Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 07, 2025

By Ehteesham Ansari

Swedish buy now, pay later provider Klarna Group PLC (NYSE: KLAR) will release its first earnings report as a public company on Friday, November 14, offering a first look at how the fintech’s growth strategy is holding up under public market scrutiny. The Stockholm-based fintech, which listed on the New York Stock Exchange in September, enters the quarter with expectations of solid growth across its lending and payments businesses.

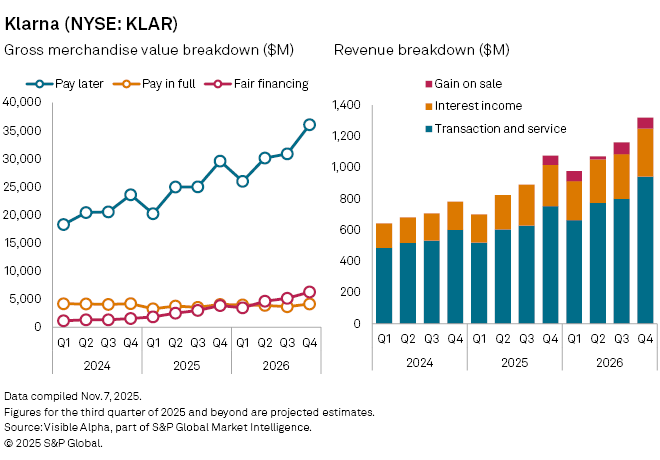

According to Visible Alpha consensus estimates, Klarna’s Q3 revenue is projected to climb 26% year-on-year to $889 million, supported by resilient consumer spending and expanding merchant adoption. Transaction and service revenue — Klarna’s largest source of income — is forecast to rise 18% to $627 million, reflecting continued momentum in its merchant network and digital payment volumes.

Interest income is expected to surge 51% to $263 million, driven by higher lending volumes and stronger monetization of its “Pay Later” loans, as the company leans further into credit products amid intense competition from rivals such as Affirm Holdings Inc. (NASDAQ: AFRM) and Block Inc. (NYSE: XYZ) Afterpay. Analysts expect Klarna’s gain-on-sale segment — tied to its loan securitization plans — to begin contributing meaningfully from Q4 2025, adding roughly $58 million in revenue in Q4.

Underlying demand also looks healthy. Gross merchandise value (GMV) — the total value of transactions processed through Klarna — is expected to increase 21% to $31.7 billion, with the “Pay Later” segment growing 22% to $25 billion. The company’s “Fair Financing” offering is forecast to more than double year-on-year, up 129% to $3 billion, even as “Pay in Full” transactions decline 13% to $3.5 billion.

Klarna’s active users are projected to grow 30% to 114 million, with total transactions reaching 290 million. Both GMV per customer and average order value are expected to edge higher — up to $279 and $108, respectively — signaling rising customer engagement and purchase frequency across its major markets, including the US, UK, and Germany.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings