Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 18, 2025

By Ankita Patil

In September, the US FDA approved Johnson & Johnson (NYSE: JNJ) drug delivery system, Inlexzo, for a subset of high-risk non-muscle invasive bladder cancer (NMIBC) patients who did not respond to Bacillus Calmette-Guerin (BCG) therapy (the current standard-of-care) and are ineligible for, or refuse, bladder removal surgery. The approval offers a potential surgery-free alternative, addressing a significant unmet need in uro-oncology.

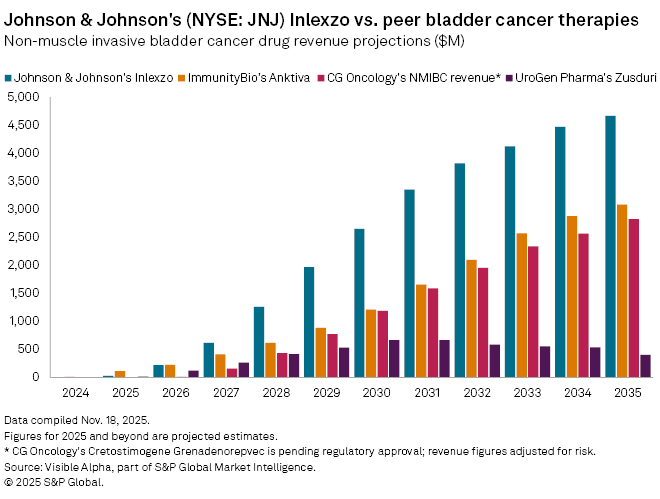

Inlexzo, acquired through Johnson & Johnson’s 2019 acquisition of biotech TARIS Biomedical, is also under investigation for muscle-invasive bladder cancer. Based on Visible Alpha consensus, analysts project $33 million in revenue for Inlexzo in 2025, rising to $223 million in 2026, with blockbuster sales of $1.3 billion expected by 2028 and peak global sales of $4.7 billion by 2035.

The NMIBC treatment landscape has expanded rapidly in recent years. ImmunityBio Inc. (NASDAQ: IBRX) Anktiva, approved in 2024 for BCG-unresponsive NMIBC, is forecast to generate $116 million in 2025, reaching $3.1 billion by 2035. UroGen Pharma Ltd. (NASDAQ: URGN) Zusduri, approved earlier this year for certain NMIBC indications, is projected to produce $18 million in 2025 and $408 million by 2035. Meanwhile, clinical-stage biotech CG Oncology Inc. (NASDAQ: CGON) is developing Cretostimogene Grenadenorepvec (CG-0070), a Phase 3 candidate that has received Fast Track and Breakthrough Therapy designation from the FDA. With an estimated probability of success of 85% for NMIBC approval, the drug could generate $11 million in first-year risk-adjusted sales, potentially reaching $2.8 billion by 2030.

Despite rising competition, comparative forecasts highlight Inlexzo as the market leader in NMIBC revenue potential, with a projected $4.7 billion by 2035, ahead of Anktiva ($3.1 billion), cretostimogene grenadenorepvec ($2.8 billion), and Zusduri ($408 million).

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment