Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 26, 2025

By Hardik Savla

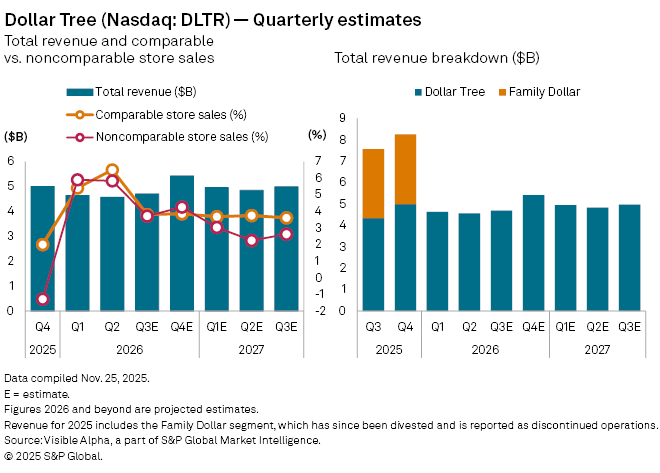

Dollar Tree Inc. (NASDAQ: DLTR) will report third-quarter fiscal 2026 results on Wednesday, December 3, 2025. Analysts expect revenue of $4.7 billion in Q3, up 8.3% year-on-year, supported by comparable sales growth of 3.8% and non-comparable sales growth of 3.7%.

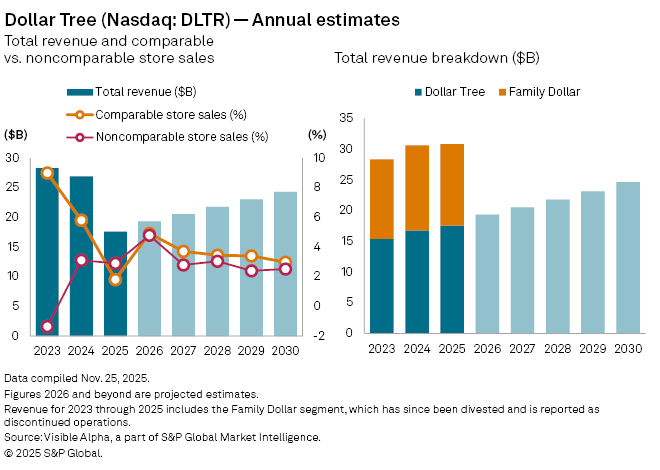

The US variety discount retailer is set for a meaningful revenue growth in fiscal 2026, with analysts projecting total revenue growth of 10% year-on-year. The upswing is expected to come from a 4.9% increase in comparable store sales and an additional 4.8% contribution from roughly 394 new store openings.

The 2024 and 2025 downturn reflect a combination of inflationary pressures, rising supply chain costs, intensifying competition, and lingering structural challenges from the 2015 Family Dollar acquisition. Dollar Tree completed the divestiture of Family Dollar in July 2025, enabling the company to focus on its core brand. The move simplifies operations, reduces complexity, and frees capital for reinvestment in store growth and merchandising initiatives.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings