Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 19, 2025

By Afaque Zia, Neha Jain, and Zulekha Manee

The world’s leading farm machinery makers are facing a prolonged slowdown as weakening farmer sentiment, falling crop prices, trade uncertainty, and higher borrowing costs weigh on demand for agricultural equipment.

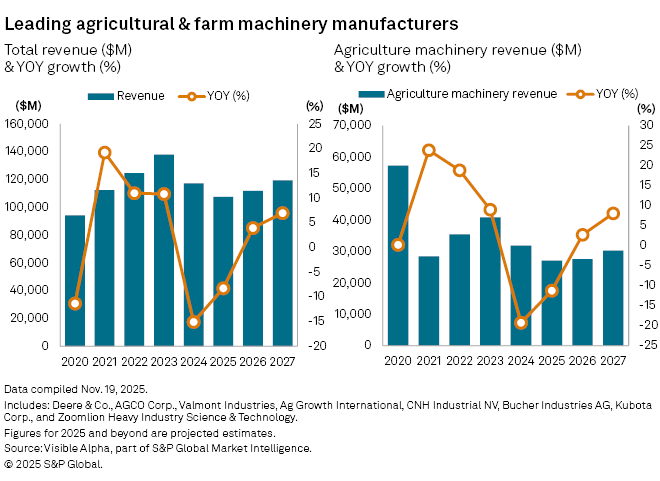

According to Visible Alpha consensus estimates, combined revenues of major global manufacturers — including Deere & Co. (NYSE: DE), AGCO Corp. (NYSE: AGCO), and Valmont Industries Inc. (NYSE: VMI) in the US; Ag Growth International Inc. (TSX: AFN) in Canada; CNH Industrial NV (NYSE: CNH) and Bucher Industries AG (SIX: BUCN) in Europe; Kubota Corp. (TSE: 6326) in Japan; and China’s Zoomlion Heavy Industry Science and Technology Co. Ltd. (SSE: 000157) — are expected to decline again in 2025, albeit at a slower pace than in 2024.

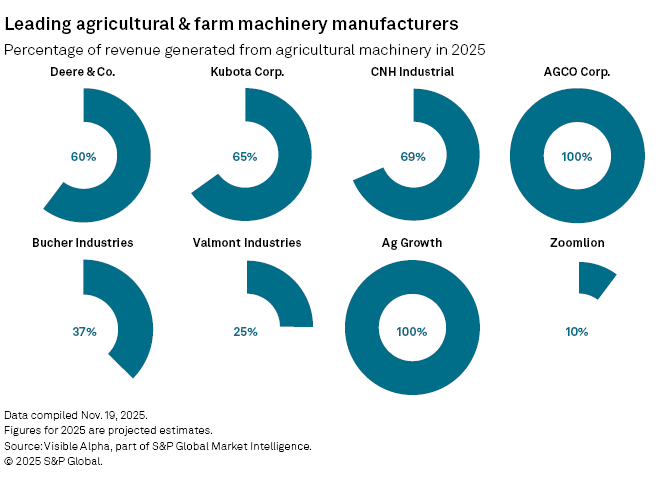

For most of these companies, agriculture equipment is the core business. Exceptions include Bucher Industries, Valmont Industries, and Zoomlion, where the segment accounts for roughly 38%, 25%, and 10% of total revenues, respectively.

2025: Another down year, but less severe

Across this group, total revenue is projected to fall 8% year-on-year in 2025, following a sharper 15% slump in 2024. Agricultural machinery sales remain the pressure point: the segment is forecast to decline 11% in 2025 after a 19% slide in 2024, reflecting continued weakness in key end-markets.

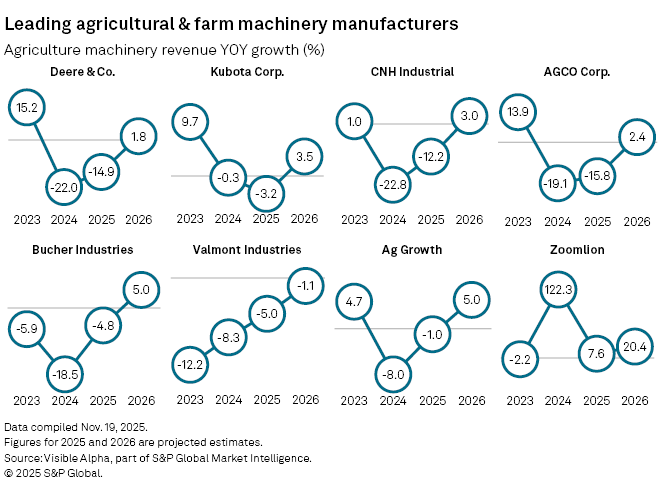

The steepest agricultural machinery revenue declines are expected at:

Other manufacturers are expected to post smaller, single-digit declines. The notable outlier is China’s Zoomlion, where analysts expect agriculture machinery revenue to rise 8% to $704 million, supported by stable domestic demand and policy-led infrastructure investment.

Earnings pressure intensifies

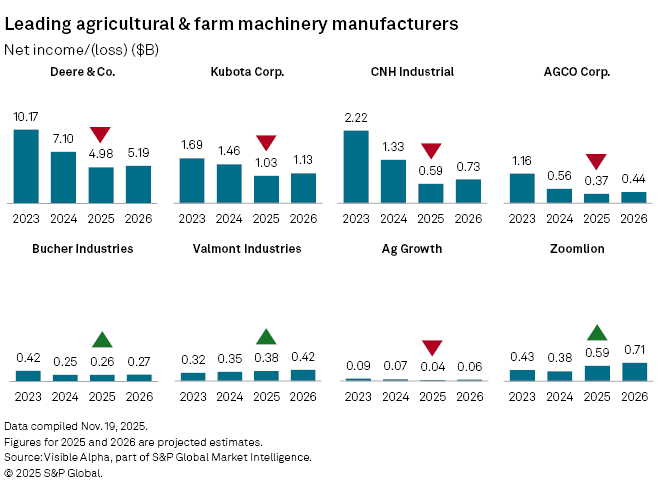

The downcycle is even more visible in bottom-line expectations. Net income is forecast to fall sharply at several major manufacturers:

By contrast, two companies are positioned to grow earnings despite the broader downturn:

A bottom in sight?

While 2025 forecasts remain subdued, analysts generally view the year as the bottom of the current cycle. From 2026 onward, Visible Alpha consensus points to gradual improvement across revenue, machinery sales, and profitability.

A rebound in commodity prices, clearer trade policy, and easing borrowing costs could help revive farm capital spending, providing a potential recovery path for the leading machinery makers after two years of contraction.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment