Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 07, 2025

By Ehteesham Ansari

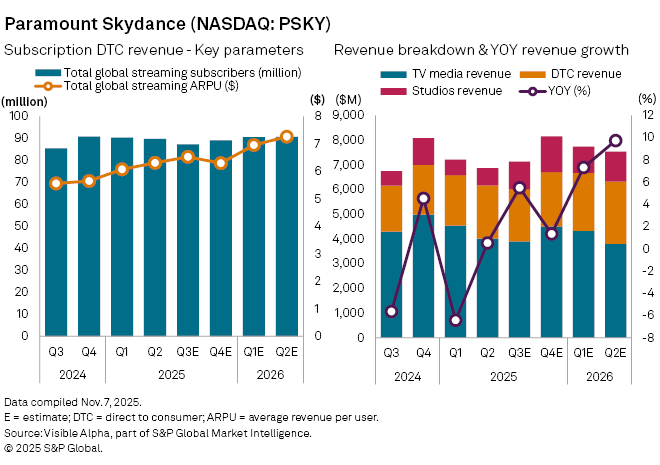

Paramount Skydance Corp. (NASDAQ: PSKY) is expected to report a steady rebound in revenue when it releases third-quarter results on Monday, November 10 — its first full quarter since the merger between Paramount Global and Skydance Media closed in August.

Visible Alpha consensus estimates show group revenue expected to rise 5.5% year-on-year to $7.1 billion, signaling early progress from merger integration and a renewed focus on profitability after several challenging quarters. Analysts see initial cost savings and a leaner operating structure beginning to take hold, with management prioritizing the expansion of high margin streaming and studio segments.

The company’s direct-to-consumer (DTC) division — which houses Paramount+ and Pluto TV — is forecast to deliver a 13% year-on-year increase in revenue to $2.1 billion. Subscription revenue within DTC is projected to climb nearly 20%, supported by a 17% rise in average revenue per user and modest subscriber growth to 87.2 million, including an estimated 78.9 million Paramount+ subscribers, up 10% from a year earlier.

Studio operations are set to show the most dramatic improvement, with revenue expected to surge 88% year-on-year to $1.1 billion, driven by strong franchise releases and resumed production pipelines following last year’s industry strikes. Meanwhile, traditional TV Media remains a drag on performance, with revenue expected to decline 9% to $3.9 billion as cord-cutting continues to erode both advertising and affiliate income.

Profitability is forecast to improve meaningfully, with consensus pointing to net earnings of $414 million — a sharp recovery from $57 million in the previous quarter and $1 million a year ago. Diluted earnings per share are projected to rise to $0.42, reflecting the company’s early progress in margin recovery.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment