Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Nov. 05, 2025

By Jordan McKee

Payments managers within merchants sit at the intersection of finance, technology and operations. They help to drive business impact by managing costs, reducing risk, improving customer experience, and leading cross-functional and external partner collaboration to ensure that payments are a competitive advantage. Here we examine the responsibilities, organizational placement and key performance indicators of payments managers, while providing guidance on the types of messaging that best appeal to them.

Payments managers play a pivotal role in modern commerce. They are strategists, negotiators, operators and cross-functional leaders, tasked with shaping the customer journey and driving growth as much as protecting the bottom line. By aligning cost optimization, fraud prevention, compliance and customer experience, high-performing payments managers help merchants differentiate in a competitive landscape. In this sense, the payments manager is becoming more of a strategist and innovator, elevating their importance and influence within the enterprise.

What payments managers do

A payments manager is responsible for overseeing how a merchant accepts, processes, manages and optimizes payments. They act as the strategic lead and operational owner of the payments function, balancing technical, financial, regulatory and customer experience considerations. Key elements of the role include strategy and road-map development, which involves designing multiyear road maps for payment acceptance, evaluating new payment methods (e.g., digital wallets, "buy now pay later," local payment methods) and driving payment platform modernization efforts. Payments managers also perform cost and risk optimization, where they reduce interchange and processing fees, implement least-cost routing and minimize fraud, chargebacks and disputes.

Other elements are partnership management — owning relationships with payment service providers, acquirers, card networks and technology vendors; managing performance, contracts and service-level agreements. Payments managers also run RFPs and evaluate new partnership opportunities. They are responsible for operational reliability — ensuring uptime and resilience of payment systems across online, mobile and in-store channels. This may include point-of-sale infrastructure, redundancy planning and incident management.

Payments managers act in the compliance and security element by meeting PCI DSS requirements, adhering to network rules and working with legal and compliance teams on regulations across markets; and in cross-functional collaboration, serving as the bridge across finance, operations, product and engineering areas to ensure that payment solutions meet business and customer needs. In the performance and analytics element, they track key performance indicators (KPIs) like conversion, decline rate, dispute/chargeback rates and convert data into actionable improvements.

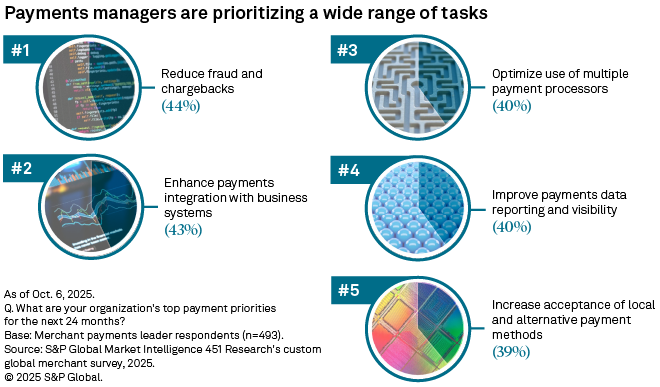

The chart below highlights the role's diverse requirements. In a global survey of nearly 500 merchant payments leaders, the top priorities span a wide range of areas, from fraud reduction and IT integration to analytics to payment method acceptance.

Payments managers are typically in finance, accounting or corporate operations, but they maintain strong ties to product and technology teams. At platform companies (e.g., marketplaces, on-demand economy) and digital natives, payments leadership is often embedded more closely with product and partnerships, reflecting their customer experience and innovation focus. Depending on the merchant and team structure, some roles are more solutions and infrastructure-focused, while others skew more toward partnerships, cost management and optimization.

Regardless of the reporting line, payments managers work in a matrixed environment, engaging with many different business functions, often on a daily basis. Their placement highlights the inherently cross-functional nature of payments — neither purely financial nor purely technical, but a discipline that requires both.

In larger merchants, senior manager or director roles will often focus more on strategy and road map and less on daily operational minutiae. For global merchants, the payments manager's role expands from managing a single payments ecosystem to orchestrating a network of regional systems, partners and regulations. In this context, the function becomes more strategic, analytical and partnership-driven. Organizationally, global merchants often adopt a hub-and-spoke model: a global payments strategy team sets direction, vendor strategy and governance, while regional teams execute and optimize local performance.

