Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 24, 2025

By Ehteesham Ansari and Hardik Savla

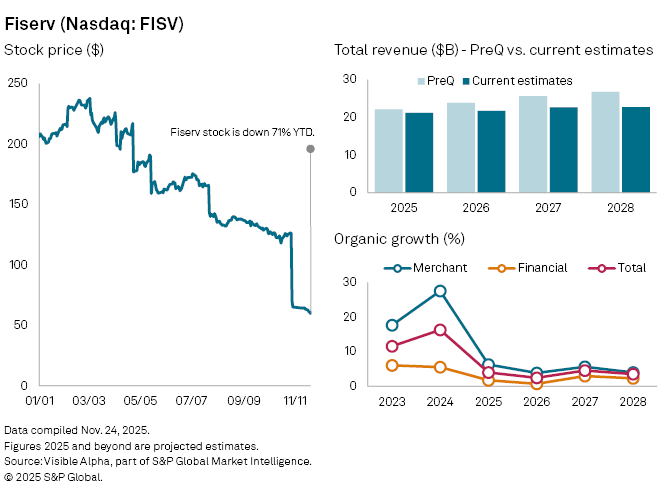

Fiserv Inc. (NASDAQ: FISV) stock has dropped nearly 71% year-to-date, reflecting a sharp reassessment of the payments group’s growth prospects after repeated guidance cuts and a disappointing third-quarter update. The company has lowered its organic revenue growth targets twice over the past year, and its latest Q3 2025 results missed market expectations, triggering analyst downgrades.

Fiserv challenges have been accompanied by rising pressure on the company’s management. Fiserv is facing two shareholder lawsuits alleging it misled investors, and the company has reshuffled parts of its leadership team following the Q3 earnings release. Based on Visible Alpha consensus, analysts have marked down expectations. Fourth-quarter revenue is now projected at $5.3 billion, down 8.8% from pre-earnings expectations. Full-year revenue is expected to rise 3.6% to $21.2 billion, compared with earlier forecasts of 8.2% growth to $22.1 billion.

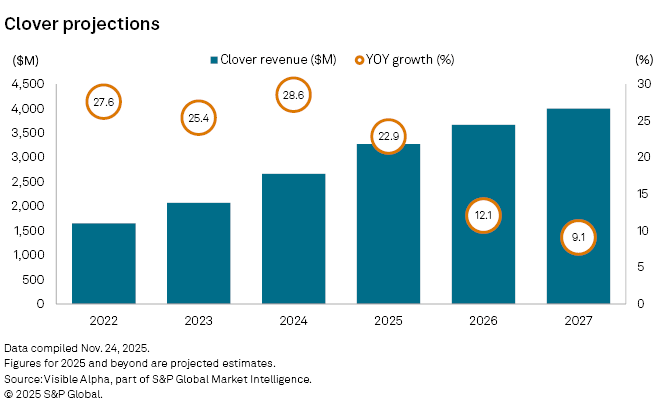

Yet one area continues to offer a clearer growth story. Fiserv has been stepping up investment in Clover, its point-of-sale and business-management platform for small merchants, and plans to launch the service in Japan as part of a broader push into international markets. Analysts expect Clover to deliver robust results. Q4 revenue is forecast at $804 million, up 12% year-on-year, with full-year revenue set to rise 23% to $3.3 billion. Clover is poised to account for 32% of the merchant-solutions segment, Fiserv’s largest division, expected to generate roughly $10.2 billion of revenue in 2025, or about 48% of the group total.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings