Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 27, 2025

By Hardik Dave

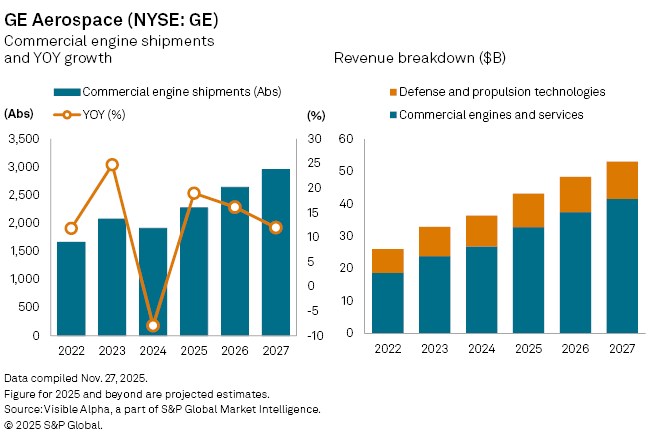

General Electric Co. (NYSE: GE), doing business as GE Aerospace, is positioned for robust growth in 2025, driven by a rebound in commercial engine shipments and sustained strength in services. Visible Alpha consensus shows analysts expect total revenue of $44.4 billion, up 15% year-on-year, with commercial engines and services expected to account for the bulk of the growth, climbing 22% to $32.8 billion.

The turnaround follows a challenging 2024, when supply chain disruptions and production bottlenecks caused commercial engine shipments to fall 7.9%. In 2025, shipments are projected to rise 19% to 2,273 units, led by GE’s LEAP engine, which powers popular narrowbody jets such as the Airbus A320neo and Boeing 737 MAX. LEAP deliveries, down 10.4% last year, are expected to jump 26% to 1,773 units in 2025.

Other engines are also seeing momentum. Deliveries of the GEnx, powering Boeing 747s and 787s, are forecast at 136, while the GE9X, for the Boeing 777X, and the GE90 are expected to reach 27 and 54 units respectively. GE has secured multiple orders and service agreements for its GEnx and GE9X engines from carriers including Korean Air, Qatar Airways, and Cathay Pacific.

Beyond commercial aviation, GE Aerospace’s defense and propulsion segment is expected to deliver a 9% rise in revenue to $10.3 billion, supported by ongoing military contracts and propulsion technology sales.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings