. 2 US private auto insurer reported on Nov. 3 that its third-quarter ad spend increased by 10% to $1.3 billion. The rate of increase decelerated from 35% in the second quarter, reflecting the timing of the company's 2024 pivot to a more growth-oriented posture. Despite the additional spending, however, the quote volume in Progressive's direct channel, which is the segment most dependent upon advertising, decreased by 4% year-over-year due in part to what the company described as "competitiveness in the marketplace." New applications in the direct channel were flat.

Progressive's growth in direct channel private auto net premiums written continued to significantly exceed GEICO's at 15.4% for the quarter in the combination of its direct and agency private auto channels. The Visible Alpha consensus suggests a narrowing in the gap between GEICO and Progressive Direct's growth rates to 9.0% and 7%, respectively, by the fourth quarter of 2026.

In both cases, those growth rates significantly exceed S&P Global Market Intelligence's projections for the US private auto business as a whole.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language