Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec. 2, 2025

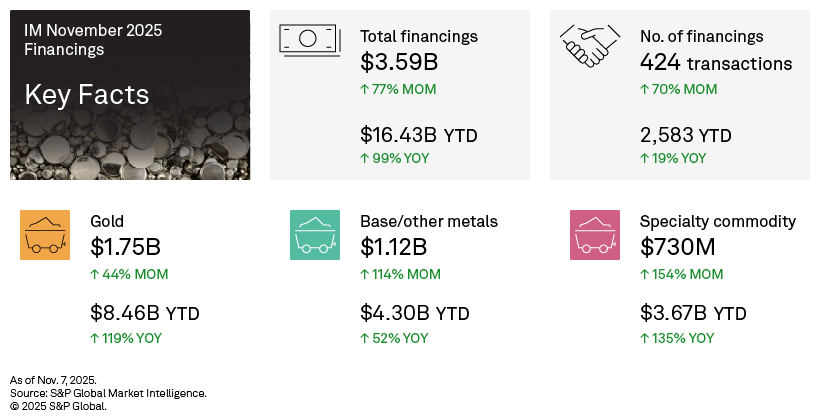

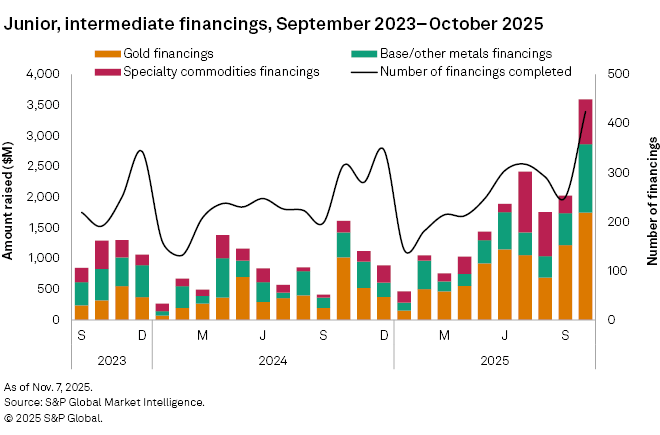

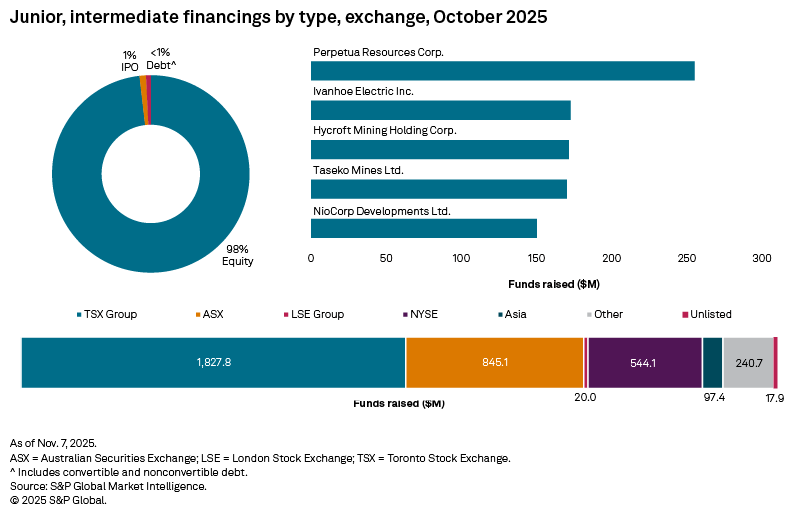

Funds raised by junior and intermediate companies surged 77% to $3.59 billion in October, representing the second-highest level in our records dating back to January 2014, and not far short of the March 2021 peak of $3.69 billion. Gold fundraisings achieved a new record-high, while all three commodity groups posted gains, led by the base and other metals group, which more than doubled month over month. The number of transactions also hit a record, climbing 70% to 424 from 250 in September. Significant financings — transactions valued at over $2 million — rose to 205, up from 117 in September. There were 16 transactions valued at over $50 million, up from 10 in September, reflecting that this month's jump is broader in scope, rather than being driven by a few high-valued financings.

The October 2025 financing data is available in the accompanying databook.

Gold financings climb again to new all-time high

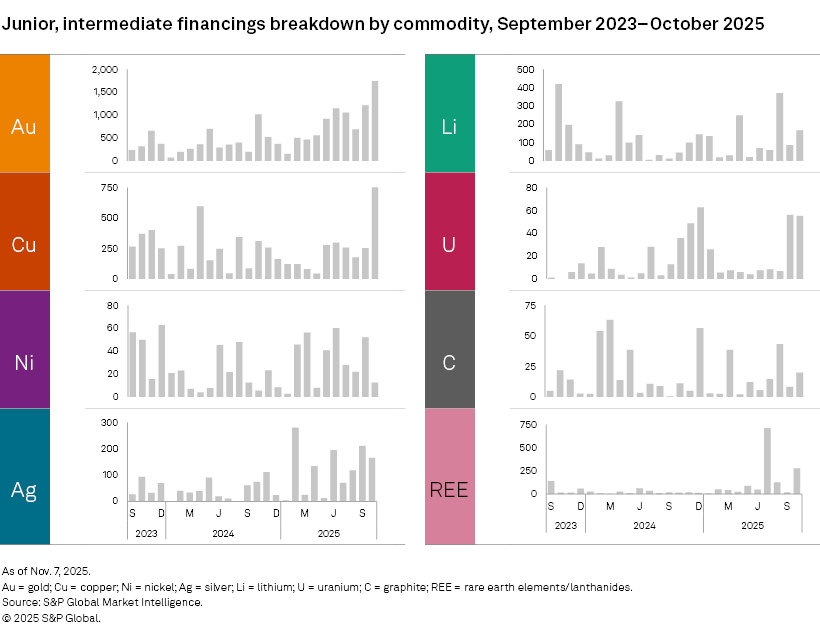

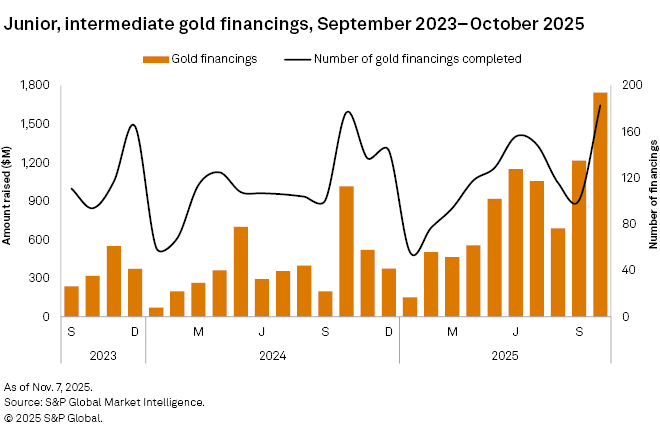

Gold fundraisings increased for the second consecutive month, rising 44% to $1.75 billion in October, marking the highest level in our records dating back to January 2014. The total number of transactions climbed to 183 from 101, while the number of significant transactions nearly doubled to 102 from 52. There were eight transactions valued at over $50 million, up from seven in September.

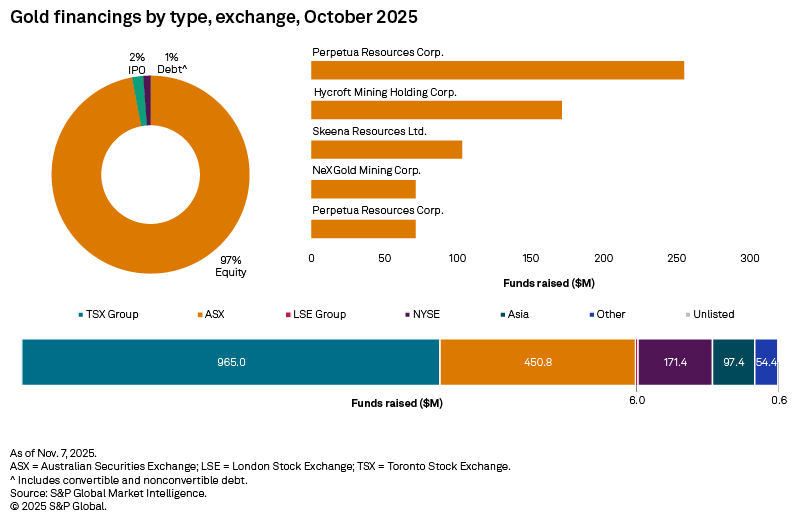

The largest gold financing — and the largest overall — was a $255 million private placement of common stock by Toronto Stock Exchange-listed Perpetua Resources Corp. Proceeds from the placement will fund development of the Stibnite gold project in Idaho, where early works construction commenced in October. In addition, Perpetua Resources also completed a $71 million public offering of common shares in October to fund the Stibnite project capital costs and continuing exploration activities.

Copper drives base, other metals group to 4-year record

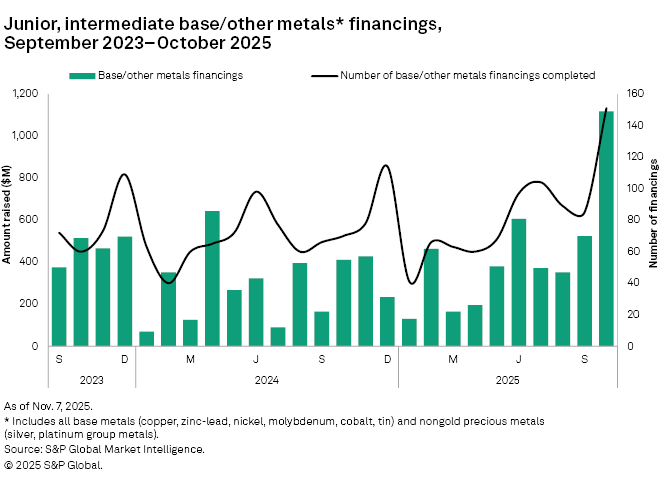

Funds raised for the base and other metals group rose to $1.12 billion in October, more than double September's $523 million and the highest level since September 2021. Although silver and nickel declined, these decreases were offset by copper's $540 million increase, with additional support from gains in zinc and cobalt. The number of transactions in this category climbed to 151 from 85 in September, establishing a new record for the group. The number of significant financings rose to 61 from 43, while the number of transactions valued at over $50 million increased to five from three in September.

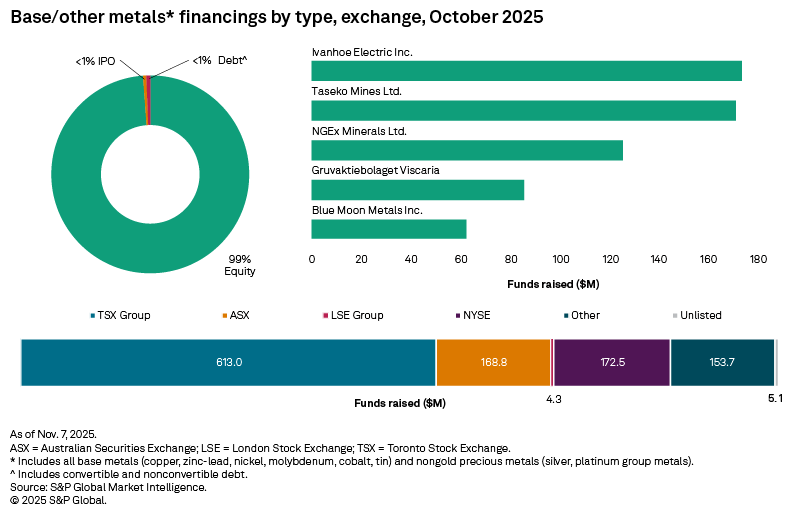

The largest financing in this category, and the second-largest overall, was a $173 million follow-on domestic offering by Arizona-based Ivanhoe Electric Inc. Proceeds will be used for land purchase payments and development of the Santa Cruz copper project in Arizona, exploration activities at the company's current projects and joint ventures.

Rare earths, lithium, niobium head specialty group recovery

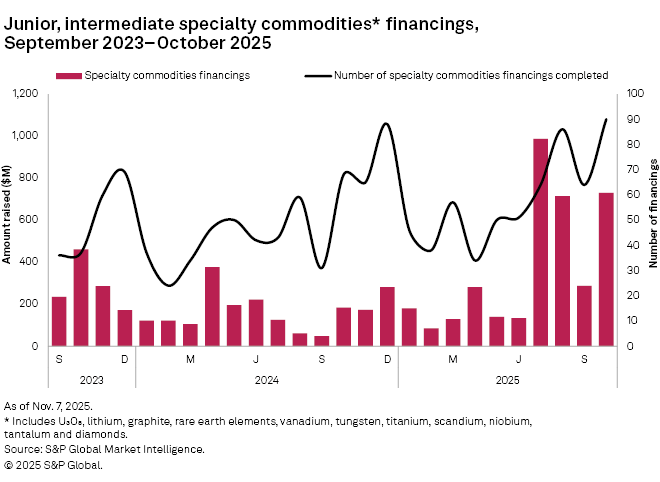

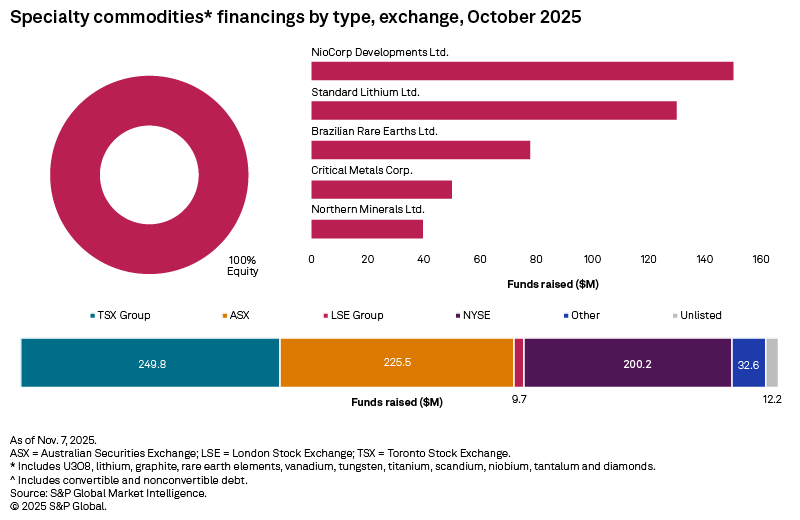

Funds raised for specialty commodities rebounded in October after two consecutive monthly declines, rising 154% to $730 million from $287 million in September. Apart from tungsten, uranium and diamonds, all major commodities in the group recorded increases, led by rare earths, lithium and niobium. The total number of transactions increased to 90 from 64, and the number of significant financings rose to 42 from 22. There were three transactions valued at over $50 million, up from zero in September.

The largest financing in this category, and the fifth-largest overall, was a $150 million direct offering of common shares by Colorado-based NioCorp Developments Ltd. Proceeds from this transaction will support the continued development and construction of NioCorp's Elk Creek niobium project in Nebraska.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language