Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 17, 2025

By Harshvardhan Kyal

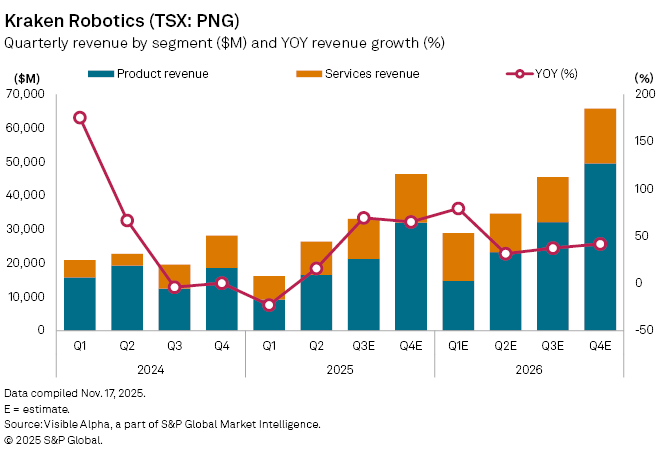

Canadian marine technology firm Kraken Robotics Inc. (TSX: PNG) is set to release third-quarter results for the period ending September on Friday, November 21. Visible Alpha consensus shows analysts expect total revenue to climb 69% year-on-year to C$33 million in Q3, driven by robust growth across both product and services segments.

Product sales, which represent roughly 65% of total revenue, are forecast to rise 71% to C$21.3 million. This marks a notable turnaround following four consecutive quarters of declines. Analysts attribute the recovery to stronger demand for high-density sea power batteries, renewed sales momentum in the company’s KATFISH and Remote Minehunting and Disposal Systems (RMDS) systems, and ongoing growth in synthetic aperture sonar (SAS) technology.

KATFISH, Kraken’s flagship towed sonar system used to generate high-resolution seabed maps, accounts for roughly 52% of product revenue. RMDS — systems that enable navies to identify and neutralize mines from a safe distance — contributes about 4%. SAS, which provides detailed seabed imaging, represents a further 14% of product revenue and is a key differentiator in naval and offshore-survey markets.

Service revenue is also projected to see a significant increase, up 67% to C$11.8 million in Q3, driven by recurring contracts through Kraken’s Robotics-as-a-Service (RaaS) model.

On profitability, Kraken is projected to swing to a net profit of C$3.9 billion in Q3, compared with a net loss of C$699 million in Q2 2025.

Kraken Robotics develops advanced subsea sensors, batteries, and robotic systems for underwater exploration, surveying, and security.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment