Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov. 20, 2025

By Tim Zawacki and Husain Rupawala

Amid escalating risks from severe convective storms, and particularly hail damage, the financial dynamics for homeowners insurance and mortgage originations grow increasingly complex. Homeowners face pressures in obtaining insurance coverage in a growing number of geographies due to declining availability and affordability with negative implications for mortgage loan performance and the broader residential real estate market.

An analysis by S&P Global Market Intelligence utilizing two significant datasets, loan funding data reported pursuant to the Home Mortgage Disclosure Act (HMDA) and the Federal Emergency Management Agency's (FEMA) National Risk Index, seeks to examine the impact of hail risk on mortgage originations through the identification of lenders and purchasers of conventional single-family mortgage loans originated in individual census tracts deemed to be at "very high" or "relatively high" risk of hail losses. Among other things, this analysis highlights disparate levels of vulnerability within individual states and across the country as a whole. It also may be suggestive of where homeowners insurance availability and affordability may increasingly play a role in real estate and mortgage markets as carriers re-underwrite their books of business to withdraw, reprice and/or revise terms and conditions applicable to individual risks.

Given the extent to which hail can damage or destroy structures, various carriers have submitted form, rate and rule filings for the purposes of raising rates, introducing wind and hail deductibles, and adopting aggressive Actual Cash Value (ACV) depreciation schedules for roofs depending upon their age and materials used in their construction. These steps allow insurers to combat the volatility associated with catastrophe losses, particularly from severe convective storms, that contributed to outsized losses in certain recent years and promote solvency. But they may also increase the post-claim financial burden for policyholders and negatively impact a home's resale value. Both of these outcomes potentially carry negative implications for mortgage loan delinquency statistics and recoveries in the event of a loan default, suggesting a potential cyclical effect that could impact housing market stability and the overall economic landscape of the affected localities.

Insurers and policyholders may be the parties most immediately and directly affected by these shifts, but the longer-term fallout could impact a wide range of stakeholders, including bank and nonbank mortgage lenders, mortgage servicers, the housing-related government-sponsored enterprises, investors in mortgage loan securitizations, homebuilders, realtors, contractors and various others in the real estate value chain. Such dynamics underscore the need for proactive outreach regarding the evolution of homeowners policy structures and the need for individuals and governments to invest in resiliency.

Methodology

The HMDA dataset, accessible at the national, state, county and metropolitan statistical area levels through S&P Capital IQ Pro, offers granular information on mortgage originations throughout the United States. Each year, lenders are mandated to report data regarding mortgage applications, originations, and denials, including essential details such as loan amounts, borrower demographics, and property locations. For this analysis, we limited our focus to conventional mortgages on one-to-four-family residences at the census tract level that were funded in 2024, yielding an overall total of $188.07 billion in aggregate value, or approximately 11.9% of total conventional fundings. This allows us to capture recent lending trends and the geographic distribution of mortgage originations at a time when insurance-related risks in hail-prone markets had become more readily apparent.

The National Risk Index (NRI) data, meanwhile, categorizes regions down to the county and census tract levels based on their exposure to various climate-related risks, including hailstorms, wildfires and winter storms. For this analysis, we focused on hail risk at the census tract level to promote granularity and cross-reference output from the HMDA data. Areas are classified as having anywhere from "relatively low" to "very high" potential for hail damage, which is essential for identifying the most vulnerable census tracts. The New England states, where winter storms present an annual threat, did not contain any census tracts deemed to be at "relatively high" or "very high" risk of hail losses, for example, while those designations were prevalent in certain Midwest states.

The NRI evaluates factors such as historical frequency and severity of hailstorms as well as the value of buildings and the size of the population at risk. This classification allows us to concentrate our analysis on regions where the intersection of hail risk and mortgage lending may be most pronounced.

Additionally, we aggregated data from both sources to evaluate the concentration of mortgage funding in states with significant hail exposure, thereby highlighting their prospective vulnerability to hail-related risks. We also analyzed the roles of major purchasers in the mortgage market, such as Federal National Mortgage Association and Federal Home Loan Mortgage Corp., or Fannie Mae and Freddie Mac, to discern their influence on the funding environment in high-risk regions. This comprehensive approach attempts to provide an understanding of the interplay between hail risk, homeowners insurance, and mortgage origination trends.

Aggregating results from individual census tracts, we focus on total dollar value of 2024 funded loans in "relatively high" and "very high" areas at the state level as a percentage of the national total so as to identify those markets where the relative impact on housing markets may be most significant in the aggregate. While states like Texas and Colorado, where large metropolitan areas like the Dallas-Fort Worth metroplex and Denver have numerous census tracts deemed to be at "very high" hail risk, would rank highly based on virtually any methodology, this approach favors states like Georgia where a preponderance of the elevated risk is located in and around metro Atlanta, the most populous area of the state.

Another approach would be to compare the dollar value of 2024 loans in high-risk census tracts to statewide totals. States like Nebraska and Oklahoma, where elevated hail risk is particularly common, would generate high ratios in that regard, but the impact on a national scale is lesser due to much smaller funded loan dollar amounts.

Some insurers have taken a very targeted approach to combating peril-specific risks while others have implemented policy changes in a much broader manner, so it is possible that certain areas not considered to be at particularly high risk of hail (or other natural perils) could experience the sort of fallout we have suggested in this article. It is also possible that these changes may not be as prevalent in those states where the highest-risk designations are more geographically limited in scope.

Analysis

Texas and Colorado stand out as the states where hail risk is most prevalent and significant. The aggregate value of total conventional single-family funded loans in high-hail-risk census tracts in those states accounted for 37.7% and 17.5%, respectively, of the high-hail-risk national total. Those loans accounted for 58.1% and 73.2% of the Texas and Colorado conventional mortgages funded in 2024 regardless of the underlying property type. Due in part to elevated losses from natural catastrophes along Colorado's Front Range over the past decade, an analysis of our RateWatch data finds that the state leads the nation with a cumulative aggregate approved homeowners rate increase in excess of 100% from January 2020 through October 2025.

The impact of funded loans in high-hail-risk census tracts in other states is much lesser relative to the national total, including Missouri's 5.0%, Minnesota's 4.1%, Oklahoma's 3.9% and Nebraska's 2.3%. But the high-hail-risk conventional single-family loans in each of those states account for significant portions of total conventional loan originations, ranging from 30.7% in Minnesota to 68.5% in Oklahoma.

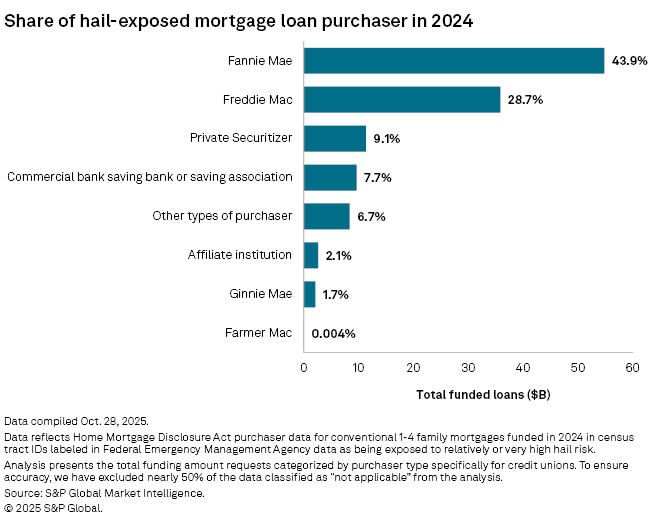

On the other side of the equation, the analysis finds that Fannie Mae and Freddie Mac unsurprisingly serve as the dominant purchasers of the total 2024 funded conventional single-family loans in high-hail-risk areas. Purchases by the two GSEs accounted for approximately 72.7% of the total funded loan value of the high-risk-hail loans for individual records where the purchasers' identity was disclosed. Fannie Mae and Freddie Mac maintain a particularly significant role in shaping the interface between homeowners insurance and mortgage lending, given their prescriptive requirements for obtaining and maintaining full property insurance coverage on the loans they purchase. Fannie Mae's selling guide, for example, specifies that property insurance policies for one- to four-unit properties securing loans it purchases must provide multiple peril coverage for at least 80% of replacement cost value, subject to various upward adjustments.

The largest lenders identified in the high-risk-hail areas, such as United Wholesale Mortgage LLC, Rocket Mortgage LLC, and PennyMac Loan Services LLC, are among the largest originators in the overall US mortgage market, generally operating originate-to-sell business models. In 2024, United Wholesale Mortgage funded approximately $16.68 billion, capturing a 4.8% share of the overall originations. Rocket Mortgage followed closely with approximately $12.36 billion in funded loans, representing a 3.6% share, while PennyMac Loan Services contributed around $9.15 billion, accounting for 2.6% of the originations. Collectively, these three originators combined to fund loans with an aggregate amount of $38.19 billion.

The Mortgage Origination Market Share Summary available on S&P Capital IQ Pro shows the parents of United Wholesale Mortgage and Rocket Mortgage as the first- and second-largest overall mortgage originators in the mortgage market. In 2024, UWM Holdings led with a total of $139.72 billion in funded loans and an associated market share of 6.9%. Rocket Mortgage followed in second place with $97.56 billion and a 4.79% share. The banking unit of JPMorgan Chase & Co. ranked third with $50.65 billion and a 2.49% share. Other notable participants include CrossCountry Mortgage LLC and the banking units of Wells Fargo & Co. and U.S. Bancorp, each contributing significantly to the overall market. The total volume for institutions in the market reached over $2.03 trillion in mortgage originations.

The competitive environment of homeowners' insurance in these states reveals further insights into each market. In the top five states with the highest total funded loans, the group led by State Farm Mutual Automobile Insurance Co. holds the largest market share, ranging from 19% in Texas to 26% in Minnesota. It is followed by The Allstate Corp., Farmers Insurance Group of Cos., Liberty Mutual Holding Co. Inc. and American Family Insurance Group across various states. These trends highlight the exposure of insurers to hail risks in these states while also underscoring the evolving nature of the insurance market, which is increasingly shaped by the necessity to manage risks associated with extreme weather events.

State Farm, for its part, highlighted the role that elevated hail claims played in its implementation of a closely scrutinized homeowners rate increase, including the implementation of wind and hail deductibles, in its home state of Illinois. An infographic released by the company showed that it recorded more than $4 billion in hail claims in 2024 from the combination of 10 states: Texas, Illinois, Missouri, Colorado, Nebraska, Oklahoma, Kansas, Minnesota, Iowa and South Carolina. High-hail-risk census tracts in those same states accounted for $144.31 billion of the $188.07 billion in loans funded in high-hail-risk areas on a national basis. The insurer cited inflation in the costs of building materials and labor, along with higher storm frequency, in seeking its rate increase and policy changes, joining a number of its peers that had already done so.

Higher rates and new policy terms help carriers like State Farm preserve their financial strength, but increase the amounts policyholders pay up front for coverage and in the event they file a claim deemed to be caused by wind and/or hail damage. While homeowners who own their properties outright may consider self-insuring or obtaining more tailored coverage from a non-admitted carrier, property insurance requirements for properties subject to conventional mortgages limit their flexibility to pursue alternatives.

Conclusion

The intersection of hail risk and housing affordability presents a complex challenge that necessitates careful consideration and innovative responses. As urban areas continue to densify, the heightened vulnerability to hailstorms underscores the urgent need for strategies that effectively manage insurance costs while preserving housing affordability. Homeowners in high-density regions are increasingly facing rising premiums, which can exacerbate affordability issues and negatively affect mortgage loan performance. This dynamic highlights the importance of exploring new approaches to mitigate the financial impacts of hail risks on homeowners while ensuring that insurance remains accessible.

With a growing number of insurers moving aggressively to combat volatility associated with catastrophe losses, particularly from severe convective storms, residential property values may increasingly hinge on the availability and cost of homeowners insurance policies within localized markets. As insurance carriers begin to evaluate individual risks more granularly, factors such as roofing age, condition and materials in areas prone to frequent and severe hailstorms will play a critical role in determining a home's value. These shifts in risk assessment could have far-reaching implications throughout the real estate market, affecting not only homeowners but also originators and holders of mortgage loans. Limited or costlier access to insurance coverage may negatively impact housing market valuations and liquidity, creating a ripple effect across the housing sector.

To address these challenges, the adoption of enhanced risk transfer mechanisms and loss mitigation strategies becomes even essential for the insurance industry. Proactive engagement from state and local governments is increasingly critical as the socioeconomic risks associated with severe weather events continue to rise, including through public-private partnerships that encourage meaningful investments in resilience and broader outreach to better publicize the new realities of the marketplace. Collaboration among various stakeholders that leverages increasingly sophisticated risk-modeling tools and innovative building materials will be vital in developing actionable and sustainable solutions that address the associated complexities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language