Key performance indicators

Success in payments management is measurable. Payments managers are typically evaluated against metrics such as the following:

– Authorization and conversion rates — maximizing successful payment completions.

– Processing costs per transaction — reducing interchange and gateway expenses through partner negotiation, least-cost routing, new payments partner terms and technology improvements.

– Chargeback and dispute rates — limiting financial losses and operational burden from fraud or disputes.

– System reliability and uptime — ensuring that customers rarely face transaction failures.

– Adoption of payment methods — successfully rolling out and driving usage of new acceptance options.

– Compliance performance — clean audits and minimal risk findings.

– Operational metrics — time to onboard a new payment method or partner, time to resolve payment incidents, average time for settlements, reconciliation accuracy.

– Customer experience metrics — payment friction (e.g., false declines), transaction speed, processing errors and customer complaints regarding payments.

These KPIs highlight the payments manager's dual responsibility for both financial outcomes and customer experience.

Skills and expertise required

A hybrid skill set is imperative in the payments manager role: financial acumen to understand cost drivers, technical literacy to navigate payment architecture and operational leadership to coordinate incident management. Negotiation and vendor management are critical, as is fluency in the evolving payments landscape — digital wallets, tokenization, regulation and regional differences in payment preferences. Strong analytical skills are equally important, enabling managers to track and interpret performance data and to translate metrics into actionable decisions. This combination of skills positions payments managers as both strategists and operators, equally comfortable in executive meetings and technical discussions.

Payments is a niche and rapidly evolving discipline, and many merchants still lack deep internal expertise. As a result, payments managers often operate as a lone subject matter expert, responsible for everything from vendor management to compliance and incident response. For lean teams, the constant operational pressure often leaves limited time for long-term strategy, data analysis or innovation. As a result, payments managers continue to be a critical but overextended linchpin holding together one of the most complex and consequential parts of the business.

Appealing to payments managers

Payments managers are both gatekeepers and champions of merchant payment strategies. The most effective processors and payments partners frame their offerings not simply as infrastructure but as tools that directly support a Payments Manager's KPIs and professional success. They go beyond being seen as service providers and instead position themselves as strategic allies in cost control, customer experience and operational resilience. We advise an emphasis on:

Demonstrating cost transparency and optimization: Processors that provide clear, granular visibility into fees, along with analytics that identify savings opportunities, will stand out. Proactive optimization — whether through interchange management, least-cost routing or competitive rate structures — directly ties into a payments manager's mandate to protect margins.

Reliability as a nonnegotiable: A single outage can have significant financial and reputational consequences. Processors that emphasize redundancy, uptime commitments and rapid incident response build trust. Payments managers value vendors that can act as partners during crisis management, offering real-time transparency and resolution support.

Ease of integration and technical flexibility: Merchants often operate on legacy systems alongside modern digital platforms. Processors that offer robust APIs, flexible integration paths and support for both digital and in-store channels make a payments manager's job significantly easier.

Partnership and account management: The payments manager's role is highly relational. They look for processors that act less like vendors and more like strategic partners. This means dedicated account teams, joint road-map planning and proactive sharing of insights about market trends and network changes.

Data, insight and benchmarking: Beyond processing transactions, payments managers need data to make strategic decisions. Processors can appeal to them by offering actionable reporting dashboards, benchmarking against industry peers and predictive analytics to anticipate fraud, declines or network changes. Tools that link data to clear business outcomes strengthen the relationship.

Compliance and risk support: Payments managers bear responsibility for PCI compliance, fraud management and regulatory adherence. Processors that stay ahead of compliance obligations, simplify certification and provide flexible fraud prevention tools help payments managers sleep at night. The ability to customize fraud settings to balance risk and conversion is especially valuable.

Innovation and future-proofing: Payments managers are looking for partners that can keep them ahead of consumer expectations. Processors that support emerging payment methods and can scale globally with local payment method acceptance are signaling that they are investing in the future. Positioning innovation as a way to improve conversion and customer satisfaction resonates strongly.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment

Language